Gold was down as much as 1.2% before recovering to trade above the $4450/oz. The precious metal is still finding significant buying support on dips but does remain vulnerable if it does not breach the $4500/oz level.

Geopolitics and US Data

Geopolitical risk rears its head again as news came through earlier today that the US were going to seize another tanker out of Venezuela which was sporting a Russian flag. This has caused some concern about an escalation between the US and Venezuela as well as potentially Russia.

The White House separately confirmed discussions about acquiring Greenland, including potential military involvement which is likely to keep safe haven demand in play as well.

Further underpinning the precious metal was softer than expected employment data which continues to support further Federal Reserve interest rate cuts. US job openings fell more than expected in November after rising marginally in October, while a separate ADP report showed that private payrolls increased less than expected in December.

What Comes Next for Gold Prices?

Investors are closely watching for the release of the NFP data on Friday, January 9. This will likely have a major impact on rate cut expectations and thus could serve as a catalyst for gold's next big move.

Gold does appear to still be volatile given the price action we saw today. So I would not rule out significant movement overnight in the Asian session.

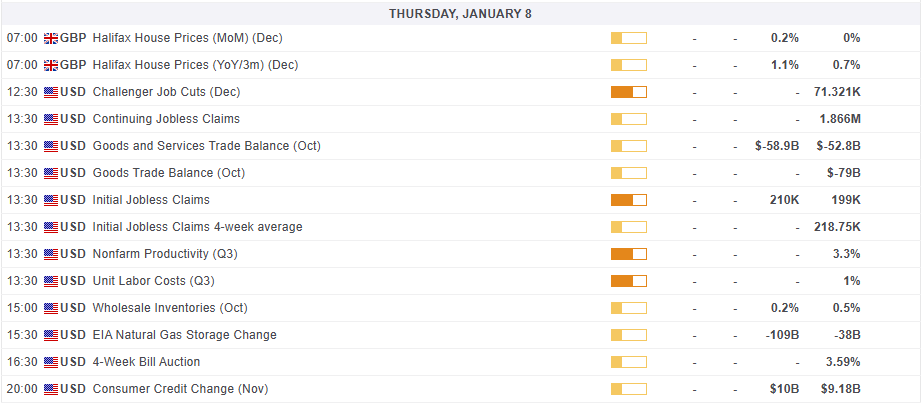

Tomorrow brings a batch of mid-tier US economic data that could spark some volatility. The key releases to watch include the initial jobless claims and the trade balance for goods and services.

Technical Outlook - Gold (XAU/USD)

Looking at the four-hour chart below, the technical picture is intriguing to say the least..

The rally since the start of the week has failed to gain acceptance above the crucial $4500/oz level.

The selloff today however, has run into a key area of support provided by the 50-day MA which rests at $4419/oz.

Price has bounced and is now resting just around the $4450/oz handle, with the period-14 RSI also having bounced off the 50 level which hints at bullish momentum remaining in play.

As things stand buyers remain in control with significant support to the downside. The ongoing geopolitical drama is also underpinning prices.

This could all change with Friday's jobs data where a strong NFP print and a significant improvement in the unemployment rate could lead to a selloff which may threaten the $4400/oz handle.

A move lower may look to retest the weekend gap which rests between the $4332-$4354/oz handles.

Meanwhile, a move higher from here needs acceptance above the $4500/oz handle before a sustainable break of the current all-time high around $4550/oz becomes a possibility.

Gold (XAU/USD) Four-Hour Chart, January 7, 2025

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Opinions are the authors'; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. The provided publication is for informational and educational purposes only.

If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please refer to the MarketPulse Terms of Use.

Visit https://www.marketpulse.com/ to find out more about the beat of the global markets.

© 2026 OANDA Business Information & Services Inc.