It was surprising to see such straightforward flows during a volatile period.

While black swans are unpredictable, the market's capacity to ignore risk until something breaks can be surprising.

So what changed in the past hour?

Metals rallied to new highs following Powell's press conference yesterday. The reaction was aggressive given the context. Powell highlighted US economic strength and defended Federal Reserve independence, factors that typically support the Dollar.

Explaining the post-FOMC surge was difficult as the rate pause was not dovish.

Yet, Gold rose 5% to $5,602, suggesting the debasement trade was spiraling. Recent volatility indicates otherwise.

Gold corrected by 10% from its highs, dragging Silver and Platinum lower. Copper remains the outlier, reaching new highs in today's session.

Is the uptrend over? Tough to say for now, but what's for sure is that up-and-down spikes have been getting more common as of late, indicating unstable Market conditions and potential changes in recent dynamics.

Seeing rangebound conditions here would make sense – On the bigger picture, watch for breakouts to today's session up and down levels to get an idea of where flows are heading.

Stocks are also diving lower, particularly recent AI performers.

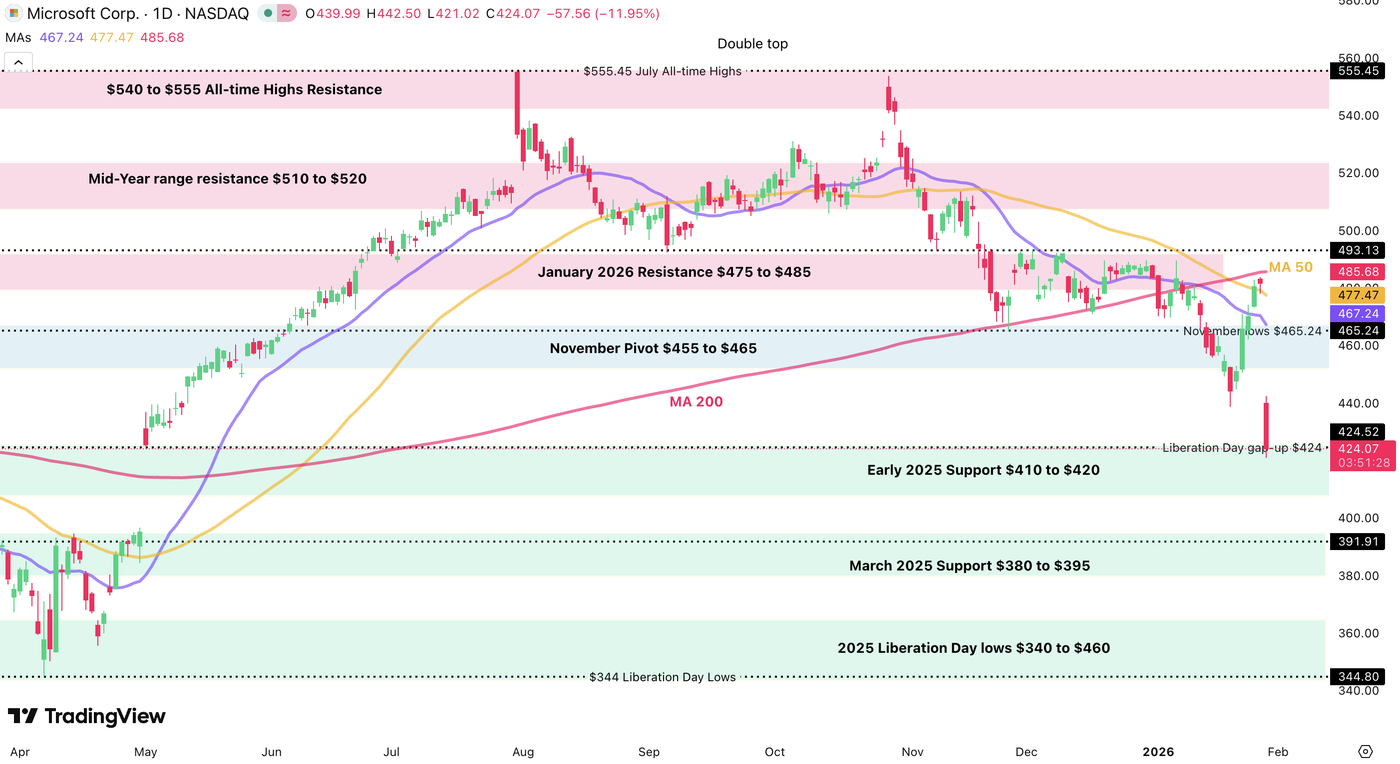

Disappointing Microsoft earnings dampened equity sentiment, sending the Nasdaq down 2.51% at its trough.

MSFT is down 12%, weighing heavily on the technology sector.

Nasdaq sold off harshly, rebounding slightly in the mid-session

The picture in equities isn't looking very bullish across different Benchmarks – Watch out for volatility in upcoming sessions ahead of Weekend risk.

The US Dollar doesn't know where to go

While Oil flows might appear linked to Iran, a purely geopolitical driver would typically boost precious metals as safe havens.

The current correction appears driven by a confluence of risks: post-FOMC repositioning, Iran tensions, weak earnings, and anxiety regarding the next Fed Chair nomination.

Discover: WTI explodes to $66 as Iran tensions boil – US Oil Outlook

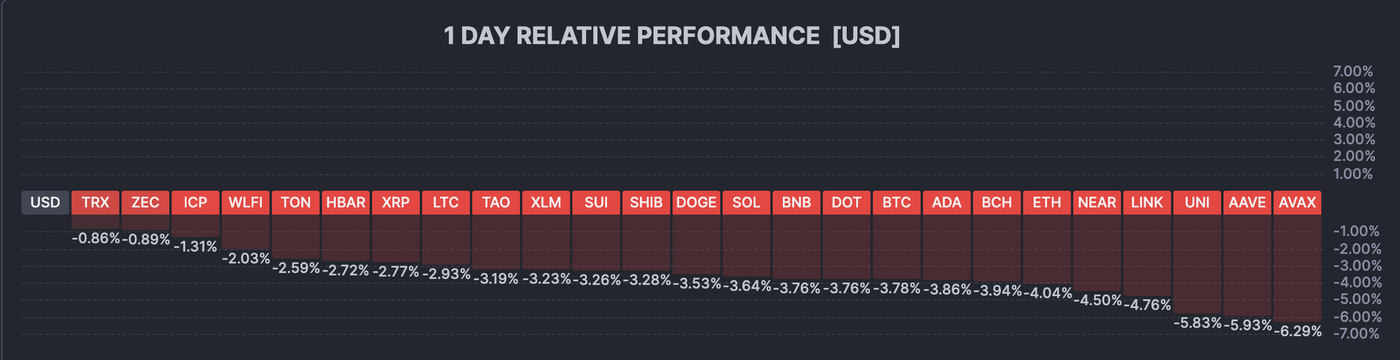

Cryptos are getting rejected harshly

A detailed Crypto piece will be releasing soon.

Keep a very close eye on the headlines to monitor Market developments.

Safe Trades!

Follow Elior on Twitter/X for Additional Market News, interactions and Insights @EliorManier

Opinions are the authors'; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. The provided publication is for informational and educational purposes only.

If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please refer to the MarketPulse Terms of Use.

Visit https://www.marketpulse.com/ to find out more about the beat of the global markets.

© 2026 OANDA Business Information & Services Inc.