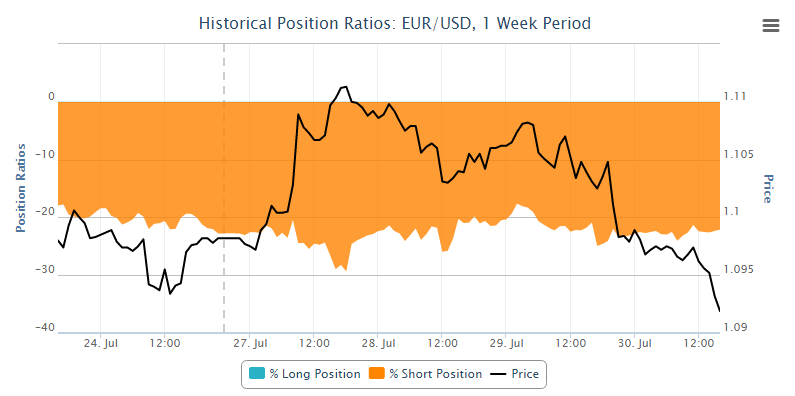

The euro has been under pressure against the dollar over the past few days since running into significant resistance from the 144-day simple moving average and descending trend line, from 14 July highs. This came as divergences were appearing on the 4-hour chart (see EURUSD – Divergence at Major Resistance).

Not only did the pair fail at this level, it also formed a double top, the neckline of which was broken shortly after it broke below the ascending trend line, from 21 July lows.

The pair has now run into some support around 1.09, the price projection from the double top and also a previous level of support and resistance, and a round number.

While we may see some consolidation, the 4-hour and 1-hour charts are not showing any signs of momentum loss. The last couple of candles on the daily chart are also rather bearish.

If this level is broken, the next notable level of support is 1.0870 – 22 July lows – followed by 1.0808-1.0820. Aside from being a key area of support since 27 April, this may also coincide with the ascending trend line from 13 May lows, providing additional support at this level.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.