Spanish Prime Minister Mariano Rajoy denies allegations that Spain will make an official request for a bailout this weekend. The issue of a bailout package for Spain has been an WHEN not an IF matter for a couple of months now.

After clearing all the member state hurdles last month, October should be the month when the official aid request is submitted. There is no real dependency between the member states approving the ESM and the bailout request, but it seems Spain will not move until its sure the Troika does not have an excuse to withold funds.

There is also rumors circulating about Germany being the force behind the bailout request delay. And by Germany they probably mean the Merkel goverment who wants to grant the aid, but will prefer if its a last minute “had to be done†affair to avoid political fallout.

Another side effect of waiting for a bailout is that the unceirtainty in Spain has made more companies move their assets abroad, which will make it harder for the country to meet its austerity measures objectives and deficit targets in the coming years.

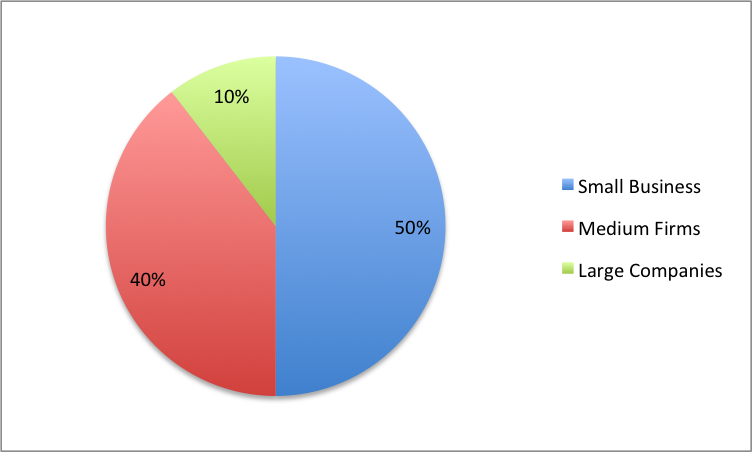

The currency market is waiting for Friday’s U.S. Non-farm payroll report. The private sector ADP figures set up a positive expectation after 162,000 jobs were created. This figure was better than expected. The vast majority of the jobs addes came from small and medium sized business. Large companies only accounted for 10 percent of jobs created.

To download the full ADP Employment report click here

With two job reports before the presidential election they take on an additional meaning. The only non factor would be if they come in as expected, which would indicate stagnant growth.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.