- CPI Morning is sending surprising signals around the Markets

- Traders could be preparing for more volatile events, potentially including US interventions in Iran.

- Volatility is a bit constrained, but a tense atmosphere can be felt.

Markets just received a constructive CPI report: no upside surprises and a relatively cool year-over-year print below 3% (Core CPI at 2.6%!).

There is no base effect distortion here but decent stability in inflation.

You can look at the details of the morning release right here.

By the textbook, the decent report should have triggered a continuation of the "Debasement Trade" (metals and stocks rallying while the Dollar slips).

The reality, however, is unfolding quite differently.

It seems traders are looking right past the inflation data to focus on other, potentially more volatile catalysts.

Let's take a look around the Market by diving into key performers around asset classes (US Dollar, Silver, Dow Jones, Bitcoin and WTI Oil).

US Dollar Rallies Back

After an initial knee-jerk drop, the Greenback staged a surprising recovery to past week highs.

The theme here goes beyond the CPI; participants could be pricing in a potential Iran intervention, driving safe-haven flows back into the Dollar.

Silver Explodes to $89 (New ATH) while Other Metals are Asleep

A look at the daily performance in Metals, January 13, 2026 – Source: TradingView XAG = Silver, XAU = Gold, XCU = Copper, XPT = Platinum, XPD = Palladium

XAG/USD has exploded compared while most metals are flat or down, Silver is rising toward $90 (the move is calming slightly as we speak).

This bizarre divergence suggests potential positioning issues—Are some big players caught short?

By the way, the CME just changed their margins requirements to a percentage of the notional value compared to the traditional value in an attempt to restrict ongoing volatility.

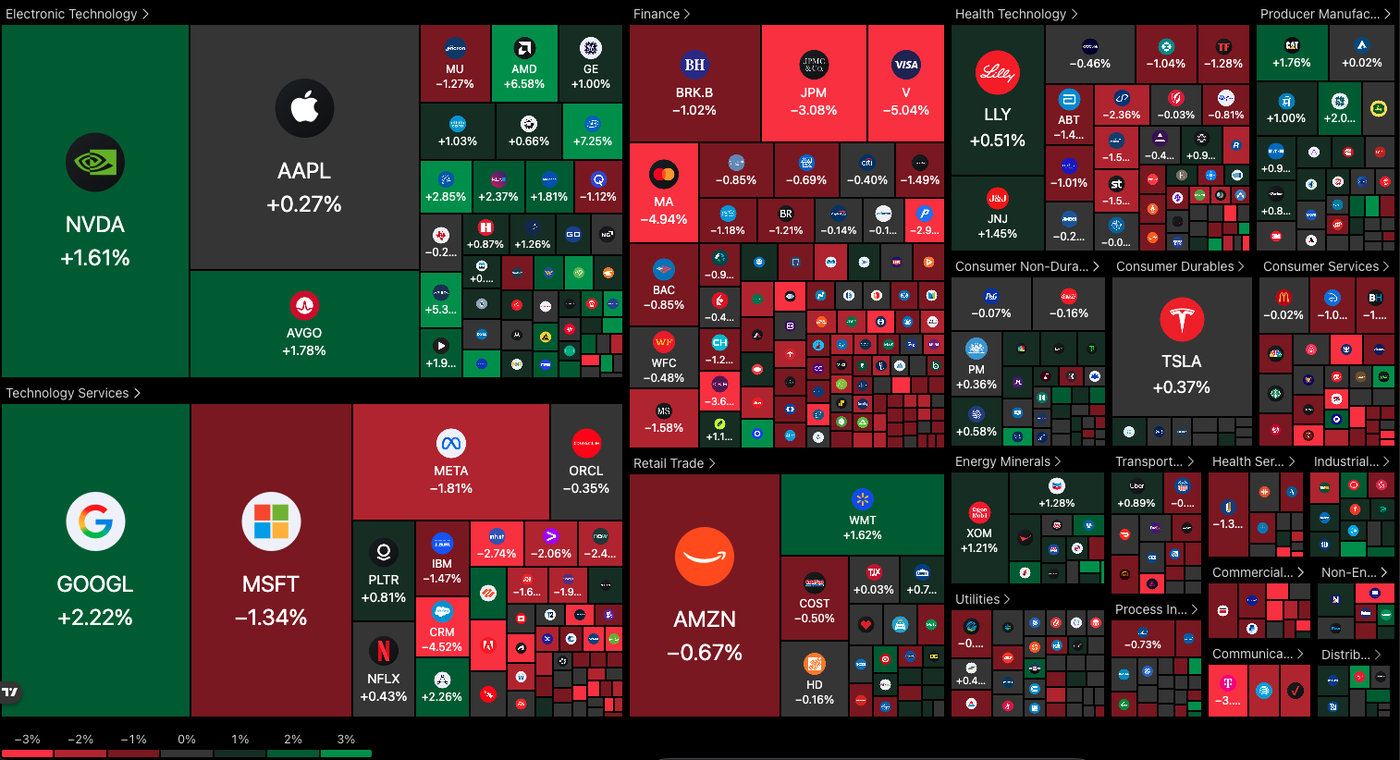

Stocks Retreat from their Relative Highs

Stocks, which might have been expected to celebrate the decent CPI report, are painting a mostly red picture.

The drops aren't massive, but they reflect a shift in momentum.

The "sell-the-news" reaction could be prompting profit-taking after the blistering start to 2026.

Tech and Microprocessors are actually leading the Markets while the rest of the picture is red. Nasdaq just turned slightly positive as I am writing this.

Bitcoin is rallying back – Crossing above its 50-Day MA

Bitcoin is the morning's major surprise, shining bright while traditional risk assets fade.

We will be breaking down the details of this move throughout the afternoon so stay in touch!

Oil is breaking above $60

WTI is reclaiming $60, ignoring the CPI to focus entirely on the Iranian Revolts.

With EU and US administrations canceling planned meetings and even banning Iranian officials altogether, the market is sensing that a US intervention is imminent.

A significant risk premium is being priced back in.

I hope some of you read our preview for Oil for 2026 – More could be coming if things turn sour!

Keep a close eye on geopolitical developments; they, rather than economic data, are now the primary drivers of today's market volatility.

Safe Trades!

Follow Elior on Twitter/X for Additional Market News, interactions and Insights @EliorManier

Opinions are the authors'; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. The provided publication is for informational and educational purposes only.

If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please refer to the MarketPulse Terms of Use.

Visit https://www.marketpulse.com/ to find out more about the beat of the global markets.

© 2026 OANDA Business Information & Services Inc.