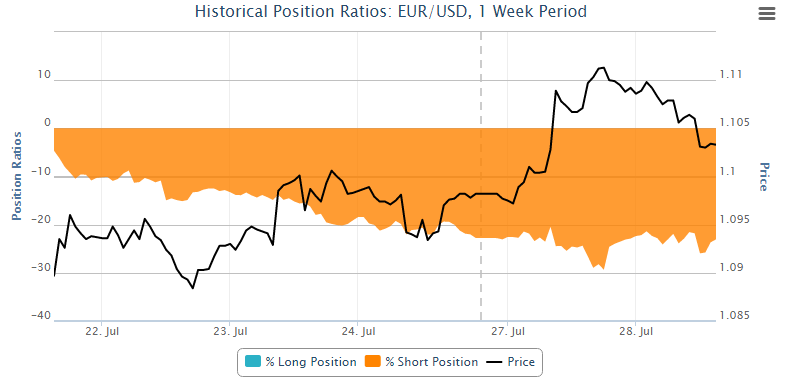

The euro is facing a big test as it attempts to maintain its recent momentum against the dollar and break through a major resistance level that would strongly call into question whether this pair could in fact hit parity by the end of the year, as some suspect.

The first thing to note is the resistance it is facing just above the current level around 1.1120. The descending trend line – 14 July highs – and 144-day simple moving average are both big resistance levels.

Both were temporarily broken in the middle of June but this just turned out to be a false breakout and they have been tested and held since. As they have on numerous occasions in the past.

It is also the 50% retracement of the move from 18 June highs to 20 July lows, which could provide additional resistance if the market is in fact still bearish on this pair in the long run.

The 4-hour chart suggests this could be the case, with both the MACD histogram and stochastic displaying divergence with price action. If the pair fails to make a new high at the next time of asking, it may suggest that the last week of gains was nothing more than a correction.

Alternatively, a break below the ascending trend line – 21 July lows – or, even better, a daily close below yesterday’s open (bearish engulfing pattern) – 1.0982 – would suggest any upside momentum has been lost and bearish bias resumed.

This could then bring 1.0810-1.0820 back into consideration, which has proven to be a strong support area in recent months. The ascending trend line from 13 March lows may offer further support at this level.

The pair could find support first around 1.0915-1.0925 and 1.08970, both of which have been key support levels during the rally over the last week.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.