Improving environment spurs market comeback

US futures are back in the green ahead of the open on Tuesday, as risk appetite continues to gradually improve following Friday’s jobs data and Powell comments.

The combination of healthy labour market data and dovish commentary from the Fed Chair has provided relief to stock markets that endured a rough fourth quarter, to put it mildly. It’s too early to claim that the worst is behind us but the environment currently looks more favourable than it has for a few months. With the US and China in talks to de-escalate their trade conflict, the central bank showing a willingness to slow its tightening cycle and the economy still performing well, the markets may be looking a little more attractive.

That said, there’s still a sense of vulnerability that could quickly unravel any rebound we see. Trump remains unpredictable and talks could take a turn for the worse at any point. The US government remains in partial shutdown. And with Samsung becoming the latest company to deliver a profit warning, not long after rival Apple warned of weaker iPhone sales, there are red flags popping up everywhere. This will likely act as a drag on the markets in the near-term, at least.

Commodities Weekly: Gold near 6-1/2 month high as dollar retreats

Profit taking and improved risk appetite weighs on gold

Gold is under a little pressure on Wednesday, still struggling to tackle the $1,300 level that has prompted some profit taking following an impressive rally. The dollar is continuing to put up a fight even as it continues to look vulnerable, which would offer support to gold in its bid to break through its resistance. A more dovish Fed has clearly aided this move but still the dollar index continues to hold just above 95.5, although I do wonder for how long. It’s not looking good at the moment.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

The improved risk environment at the start of the week doesn’t help the bullish case for gold at a time when the profit-takers are taking some of the shine off of it. Perhaps in the near-term we’ll see a bit of a corrective move, with $1,280 and $1,260 offering possible support, but I do think we’ll see a much stronger run at $1,300 soon that will test just how bullish the market really is.

A bit of the feel-good factor has temporarily abated

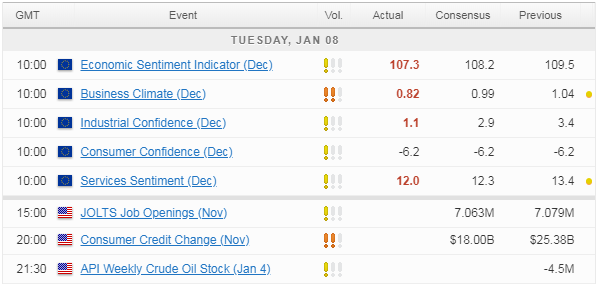

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.