It’s been a lively start to trading on Monday, with the initial relief rally following Emmanuel Macron’s victory in the French election quickly fizzling out as the euro and European stock markets reversed gains to trade lower on the day.

Markets Reverse Course as the Fact is Sold

What we’re seeing this morning is a classic case of the rumour – or the expected result in this case – being bought and the fact being sold. The gains over the last couple of weeks since Macron’s first round victory have been substantial and it would appear the trade has exhausted itself. There were clear signs that Le Pen risk was no longer being priced in after her first round performance, with the spread between French and German 10-year yields having halved since the middle of February, back to the kind of levels we we’ve been seeing for the last three years.

Source – Thomson Reuters Eikon

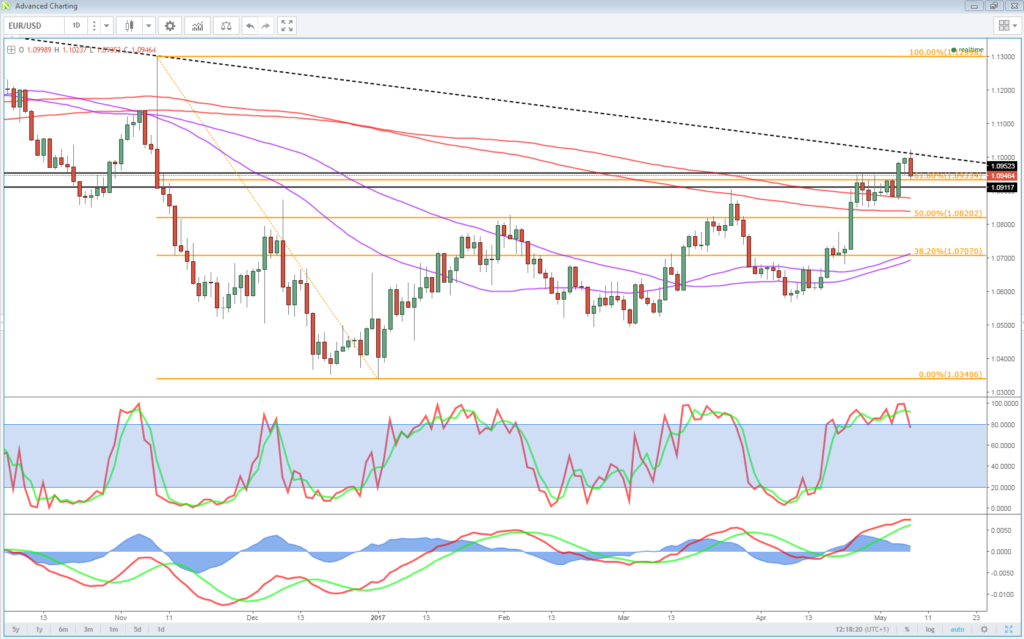

EURUSD Fails to Break Key Resistance at First Time of Asking

Still, an initial relief rally on the open came as no surprise, given the potential downside in the event of an upset, but the fact that it was so short-lived shows just how priced in it was. With the euro failing to hold above a major technical resistance level against the dollar and above 1.10 – a big psychological level – questions will now be asked about the sustainability of the recent rally. A break back below 1.0850 in the coming days could trigger a much broader correction to the downside.

OANDA fxTrade Advanced Charting Platform

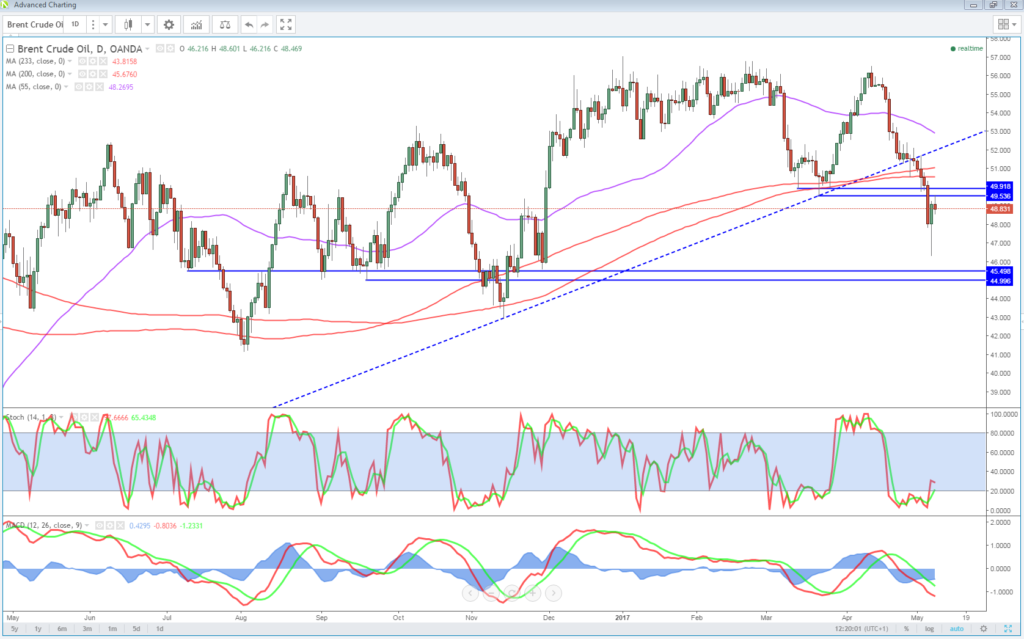

Oil Retraces to $50 But US Supply Continues to Weigh

Oil has also been very active this morning with the opposing forces of rising US output and oil rigs, and a Saudi led push to extend the production cut beyond the middle of the year creating plenty of volatility. Brent crude rebounded strongly off its lows on Friday following a strong sell-off after breaking below $50, the very level that has capped gains this morning following an early rally. If gains continue to be capped here, it could point to further downside for Brent, possibly towards the $45 levels that we were seeing late last year.

Commodities Ressens L’Amour on Monday

US Futures Slip at Range Highs

US futures are pointing at a slightly negative start on the week, with the S&P and Dow both struggling to build on Friday’s gains as they trade at the highs of the range they’ve been contained within since March. The S&P failed to break above 2,400 at the third time of asking on Friday and a break below 2,380 now could signal some weakness to follow for the index.

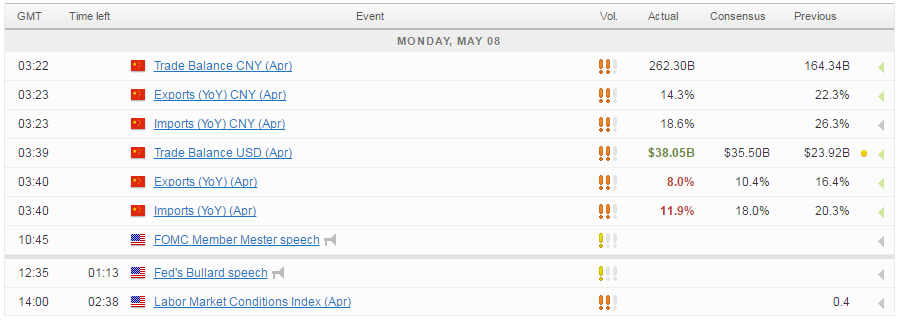

The next couple of days is looking quiet from an economic event perspective, leaving traders to focus on Friday’s jobs data and the French election result, while eyeing retail sales and inflation data later in the week.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.