Most Read: Gold (XAU/USD) Price Slides 4.5%: Key Levels to Watch Moving Forward

Oil prices edged higher for a second day as markets eye Geopolitical risks as a potential catalyst.

However, as has been the case over the last few months of the year neither bulls nor bears appear ready to fully commit. The shifting tone on the geopolitical front have failed to help thus far.

Ukraine-Russia Peace Talks

Moscow accused Ukraine of trying to attack President Putin's residence, which has raised fears that oil supplies might be disrupted. Ukraine denied the claim, calling it false and an attempt to sabotage peace negotiations.

However, US President Donald Trump expressed anger about the alleged attack after speaking with Putin. Although Trump still says a peace deal is possible, these rising tensions have led market participants to believe that an agreement will be very hard to reach, which could drive oil prices higher.

The question as has been the case for the last few months is, by how much?

Middle East Tensions, Iran Protests

Traders are worried about rising tensions in the Middle East after President Trump threatened a major strike on Iran if it tries to rebuild its nuclear or missile programs.

He also warned Hamas to disarm, hoping to advance the ceasefire agreement with Israel that was reached in October.

Oil supply worries grew after Saudi Arabia launched airstrikes in Yemen against groups supported by the United Arab Emirates (UAE). Saudi Arabia declared its national security was at risk and ordered UAE troops to leave Yemen within 24 hours.

Although the UAE was surprised and disappointed by the attack, it later announced that it would voluntarily withdraw its last remaining counterterrorism forces from the country. This conflict between traditional allies has added to market fears about stability in the Middle East.

However, even with these fears that conflict could disrupt supplies, analysts believe oil prices will not rise too high because there is currently too much oil available in the global market.

Catalyst Ahead - OPEC Meeting

There is the first OPEC meeting of 2026 ahead and it could not come at a worse time given the tensions between Saudi Arabia and the UAE over Yemen.

Despite the nature of the disagreement between the two Oil powerhouses, it is unlikely to impact oil markets. This is because OPEC functions by coordinating oil production even when its members strongly disagree on political issues.

These two nations have had conflicting goals in Yemen for years and even argued openly about oil production limits in 2021, yet they have always managed to reach agreements to keep the market stable.

The real challenge facing OPEC in 2026 is not this diplomatic spat, but rather the economic problem of managing oversupply and falling oil prices. History suggests that as long as the members can agree on the production math, their political arguments will not stop the group from functioning.

Whatever the decision at the upcoming January 4 meeting, it does have the potential to be the catalyst that may break oil prices out of its funk.

Technical Analysis - WTI

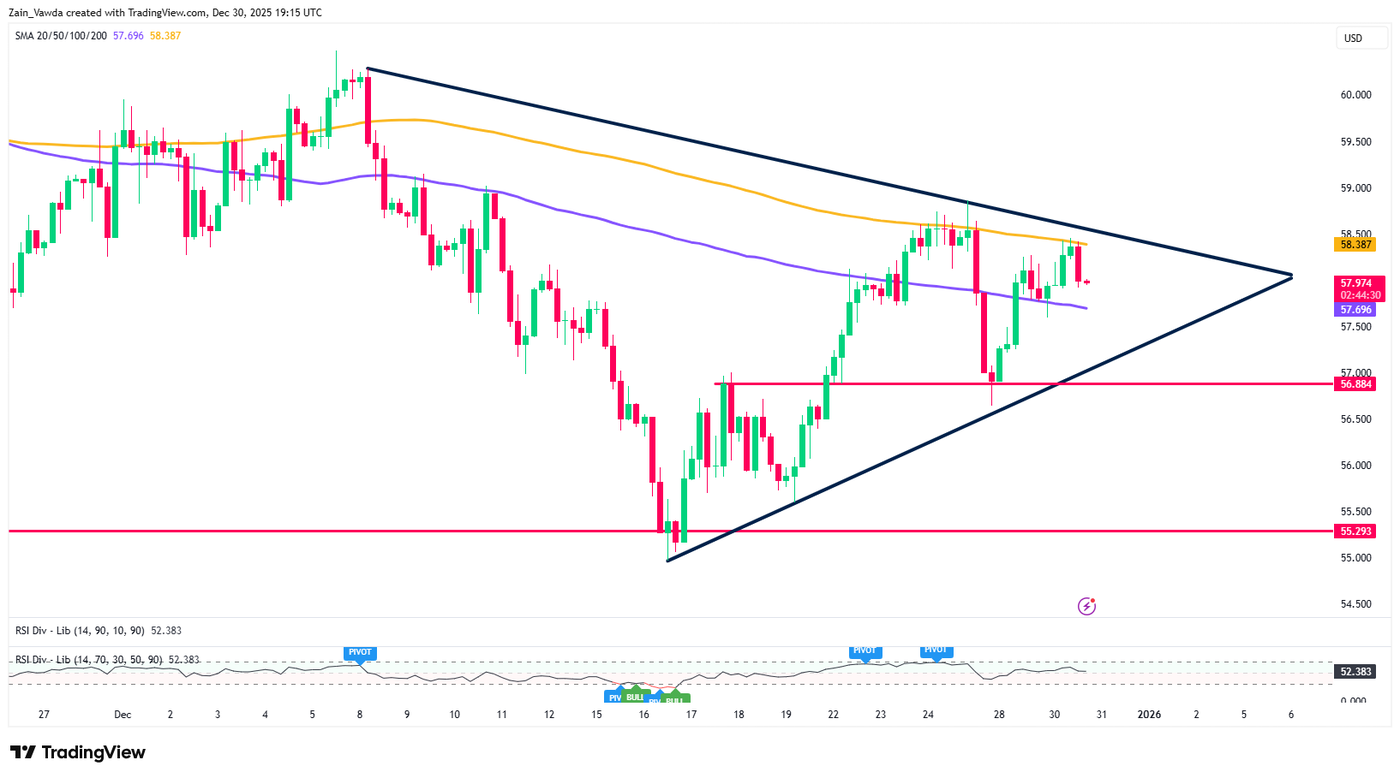

From a technical analysis standpoint, WTI continues to struggle with significant sideways movement.

Oil is trading in a large symmetrical triangle pattern with a break in either direction hopefully leading to a decent rally this time around.

Risks for me personally are still tilted toward the downside, with a break to the upside likely to run out of steam quickly. (This is just based on current dynamics and recent price action).

Brent Crude Oil Daily Chart, December 30, 2025

Key levels to pay attention to:

Support

- 57.69 (100-day MA)

- 56.88 (December 17 swing high & December 26 swing low)

- 55.79

Resistance

- 58.38 (200-day MA)

- 59.00

- 60.00 (psychological level)

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Opinions are the authors'; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. The provided publication is for informational and educational purposes only.

If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please refer to the MarketPulse Terms of Use.

Visit https://www.marketpulse.com/ to find out more about the beat of the global markets.

© 2026 OANDA Business Information & Services Inc.