Oil – OPEC’s winning the production war

The battle for the Iron Throne in the battle of oil prices is currently being won by the Saudis. The Saudis have successfully partnered with the Russians in delivering production cuts that will re-balance oil markets. The US is unhappy with the current 40% rally in oil prices and despite high oil prices they have decided to end waivers for Iranian oil buyers. The Saudis and UAE are expected to pick up the loss of Iranian crude, but this decision likely signals a complicated situation for OPEC + to keep their current program of cuts going on till year end. This will alleviate the US concerns of Saudi Arabia’s over complying on their end of the production cuts.

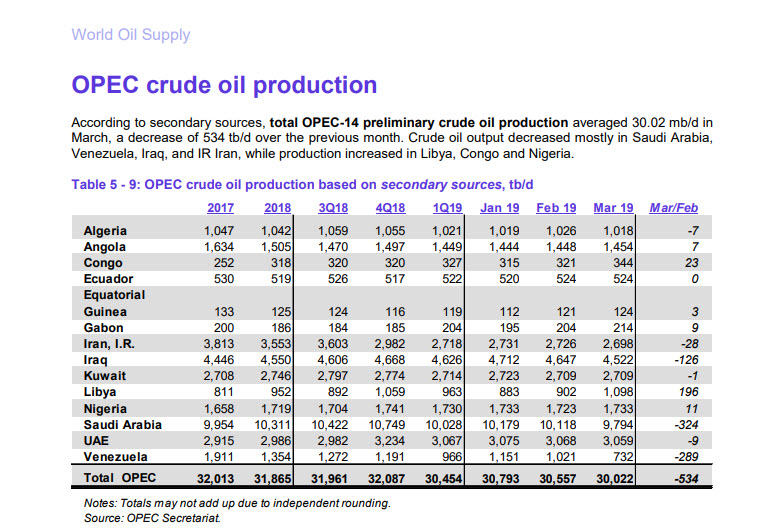

Many are surprised that OPEC + has been very compliant with the agreed upon production cuts. OPEC decided to push back their normal bi-annual meeting a month to see what the US decides to do with the waiving of sanctions on Iranian crude. While most of OPEC would be happy to see prices continue to rise, the Russians may decide that they are content with where prices are and would prefer to normalize their production.

Demand for oil showed signs of picking up in the first quarter and if we see dollar weakness, we could see emerging markets more tolerant of higher prices.

The elephant in the room for higher oil prices is the continued expectation of fresh record high levels with US production. American shale is growing and now that the US is both the biggest producer and exporter of oil, we could eventually see oil start to trade in a range.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.