The first quarter provided a change in the fundamental backdrop that had most of the major central banks adopt dovish stances, as the financial markets assessed global growth concerns and the effects of trade wars. While US stocks and oil prices had relatively stable rises in the first quarter, currencies provided a much more diverse story, with the dollar muscling out a gain.

– Global Growth Concerns Ease Up

– Trade War Season

– Oil’s Rally Remains Vulnerable to Rising US Production and OPEC+ Compliance

Major geopolitical events will dominate headlines in the second quarter with the focus remaining on the US-China trade war, Brexit, OPEC + cuts and the question of whether global growth concerns will continue to ease.

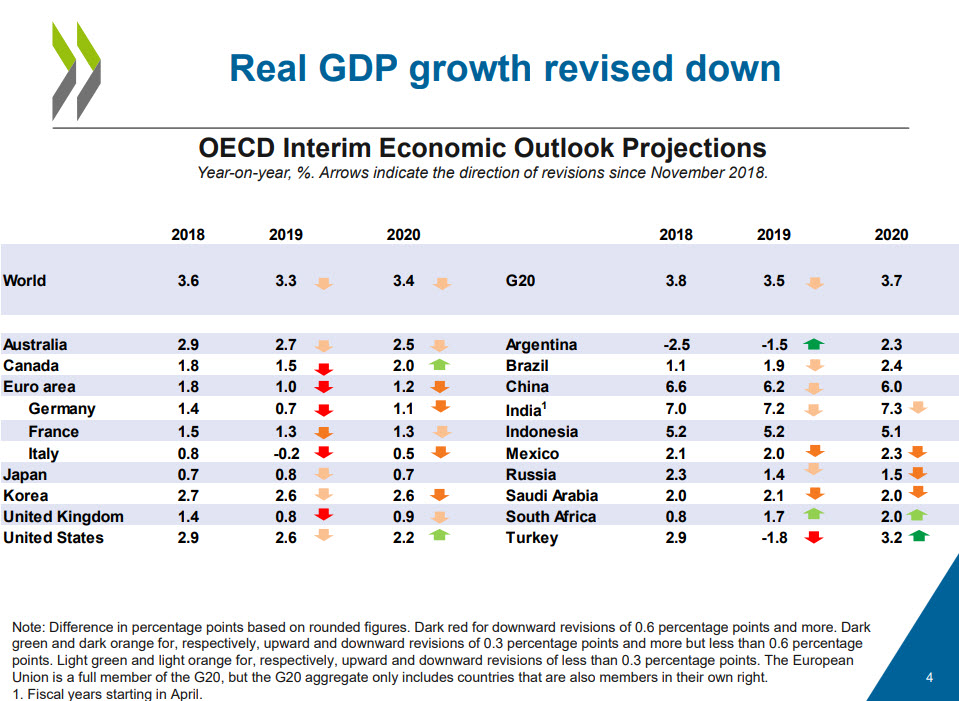

One theme for the start of the year was downgrades with economic growth forecasts. With the Fed, ECB, RBNZ, BOC, and RBA all on hold or possibly considering rate cuts, we could see a patient approach to reacting to economic data in the coming months. Most central bankers will continue to focus on deflationary conditions and will be slow to switch to a tightening bias even if we see a rebound with second quarter data.

US stocks are entering earnings season on a high note, despite a negative earnings growth estimate of -3.7% for the first quarter. The financial markets appear to be around 90% optimistic a trade deal will be reached between China and the US. When you add easy monetary policy to the narrative, many portfolio managers are behind their benchmarks and we could see heightened volatility this quarter.

Source :

| OANDA Q2 Blueprint | |

| Content | Page |

| Major Market Moving Events & Elections | 1 |

| S&P 500 Outlook | 2 |

| EUR/USD Battle of the Doves | 3 |

| GBP/USD Brexit Hangover | 4 |

| Is Safe-Haven Mania Over? | 5 |

| Emerging Market | 6 |

| Oil – OPEC’s winning the production war | 7 |

| Commodity Currencies | 8 |

| Upcoming Economic Releases and Key Speeches | 9 |

Earnings Season begins April 12thMajor Upcoming Events:

- Brexit April 23rd end of Parliament’s recess

- US Q1 Advance GDP on April 26th

- OPEC + next JMMC meeting on May 19th

- Potential Trump-Xi Mar-a-Lago meeting around June

- 176th OPEC Meeting on June 25th (OPEC + Ministerial Meeting on June 26th

- OPEC + Ministerial Meeting June 25-26th

- IPO market to heat up

Key Elections

- India general Elections during April 11th to May 19th (7 phases)

- Spanish general election on April 28th

- UK local elections on May 2nd or perhaps a general election or second referendum

- South Africa general election on May 8th

- Philippines general election on May 13th

- European Parliament election on May 23rd-26th

- Irish local elections on May 24th

- Belgian general election on May 26th

- Danish general election on June 17th

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.