Companies Warn on China Profits

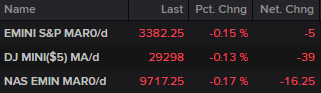

The stock market rally appears to be losing a little momentum, with Europe paring gains again and the US poised for small losses on the open.

Source – Thomson Reuters Eikon

Investors have a knack of finding some reason to buy the dips though so don’t be surprised if we’re back in record territory in no time. That said, the stuttering rally is coinciding with various companies warnings about the impact of the coronavirus on sales and production which suggests first quarter results will likely have a few nasty surprises.

That list is likely to get much longer over the coming weeks as the PR teams look to manage expectations and avoid any major shocks on reporting day. We’re not getting too much detail at the moment, which is understandable as many of them are still not running at full capacity, but early indications aren’t great.

Onwards and upwards for gold

Gold is continuing to plow higher, up for a fifth day in six and smashing through $1,600 to hit a new near-seven year high in the process. The fact that this comes as stock markets are at, or around, record highs and the dollar index is also at near-three year highs is a little bizarre. The only feasible explanation for gold’s relentless march higher in that situation is the expectation that central banks are going to be forced to pump more liquidity into the system to manage the coronavirus situation, which isn’t exactly a whacky assumption. We have to go back some time for levels for gold but it’s the $20 markers that seem to stand out, making $1,620 and $1,640 the next notable areas.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

Oil winning streak at risk

A seven day winning streak is at risk in oil on Thursday, with Brent and WTI squeezing out small but unconvincing gains in early trade. It’s been quite a recovery, with Brent now more than 10% off its lows, but still way short of the pre-coronavirus levels. The prospect of monetary stimulus does little to address the sudden drop in demand for crude at a time when oversupply is already an issue, even if things do gradually return to normal over the coming weeks.

Brent Daily Chart

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.