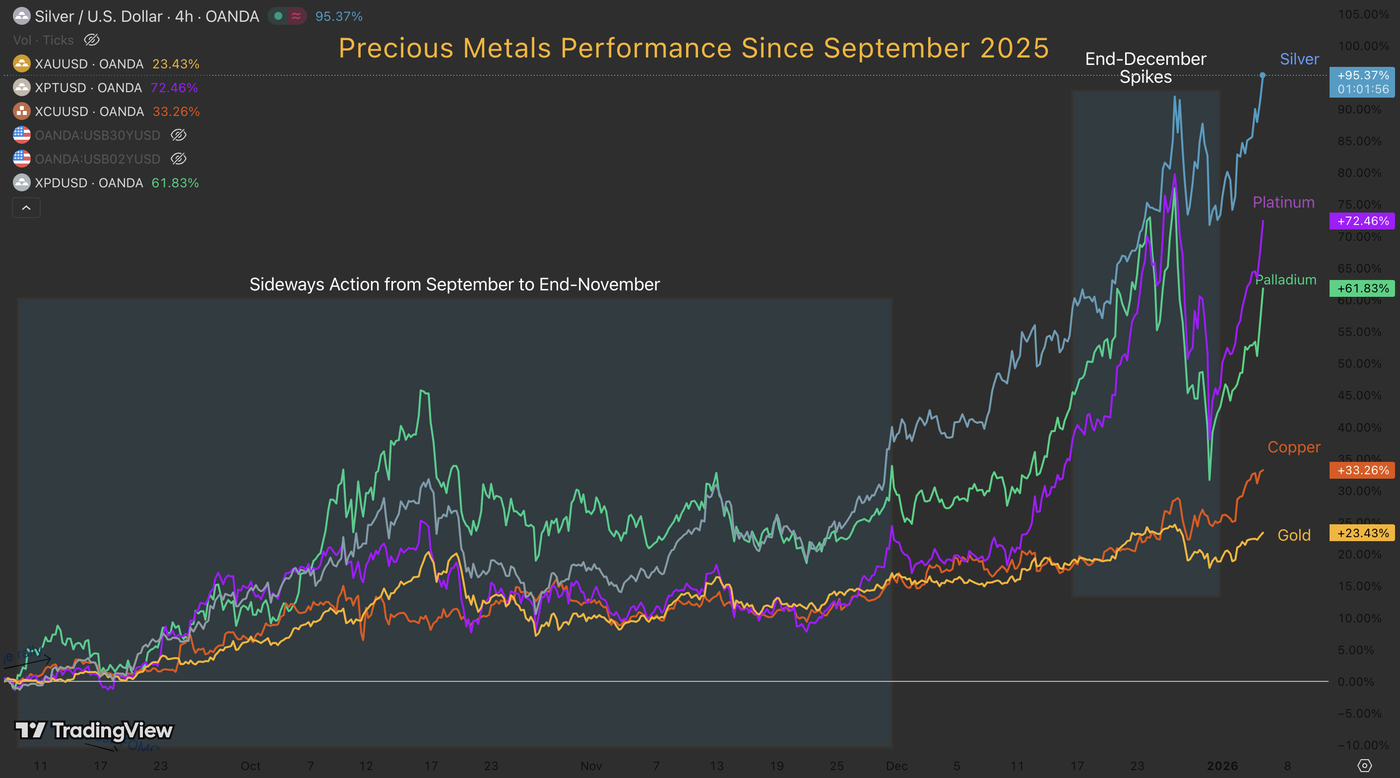

For traders returning to their desks after the mid-December break, the Metals complex has been the unmissable story, aggressively grabbing market share in investor portfolios even as volumes thinned out for year-end settlement.

After a relatively calm consolidation period from October to late November, the catalyst for the next leg up arrived via a dovish pivot from NY Fed President Williams.

His comments—early but later warranted by weaker inflation data and downward revisions to US labor numbers—rocked markets and reignited the "Dollar Diversification" trade.

Initially, the rally was driven by rate cut expectations.

The Year-end buying actually pushed prices to what resembled a short-squeeze around all metals as consecutive +5% average gains across the asset class were common theme just ahead of Christmas.

When these narrative paused, geopolitical uncertainty took the baton—and that is exactly where we find ourselves today.

The latest headline shocker arrived over the weekend with the sneaky (to say the least) capture of Venezuela's Nicolas Maduro.

While a US intervention in Venezuela had been priced in to some extent, the "sci-fi" nature of the execution caught markets off guard.

The real accelerant for the renewed panic demand in metals wasn't the capture itself, but the aftermath.

In post-operation interviews, President Trump renewed threats regarding Greenland, autonomous territory of Denmark (a NATO and EU member).

This has triggered immediate concern regarding sovereign FX reserve diversification – A Major theme during 2025.

Denmark, for instance, holds approximately $90 billion in foreign currency reserves, the majority of which are denominated in US Dollars. With diplomatic tensions rising, it is safe to assume the Danish government—and other nations watching closely—are actively looking for other solution.

This is bringing yet another buying wave in Precious Metals, further driven higher by the influx of money from asset managers at the beginning of the year and confirming the end-of-December price extremes that took Gold, Silver, and Platinum to new all-time highs.

Let's dive into an intraday timeframe analysis for Silver (XAG/USD) and Platinum (XPT/USD) as ongoing buying is catching steam.

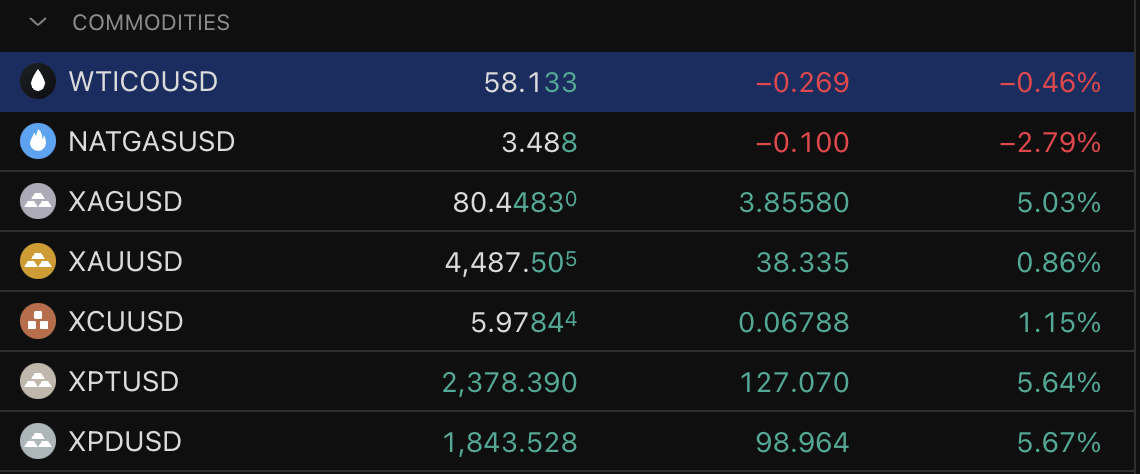

A look at the daily performance in Commodities, January 6, 2026 – Source: TradingView. XAG = Silver, XAU = Gold, XCU = Copper, XPT = Platinum, XPD = Palladium

Platinum 4H Chart and Technical Levels

It seems that our 2026 Metals Preview was timid in terms of targets looking at the current action.

Having easily breached its 2008 preceding record during the holidays, Platinum kept on extending all the way to $2,500 where traders returning and profit-taking preceded a huge pullback.

Looking at the chart, this is a picture break-retest of 2011 highs and of previous Channel bounds, mentioned in our late-December analysis.

Keep an eye on the RSI – overall, the picture is looking very bullish and strong but buyers will have to exceed preceding highs with even more momentum to avoid the formation of divergences.

For now, they are far from showing up and momentum is strong. I expect to see at least a test of the ATH or higher for Platinum.

Platinum Technical Levels to keep on your charts:

Resistance levels

- $2,450 to $2,525 Current All-Time Highs

- Session highs $2,420

- Potential Resistance at Fib Extension (1.382) $2,700 to $2,770

- Potential Resistance 2 at Fib Extension $2,900 to $3,000

Support levels

- $2,200 to $2,300 2008 Momentum Pivot

- 2011 All-Time Highs turned Support $1,900 to $1,950

- 2013 and Current year highs $1,700 to $1,750

- $1,620 to $1,650 FOMC Support

- Major High Timeframe pivot $1,500 to $1,600

Silver 4H Chart and Technical Levels

Silver is going ballistic in today's action, up another 6%.

The grey metal is once again caught up into waves of thinner supply and immense demand as beginning-year orders push up demand yet again, particularly with its positive seasonals.

Immediate reactions will be interesting:

- Entering the $82 to $84 all-time High resistance Zone without slowing down (no dojis or red candles) indicates higher chances of a breakout

- Stalling at $84 could point to a double top – The way things have been, even double tops aren't enough to generate strong pullbacks, so this could point to a dip-to-buy

- Failure to breach $82 this week seems unlikely but would be a first sign of weakness for the metal.

With Momentum and Volumes coming back to Market, continuation makes sense so keep an eye on potential new records or what happens if buyers fail to push prices all the way to there.$82 to $84 Current ATH Resistance.

On the higher timeframe, watch whether Silver holds its $75 Pivot Zone and upward trendline – $70 is the next support below.

Levels to watch for Silver (XAG/USD) trading:

Resistance Levels:

- $81.01 Session Highs

- $82 to $84 Current ATH Resistance

- $87 to $88 Potential Fibonacci Resistance

- $92 Potential Fibonacci Resistance 2

Support Levels:

- $75 to $77 Immediate Bull/Bear Pivot

- Psychological Support, Higher Timeframe Pivot $70 to $72

- Support $65 to $67 at Previous All-time Highs

Safe Trades and Happy New Year!

Follow Elior on Twitter/X for Additional Market News, interactions and Insights @EliorManier

Opinions are the authors'; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. The provided publication is for informational and educational purposes only.

If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please refer to the MarketPulse Terms of Use.

Visit https://www.marketpulse.com/ to find out more about the beat of the global markets.

© 2026 OANDA Business Information & Services Inc.