Metals and Markets in general had been trading with angst regarding today's non-event Supreme Court decision day – After the NFP release, volatile swings were depicting a sense of confusion.

The US Dollar Index is now back above 99.00 after strong swings.

The Supreme Court makes announcements regarding decisions after Opinion Days, and with this decision being fast-forwarded, it is expected to be released before July.

Elevated expectations for this Decision Day to pertain to Tariffs were followed by disappointment: We won't know if tariffs will be struck down or maintained until at least January 19th.

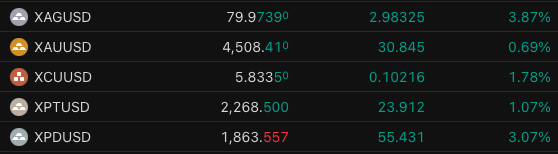

Now partly relieved of the decision (which would have huge impact on metals demand), precious metals are trading higher but still show quite some uncertainty:

- Struck down tariffs (consensus decision) would have a negative effect on metals as part of their demand in 2025 was from the fact that tariffs would require a faster de-dollarization process.

- The fact that this is priced in already would mitigate the effect somewhat – The reactions would be expected to be reflected depending on how the White House responds

- Withheld tariffs could lead to a continued high-paced upside in Metals, as it would not only maintain higher need for dollar-diversification, but would also compromise the independence of the court while adding precedent to the Trump Administration domination on legal issues.

Silver is nearing $80 per ounce (check out our freshly released analysis) and Gold is already breaching $4,500.

Ever since the final week of 2025 and record highs in almost all traded metals, the price action has been more mixed: Long metals is now a heavy consensus trade and which makes its upside limited while adding magnitude to potential downside (even if fundamental conditions still warrant demand).

Let's dive into High and intraday timeframes analysis for Gold (XAU/USD) and Palladium (XPD/USD) to spot how things are looking on the technical aspect.

Gold (XAU/USD) Weekly and Intraday Charts

Weekly Chart

Now consolidating above $4,500, Gold is holding strong as high expectations for its 2026 performance maintain prices bid, even after the not-so-dovish NFP Report.

Gold reacts very strongly to psychological and round levels – Today's close above or below $4,500 could have important repercussions.

One thing to note on the weekly chart however is the weekly RSI bear divergence which may act as a bearish catalyst in the coming trading period:

Any move lower may get magnified from the technical indication.

On the higher timeframe, look at whether the $4,000 level holds or not to see if the picture holds bullish or turns bearish.

Let's take a closer look.

4H Chart and Technical Levels

Momentum is holding very strong for Gold after today's data release and no-decision regarding tariffs.

Holding a bullish trendline, traders should watch whether prices keep bouncing towards new record highs. In case they don't, expect a swift test of the $4,400 Pivot Zone and 4H MA 50.

Levels to watch for Gold (XAU/USD) trading:

Resistance Levels

- $4,550 Current all-time High

- ATH Resistance $4,500 to $4,550

- 1.618% Fibonacci Projection $4,666 to $4,680

Support Levels

- Major Intraday Pivot $4,400 and 4H 50-MA

- December 31 Mini-Support Support $4,280

- $4,160 Major Intraday Support

- Weekly Major Pivot $3,950 to $4,000

- $3,500 Major Support

Palladium (XPD/USD) Weekly and Intraday Charts

Weekly Chart

Palladium is reacting to the $2,000 psychological resistance but maintains a strong picture.

Rising from $800 to $2,000 throughout 2025, the metal is a late bloomer of the trend.

Hanging above its Major pivot Zone ($1,600) provides a still-bullish picture but the metal will track performance in other more commonly traded metals such as Silver or Gold, so keep an eye on those.

Palladium also holds a strong correlation to Platinum, the other Proxy for those who missed the huge rally in metals this year.

Let's take a closer look.

4H Chart and Technical Levels

Looking closer, Palladium is slowing its buying momentum as profit-taking occurs after high swings – Sellers are taking the lead at the $1,900 resistance, giving them the advantage.

Stuck in a triangle consolidation, keep an eye on these breakout scenarios:

- Bullish breakout ($1,930) – Test of the recent $2,080 highs, breaking would open to October 2022 levels around $2,300

- Bearish break ($1,730) – Retest the short-timeframe Major Pivot from $1,650 to $1,670

Palladium Technical Levels to keep on your charts:

Resistance levels

- $1,950 to $2,080 Major Resistance

- Immediate Resistance $1,900 to $1,930

- October 2022 Highs $2,390

- $3,410 2022 All-time Highs

Support levels

- $1,720 to $1,730 Key intraday Support, 4H 50 MA

- Current Pivot $1,650 to $1,670 (October peak)

- $1,500 Major Psychological Support

- November Support $1,350

- $1,100 September Lows Support

Safe Trades!

Follow Elior on Twitter/X for Additional Market News, interactions and Insights @EliorManier

Opinions are the authors'; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. The provided publication is for informational and educational purposes only.

If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please refer to the MarketPulse Terms of Use.

Visit https://www.marketpulse.com/ to find out more about the beat of the global markets.

© 2026 OANDA Business Information & Services Inc.