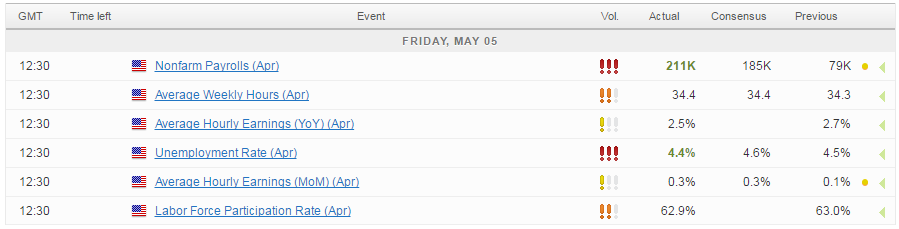

We’ve had another mixed jobs report from the US today that will likely do nothing to either encourage or deter the Fed when it comes to deciding whether to raise interest rates next month.

Arguably the most important aspect of the report was wage growth given that the Fed has all but achieved its full employment mandate but continues to fall a little short on inflation. With the Fed pinning their hopes on a tighter labour market spurring higher levels of wage growth – which is still far from reaching the levels prior to the financial crisis – traders are understandably a little underwhelmed today. Wages grew by only 2.5% compared to last year, remaining stubbornly around the levels we’ve seen over the last year.

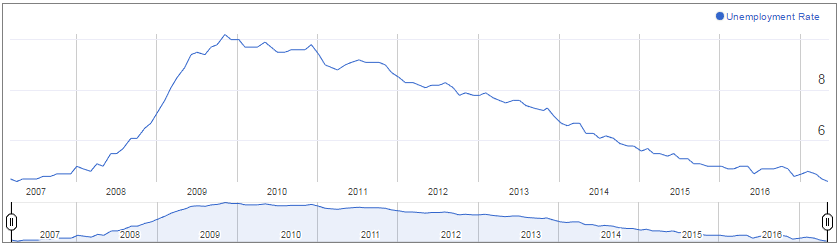

Still, the Fed seems determined to raise rates twice more this year as long as the economy continues to improve and despite another weak first quarter, it’s hard to argue that this is happening, albeit slowly when it comes to wages. Job creation was above 200,000 again last month and unemployment fell to 4.4%, a level it hasn’t reached in around a decade.

This is also the pre financial crisis lows, just to put it into perspective, with lower levels again not being seen for around 16 years. It is worth noting here though that participation – another frustration for the Fed – did fall to 62.9% which would have contributed to the fall in unemployment. Prior to the financial crisis, this was around 66%.

Oil Tanks, Greasing Sell-Offs Elsewhere

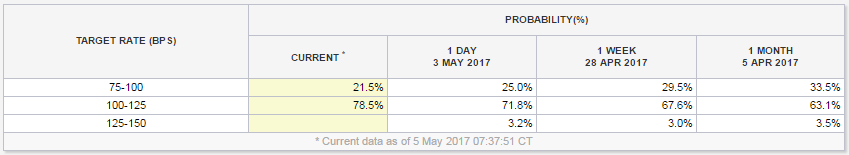

The decline in the dollar would suggest markets are disappointed in the numbers and after the implied probability of a hike next month rose to 79% on the back of the Fed’s statement, it could be about to reverse course.

Source – CME Group FedWatch Tool

The reality is that today’s report, containing both positive and negative aspects, is unlikely to have altered the Fed’s plans and a June hike very much remains on the table.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.