Log in to today's North American session Market wrap for January 16

Today marked another strange session with stock indexes fluctuating significantly before closing the week virtually unchanged.

This indicates that traders are unsure how to position themselves ahead of potential volatility over the weekend. Geopolitical events often occur on weekends, which keeps anxiety high for the Monday open and explains the focus on weekend risk.

Before this large rally, Gold would have been an obvious safe haven.

However, the Bullion closed down 0.70% today, while other metals saw drops of up to 4%.

US Treasuries surely were not bid today in expectation for this weekend risk (30Y US Bond down -0.50%)

The Dow Jones fell 0.2%, while the Russell 2000 rose as US credit spreads reached their lowest levels since 2007. Both the S&P 500 and Nasdaq closed flat.

Some analysts are warning about these ultra-low spreads, but no structural cracks are showing yet.

Uncertainty remains high as evidenced by the rangebound trading across asset classes. Keep a close eye on the headlines.

Stock Market Heatmap – A confused Stocks Board

Producer Manufacturing firms have remained solid but for the rest, there has been virtually no sector trend today. Expect a lot of volatility next week.

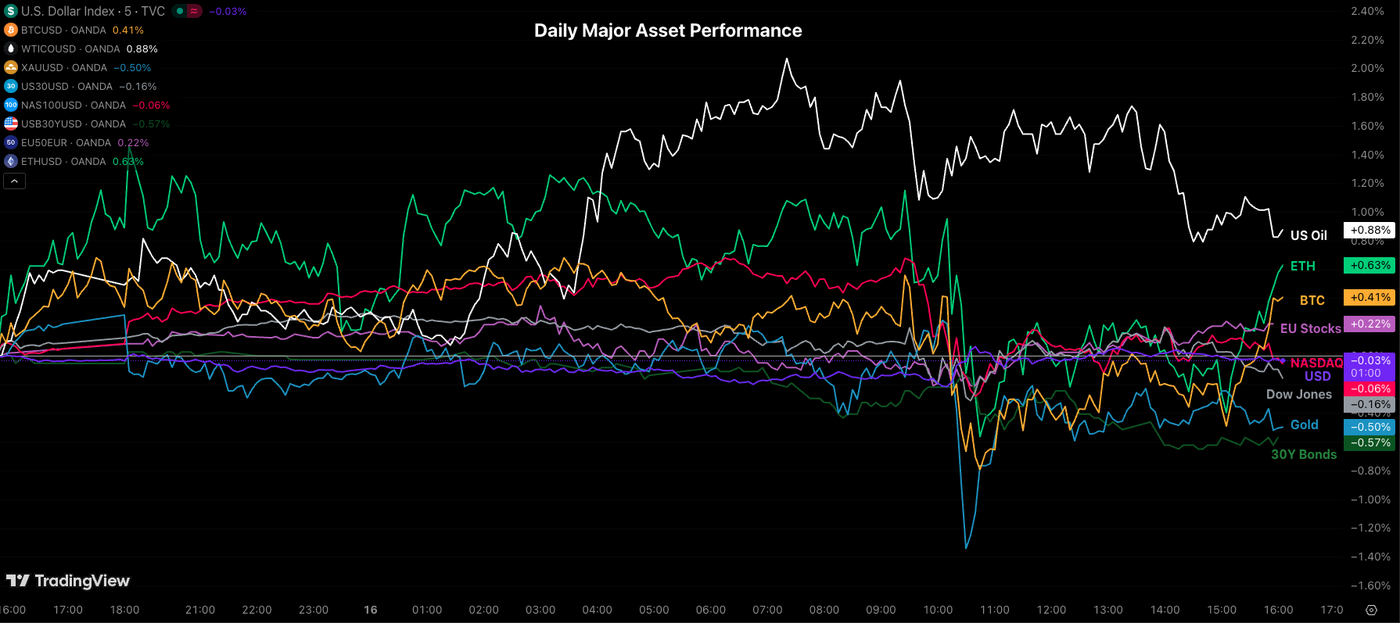

Cross-Assets Daily Performance

Today's action reflects a confused but uncertain Market as most assets finish down except for Oil (the true but risky hedge against Middle East geopolitical risk).

Cryptos are rebounding suddenly at the weekly close, as traders head back into the asset class.

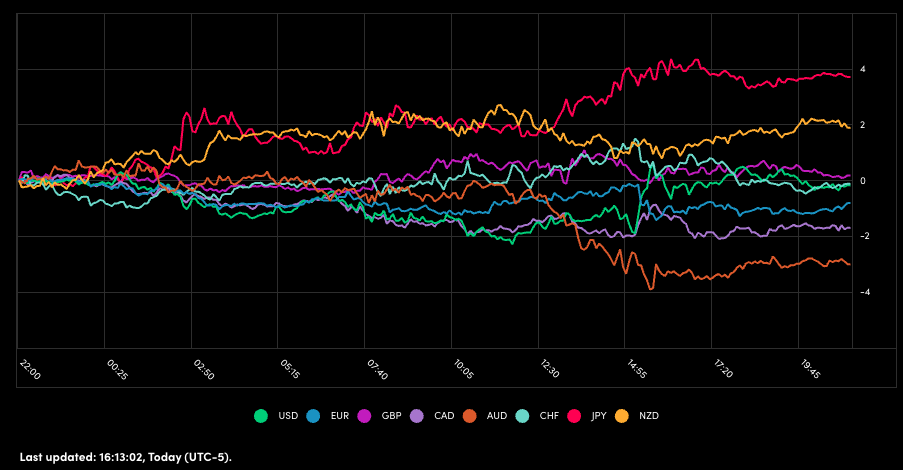

A picture of today's performance for major currencies

Today marked yet another low volatility FX session with the JPY leading and the AUD on the other side.

FX movements have been largely rangebound since 2026 – Keep a close eye on the US Dollar as it shows some signs of weakness but could also get bid in the event of a US Intervention.

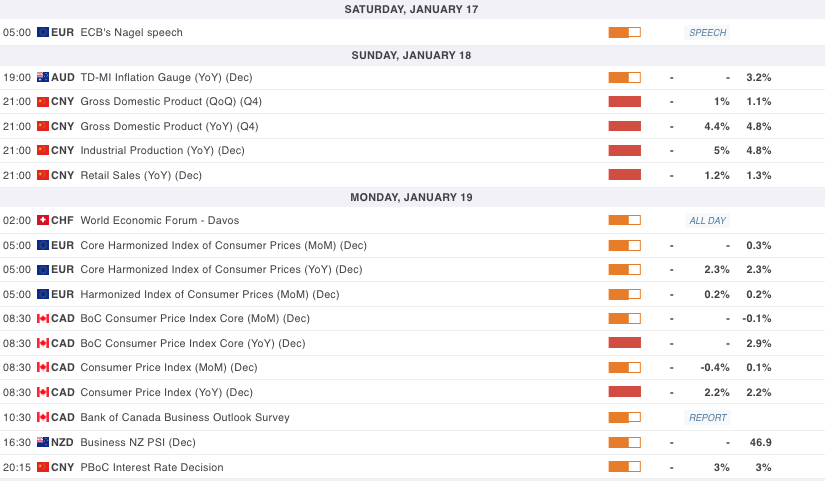

A look at Economic data releasing throughout this Weekend and Monday's sessions

The week kicks off with a heavy Asia focus.

China releases a full macro package on Sunday night, with Q4 GDP, industrial production, and retail sales setting the tone for global risk sentiment. Australia’s TD-MI inflation gauge follows, offering an early inflation signal for the RBA outlook.

Monday shifts attention to Europe and North America. Eurozone inflation data (headline and core) will be key for ECB rate expectations, while Canada delivers a full CPI print.

The session wraps with New Zealand business sentiment and a closely watched PBoC rate decision.

Monday also begins a packed Central Bank week with the Davos Economic Meeting starting.

This evening also begins the Fed Blackout Period.

Safe Trades, keep a close eye on Middle East developments!

Follow Elior on Twitter/X for Additional Market News, interactions and Insights @EliorManier

Opinions are the authors'; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. The provided publication is for informational and educational purposes only.

If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please refer to the MarketPulse Terms of Use.

Visit https://www.marketpulse.com/ to find out more about the beat of the global markets.

© 2026 OANDA Business Information & Services Inc.