GBP/JPY is a historically popular pair in Forex trading, as it is one of the most volatile products to trade and captures geographic dynamics and risk-on/risk-off flows.

The pair once again stands at a key inflection point, right after a historic run back to 2008 levels, and can offer quite interesting setups amid elevated market volatility.

It can be affected by recent tariff developments, as GBP has a historical correlation with Equity markets. Hence, if Markets rally after the tariff cancellation, GBP/JPY can retest recent highs.

However, bearish Stock Markets could bring the pair back to 200.00, a 9,000-pip move from current levels, if geopolitical developments sour sentiment.

After an insane run on the Yen throughout the latter part of 2025, the landmark victory in Japanese snap elections brought some confidence in the currency and calmed the spikes in long-end yields.

On the other hand, Sterling could be facing some weakness ahead. The UK reported the highest unemployment rate since 2021, and with a relatively cooling Inflation Rate (still too elevated for the Bank of England), the Central Bank might be inclined to cut.

With Rate differentials converging and sentiment souring, GBP/JPY could be facing a significant reversal in the coming times. The challenge for FX traders will be to capture the trade optimally.

Let's dive into a multi-timeframe analysis and technical levels for GBP/JPY, which could soon be subject to intense volatility.

GBP/JPY Multi-timeframe Technical Analysis

Daily Chart

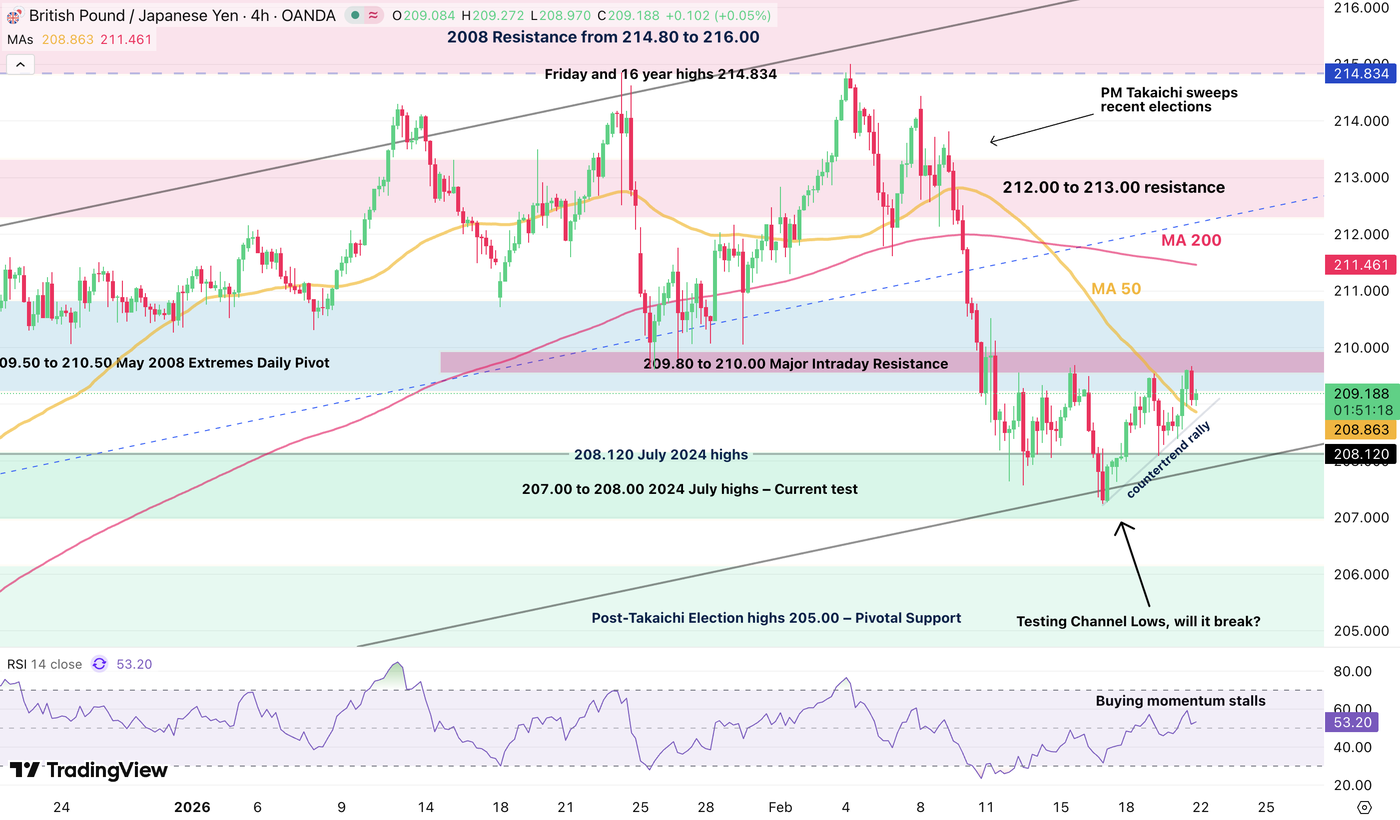

The pair is consolidating at the lows of its Mid-2025 channel that took the pair back to 2008 highs.

Momentum cool downs are common after such gigantic moves, but with recent Market developments, the action could soon get spicy.

As GBP/JPY tests its Pivot Zone, let's take a look closer at what could tilt the scales.

4H Chart and Technical Levels

The action recently formed a major intraday resistance (209.50 to 210.00) right at the beginning of its Pivot zone, leaving two potential scenarios:

- With recent rejection of resistance, sellers are attempting to take the upper hand

- Look for a break of the intraday upward trendline.

- Closing below the trendline should see a swift test of February lows at 207.240.

- Breaking this could see acceleration towards the 205.00 Pivotal Support.

- Watch out as these targets are quite far and closer profit-taking could maximize the chance to secure trading profits.

- Any break and session close above 210.00 will give more chances to test the 50-Day MA and top of the Daily Pivot Zone (210.90 to 211.00) – Lower probabilities in the current course of action

Levels to watch for GBP/JPY trading:

Support Levels:

- 208.80 Countertrend micro-support (if break, bears take the hand)

- 208.120 July 2024 highs mini-support

- 207.50 to 208.00 2024 July highs – recent test

- Post-Takaichi Election highs 205.00 – Pivotal Support (breaking this opens the door to 200.00

- Main Key Support 199.00 to 200.00

Resistance Levels:

- 209.50 to 210.00 Major Intraday Resistance

- 210.90 50-Day MA

- 212.00 to 213.00 resistance

- Early February 16 year highs 214.834

1H Chart

With recent rejection of the intraday resistance, a bearish move could appear.

- Watch out for weekend volatility which could lead to spikes at the Sunday Globex open (hence requiring larger stops, make sure to respect your risk-tolerance in that aspect).

To confirm the reversal, traders will want to see a break of the trendline.

- On the other hand, bouncing higher from here and closing above the Intraday resistance would point to higher odds of testing the 50-Day MA.

Safe Trades!

Follow Elior on Twitter/X for Additional Market News, interactions and Insights @EliorManier

Opinions are the authors'; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. The provided publication is for informational and educational purposes only.

If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please refer to the MarketPulse Terms of Use.

Visit https://www.marketpulse.com/ to find out more about the beat of the global markets.

© 2026 OANDA Business Information & Services Inc.