- Stock Markets stay flat ahead of the Key Fed event

- US Indexes remain at their highs despite the recent fear-factors influencing North American Markets

- Exploring Technical Levels for the Dow Jones, Nasdaq and S&P 500

Yesterday's session drove further bullish inflows into US indexes, fueled by dollar weakness and positioning ahead of the Magnificent 7 earnings.

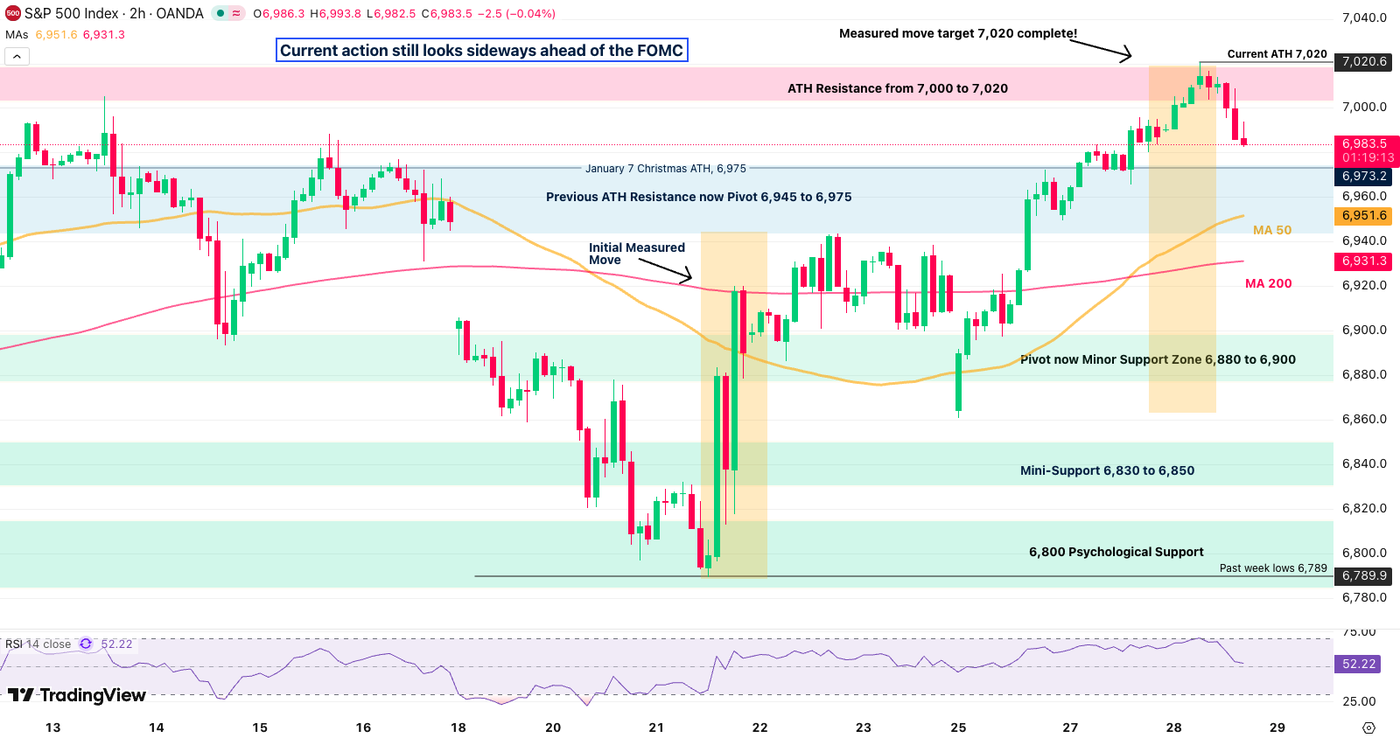

The Nasdaq led the charge, while the S&P 500 officially hit 7,000 in today's session, completing the measured move highlighted in our Monday analysis.

Despite this momentum, the next 48 hours are critical. The closing levels today and tomorrow will determine if risk assets can sustain their current path.

President Trump is currently addressing the nation at the White House, though he has offered no major updates so far.

However, markets remain on alert for a nomination surprise of the next Fed Chair to replace Powell in May 2026.

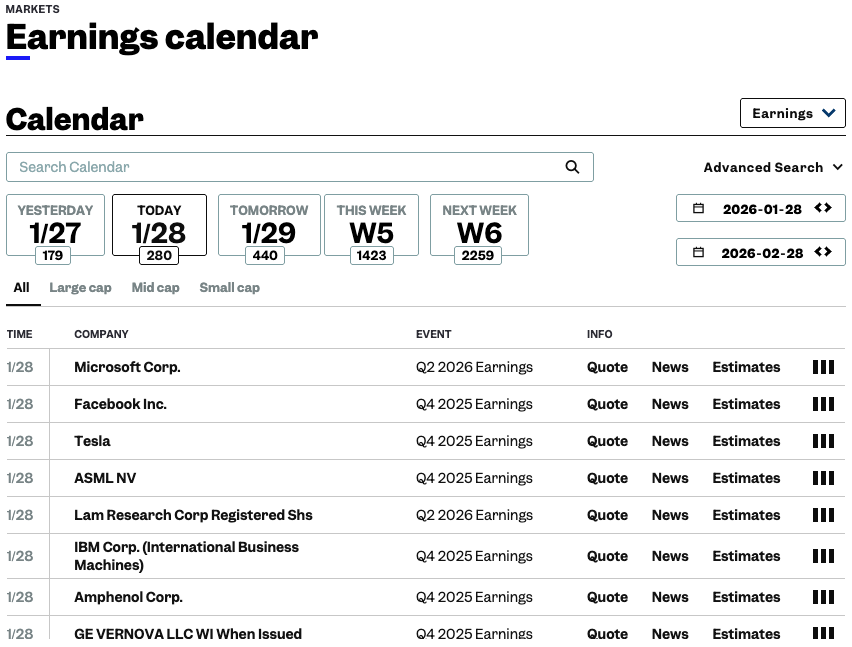

Wall Street awaits today's commencement of Mag 7 earnings.

Get access to our recent Earnings Previews right here:

Today's picture is a typical pre-FOMC session – Nothing to see here.

Dive into our daily session charts and pre-FOMC trading levels for the major US Indexes: Dow Jones, Nasdaq, and S&P 500.

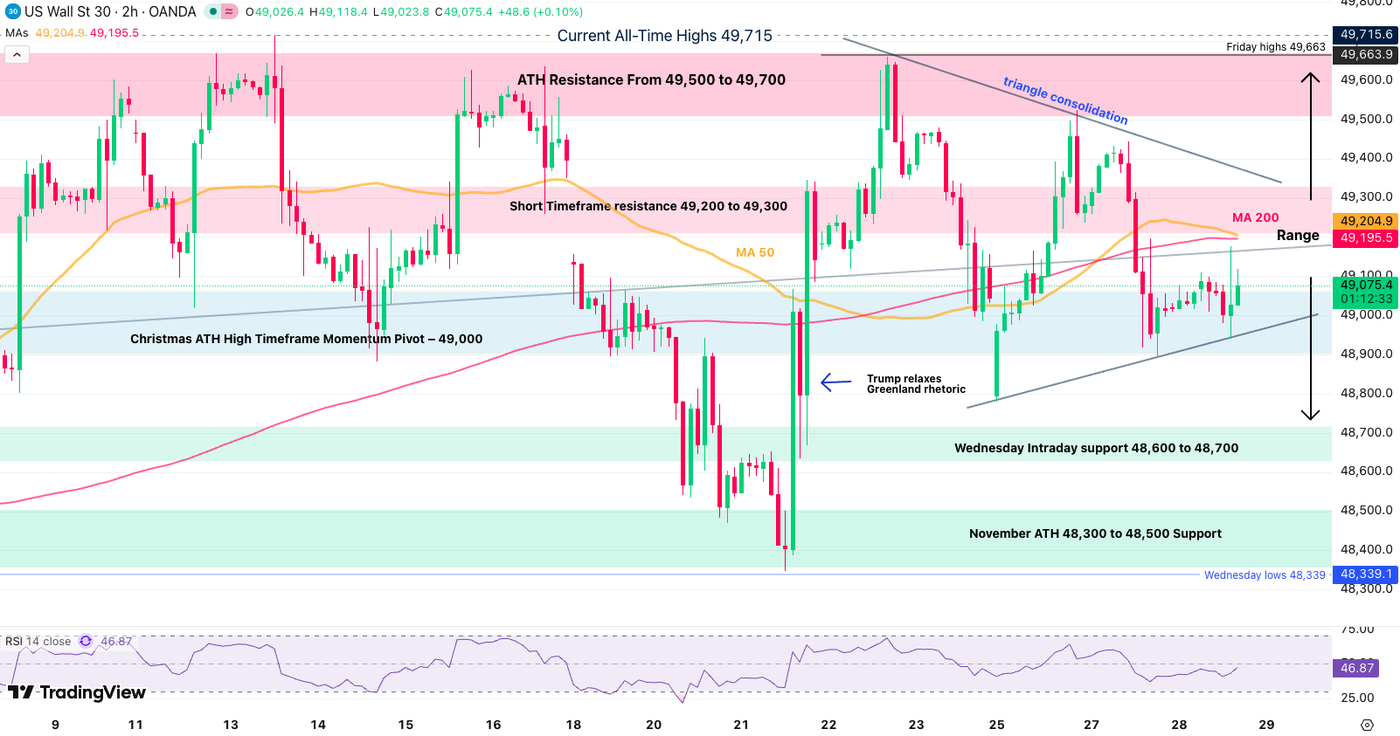

Dow Jones 2H Chart and FOMC levels

With the price action evolving within a triangle consolidation, keep an eye on these two levels for today and tomorrow's session closes:

- Closing above 49,400 hints at new all-time highs and more bullish action ahead

- Closing below 48,900 maintains a more neutral-bearish outlook on the short-term.

Looking from higher timeframes however, stocks remain at their all-time highs and consolidating around the recent rangebound levels (48,300 to 49,700) could be indicative of further upside in 2026.

This would infer that upcoming risk events (Iran, new Fed Chair) don't materialize into something worse for Equities.

Dow Jones technical levels for trading:

Resistance Levels

- Triangle Upper bound 49,385

- Short Timeframe resistance 49,200 to 49,300

- ATH Resistance From 49,500 to 49,700

- All-time Highs 49,710

- 50,000 Potential Psychological Resistance

Support Levels

- Triangle lower bound 48,900

- Christmas ATH High Timeframe Momentum Pivot – 49,000 and Triangle lows

- Intraday support 48,600 to 48,700 (4H 200-period MA)

- Psychological Support and range lows at 48,000

- 45,000 psychological level (Main Support on higher timeframe)

Nasdaq 2H Chart and FOMC levels

Like tge S&P 500, Nasdaq completed a gigantic measured move which stalled right before the All-Time highs.

The profit-taking which is occurring right ahead of the new record confirms the current hesitancy to run for new highs.

- Similarly as for the Dow Jones, closing above its morning highs (26,246) in today's and tomorrow's sessions will lead to new all-time highs.

- Failing to do so however points to a test of the lower bounds of its range (24,900)

Get access to our latest in-depth analysis of the Tech-Index right here!

Nasdaq technical levels of interest:

Resistance Levels

- Session Highs 25,817 (testing range highs)

- Intermediate Resistance 25,700 to 25,850

- Measured move target 26,050

- All-time high resistance zone 26,100 to 26,300

- Current ATH 26,182

Support Levels

- Momentum Pivot 25,200 to 25,500 +/- 75 pts

- session lows 25,503

- Wednesday lows 24,913

- 24,500 Main support

- Early 2025 ATH at 22,000 to 22,229 Support

S&P 500 2H Chart and FOMC levels

Profit-taking selling is occurring exactly at the Measured Move target as the index CFD reached 7,020.

Overall, the picture still look broadly rangebound. Except if today really turns out to be bullish, the S&P 500 (and other Stock Benchmarks) could maintain a sideways trajectory.

S&P 500 technical levels of interest:

Resistance Levels

- Current ATH 7,020

- All-time High Resistance 7,000 to 7,020 (testing)

- Potential Breakout targets (Fibinacci-Extensions)

- 1.362 = 7,080

- 1.618 = 7,119

Support Levels

- Previous ATH Resistance now Pivot 6,945 to 6,975

- Pivot now Minor-Support 6,880 to 6,900

- Mini-Support 6,830 to 6,850 (Greenland lows)

- 6,800 Psychological Support

- 6,789 Greenland lows

- 6,400 Major psychological support

Safe Trades and a successful FOMC!

Follow Elior on Twitter/X for Additional Market News, interactions and Insights @EliorManier

Opinions are the authors'; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. The provided publication is for informational and educational purposes only.

If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please refer to the MarketPulse Terms of Use.

Visit https://www.marketpulse.com/ to find out more about the beat of the global markets.

© 2026 OANDA Business Information & Services Inc.