Key takeaways

- US dollar under pressure as “sell America” narrative builds: Escalating US foreign policy tensions with NATO/EU allies over Greenland have driven a second straight session of USD weakness, with AUD and NZD outperforming most majors.

- AUD/USD breaks higher with bullish momentum: The pair has cleared the 0.6720–0.6730 resistance zone, resuming its bullish impulsive move within a broader medium-term uptrend, with 0.6760 as the next upside trigger.

- Technical and macro signals reinforce the bullish bias: A bullish engulfing pattern, supportive momentum indicators, and a widening Australia–US 2-year yield spread all argue for further AUD/USD upside unless 0.6690 support fails.

The US dollar has dropped for the second consecutive session after the latest US hostile foreign policy towards its long-time allies, where US President Trump threatened the eight NATO/EU members, which include Germany, France, and the UK, that objected to the US’s strong push to purchase Greenland, a resource-rich Arctic territory under Denmark’s autonomous control.

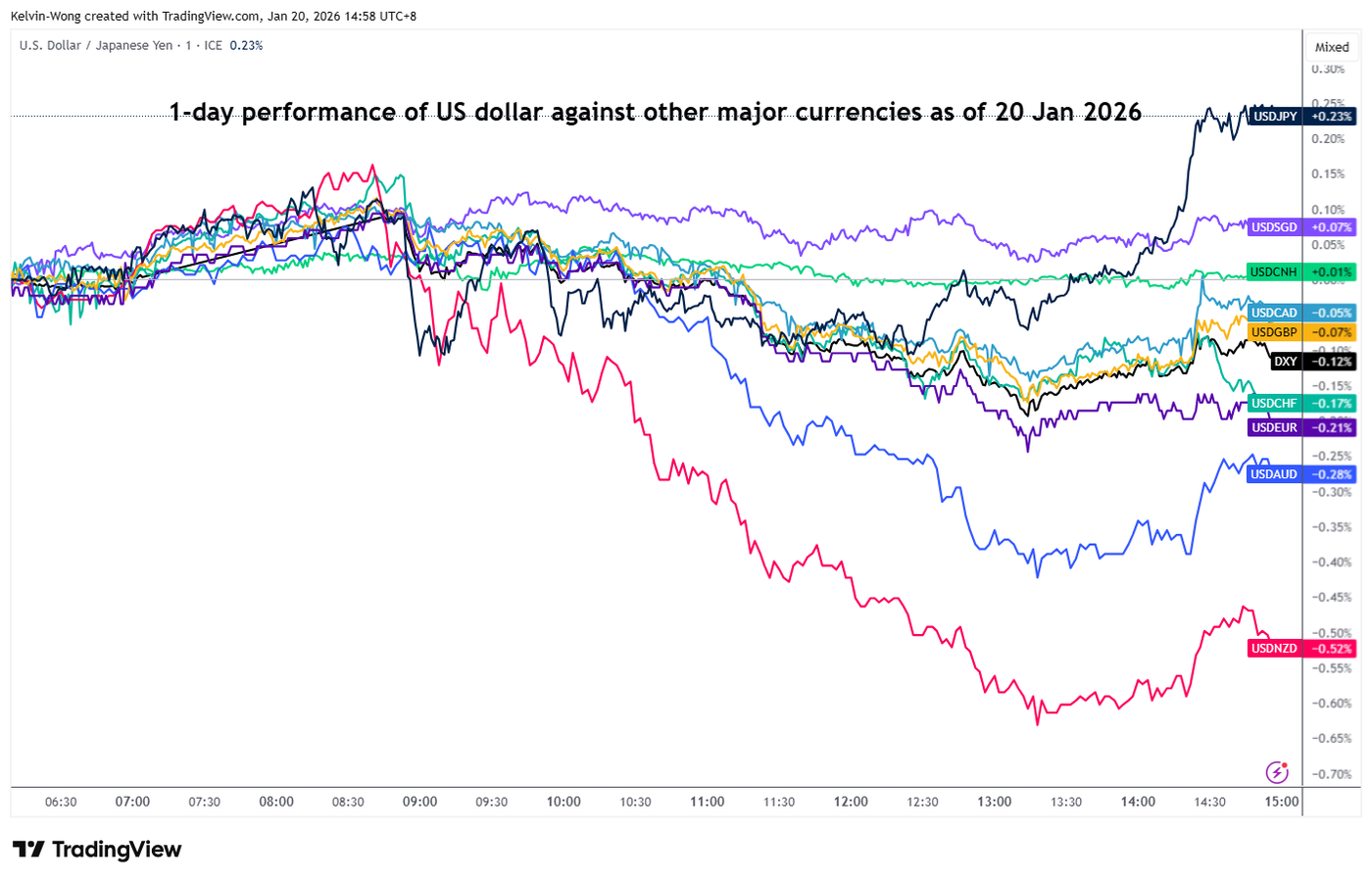

The US dollar fared the worst against the NZD (-0.5%) and the AUD (-0.3%) among major currencies on a 1-day rolling basis, but managed to buck the trend against the Japanese yen, where the greenback recorded an intraday gain of 0.2% due to the upcoming snap election in Japan on February 8 that may prevent the Bank of Japan (BoJ) issue a hawkish monetary policy guidance on its rate setting meeting this Friday, January 23 (see Fig. 1).

Let us now focus on the short-term (1 to 3 days) technical trend and key levels to watch on the AUD/USD

AUD/USD: Bullish impulsive sequence resumes within medium-term uptrend

Watch the 0.6690 short-term pivotal support (also the 20-day moving average). A clearance above 0.6760 is likely to see the next intermediate resistances come in at 0.6800 and 0.6830/6845 (see Fig. 2).

However, a break with an hourly close below 0.6690 invalidates the bullish breakout for another round of choppy minor corrective decline to retest the 0.6670/6600 minor range support. Failure to hold at 0.6660 may extend the decline to expose the next intermediate supports at 0.6630 and 0.6590 (also the close to the 50-day moving average).

Key elements to support the bullish bias on AUD/USD

- Today’s bullish breakout above 0.6720 has come after the formation of Monday, January 20’s daily “Bullish Engulfing” candlestick after a retest on the 20-day moving average (see Fig. 3).

- The hourly RSI momentum indicator has reached the overbought region, but without any bearish divergence condition.

- The monetary policy-sensitive yield spread of the 2-year Australian sovereign bond over the 2-year US Treasury note has rebounded to 0.50% from 0.43% printed on last Friday, January 16. The widening of the yield spread premium supports a further potential up move on the AUD/USD.

Opinions are the authors'; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. The provided publication is for informational and educational purposes only.

If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please refer to the MarketPulse Terms of Use.

Visit https://www.marketpulse.com/ to find out more about the beat of the global markets.

© 2026 OANDA Business Information & Services Inc.