Log in to today's North American session Market wrap for January 5 (2026!)

Today marks the official beginning of 2026 trading as most traders return to their desks.

The weekend began with a geopolitical shocker as the US officially captured Nicolas Maduro on Saturday, igniting explosive debates among economists, politicians, and market participants.

After a positive weekly open for the US Dollar, flows quickly turned toward broad selling against virtually every other asset class.

We are witnessing another wave of the Everything Rally in today's session to start the year with the Dow Jones leads US Indexes higher.

However, when looking across stocks, currencies, and cryptos, the Canadian Dollar stands out as the only major loser.

The reason for this divergence is tied to the energy markets.

For years, Canada has been the primary alternative for sourcing Heavy Crude after Venezuela closed its doors.

US Gulf Coast refineries are specifically designed to process this heavier grade of oil. If the Venezuelan economy reopens, it could flood the market with competitive supply, severely hurting the prospects for Canadian energy companies.

While the USD fades, commodities are soaring. Silver and Platinum are leading the complex, with both rising +6% on the session.

With relatively light but dovish data releasing today, the path toward rate cuts appears to be getting smoother.

However, traders will likely remain cautious until Friday's NFP report provides more clarity on the labor market.

Stock Market Heatmap – Energy, Finance and Defensives dominate

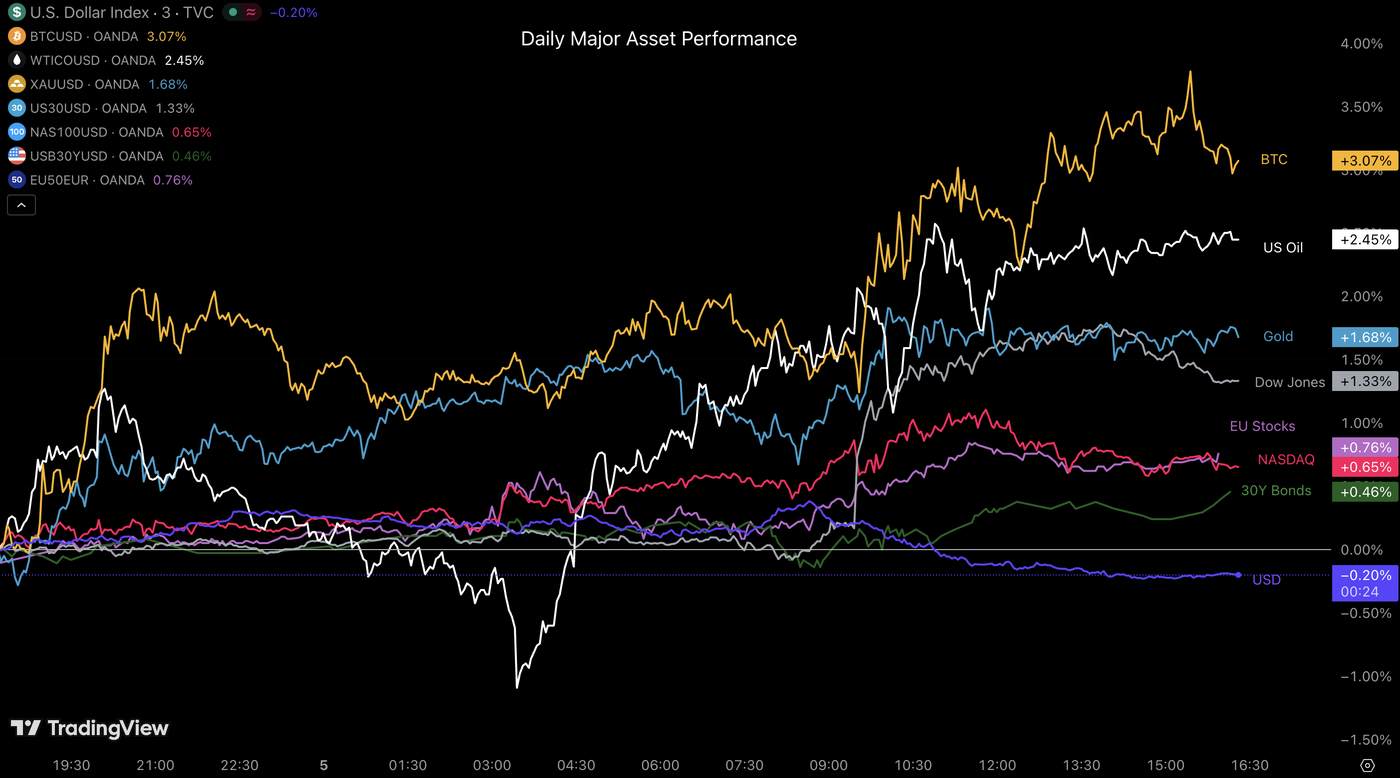

Cross-Assets Daily Performance

Only the US Dollar finishes the session down.

A very positive but surprising first official session to 2026 – With Bitcoin rebounding and Gold following closely, will this year be a mirror of last year?

Surely not. But this surely is a familiar picture.

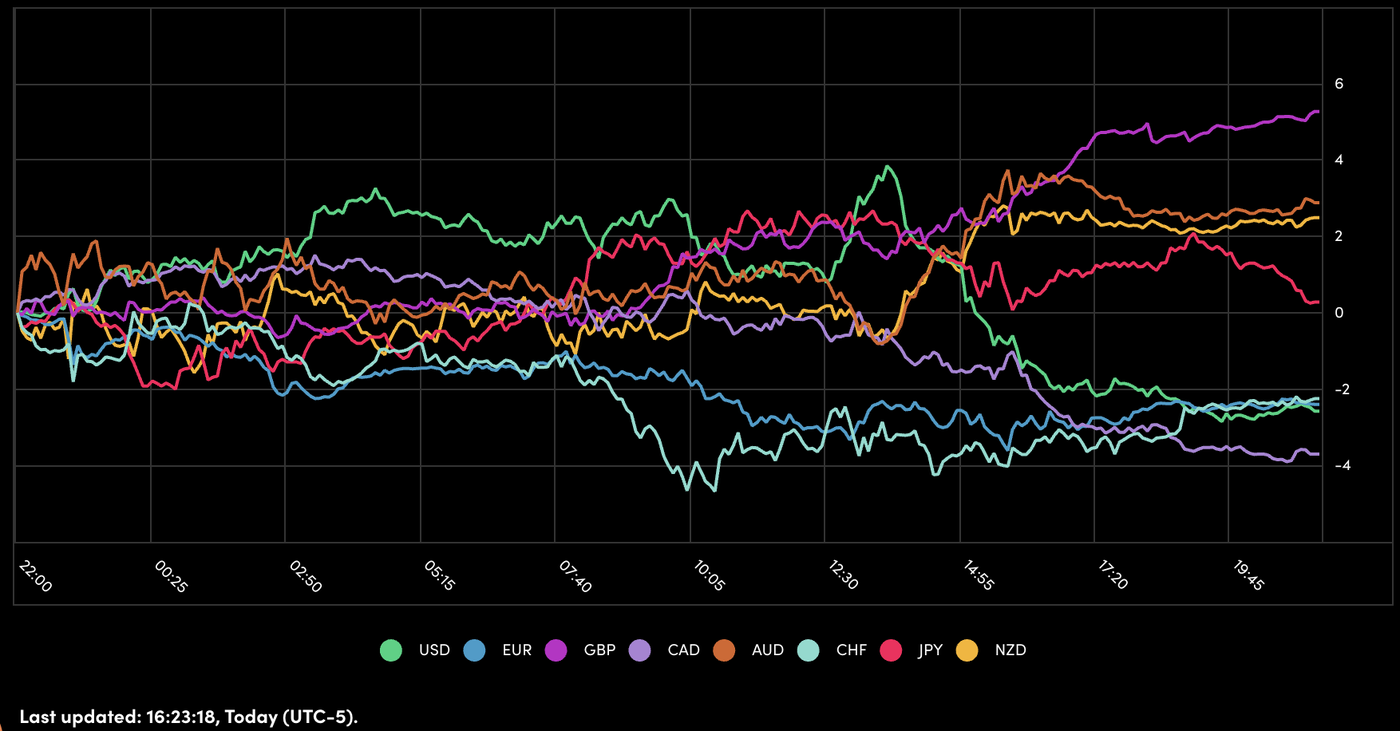

A picture of today's performance for major currencies

The FX sessions has overall been a mixed one but on theme stands out:

Risk-centric currencies are rising heavily at the cost of the US and Canadian Dollars.

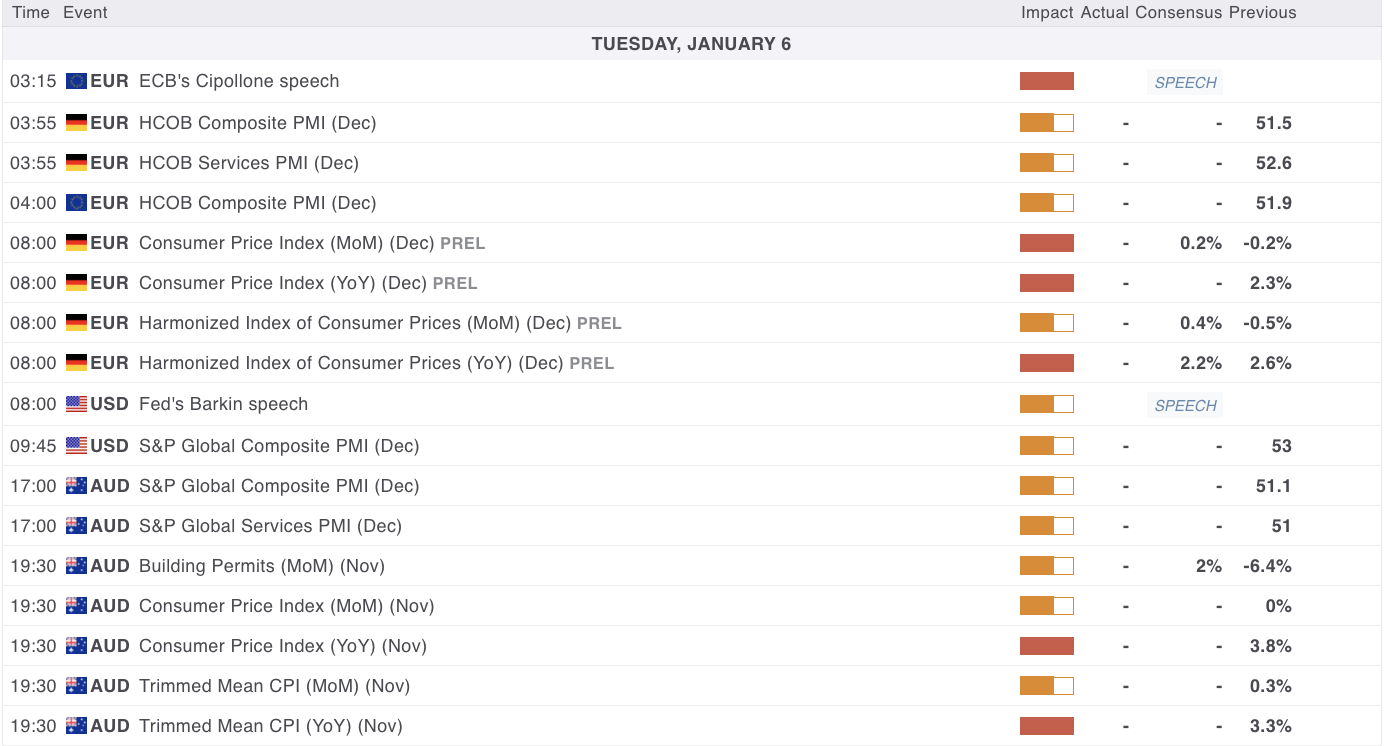

A look at Economic data releasing throughout this evening and tomorrow's sessions

The first trading week of 2026 starts with quite some heavy Euro-centric data, between some Inflation releases for Germany and the EU.

Later in the US Session, expect a few speeches (which should be market moving) and US Composite PMIs.

Who Are the Fed Speakers to Watch in 2026? A New Front-Runner for the Fed Chair

The evening session will also see the release of PMIs and more inflation releases (key report) for Australia.

Safe Trades and Happy New Year!

Follow Elior on Twitter/X for Additional Market News, interactions and Insights @EliorManier

Opinions are the authors'; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. The provided publication is for informational and educational purposes only.

If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please refer to the MarketPulse Terms of Use.

Visit https://www.marketpulse.com/ to find out more about the beat of the global markets.

© 2026 OANDA Business Information & Services Inc.