European equity markets are expected to open higher on Friday, led by the FTSE and buoyed by gains in the US overnight where indices staged a moderate recovery following some heavy selling the day before.

Investors are clearly still a little anxious about the political situation in the US, which showed to an extent on Wednesday, but as it stands I don’t think they’re too concerned. Wednesday’s sell-off may have shocked a few people but US indices remain in the same range they’ve traded in for the last few months and as long as that remains the case, it would suggest that investors are not too concerned.

Commodities: U.S. Data Puts Risk-Off, Back In Its Box.

The FTSE looks to be leading the gains in Europe ahead of the open on Friday, boosted no doubt by sterling’s performance since yesterday’s European close. The pound showed its vulnerability once again on Thursday – albeit on a much smaller scale than seen previously – as it fell around one cent against the US dollar in a very short space of time. Given the timing of the plunge, it would seem the liquidity of the market as opposed to any particular catalyst was largely responsible for the mini “flash crash”.

OANDA fxTrade Advanced Charting Platform

The pound has now settled around 1.2950 against the dollar and 0.8575 against the euro, having failed to hold onto its gains earlier in the day which came on the back of a much better than expected retail sales report. Particularly against the dollar, the pound was already looking a little unstable around 1.30 and yesterday’s mini crash has done little to convince me otherwise. We’ve seen a lot of consolidation in the pair overnight, I wonder whether we’ll see one more burst before the week is out.

The final trading session of the week is looking a little light on the events and data side of things. We have a few pieces of low tier data being released this morning which should have little impact, while the only notable releases this afternoon come from Canada, with retail sales and inflation data due out.

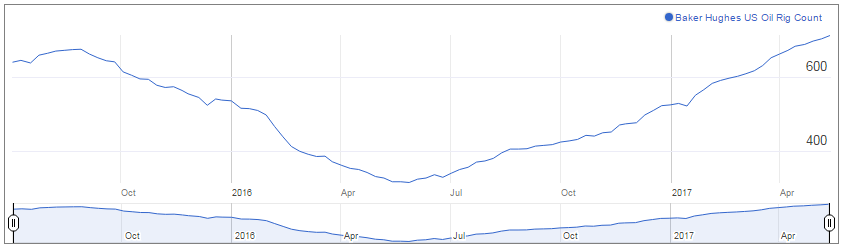

We’ll also get the latest oil rig number from the US, as Brent and WTI continue to stage a recovery on the expectation that an extension to the output cut will be agreed. The first cut was less successful than participating countries expected, largely due to the sudden increase in US output, as shale producers looked to capitalise on higher prices. The number of oil rigs has more than doubled since last summer and it will be interesting to see whether the industry can continue to chip away at the efforts of the other producers to bring the market back into balance.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.