It’s been a relatively uneventful start to the week, with equity markets in Europe trading a little mixed while those in the US are expected to open flat. The FTSE is clearly the outperformer in the European session so far buoyed by both the weaker pound sterling and the gains in commodity markets.

GBP Weighed Down as May’s Poll Lead is Cut in Half

The pound is coming under some pressure this morning, weighed down by comments from Brexit Secretary David Davis and polls over the weekend that showed the Conservatives lead over Labour has been slashed. Davis’ claim that the UK will quit talks with the EU if the reported Brexit bill isn’t revised lower appears to be putting some pressure on the currency. While the pound remains vulnerable to suggestions that talks could break down, I think this is just another case of people involved preparing for tough negotiations and threatening things they ultimately will try to avoid at all costs.

DAX Steady but Trump Concerns Remain

The polls released over the weekend may also be contributing to moves in the pound this morning, with the Conservatives lead over Labour having halved in some cases. A large majority for the Conservatives is viewed as beneficial by some when it comes to the Brexit negotiations as it gives them a strong mandate while enabling them to take a softer approach when necessary without having to rely on the support of some of the bigger eurosceptics in the party.

GBPUSD Pares Friday’s Gains But EURGBP Looks More Bullish

It is worth considering though that while sterling is among the worst performing currencies today, the loss against the dollar only equates to around half of the gains made on Friday.

OANDA fxTrade Advanced Charting Platform

The reality may well be that the apparent negative news is aiding a small correction that was on the cards regardless. That said, it is suffering a little more against the euro, with today’s moves having taken the pair through an interesting technical level that may signal further downside for the pound.

Oil and Gold Looking Good In Asia Trading

Donald Trump’s Global Tour in Focus on an Otherwise Quiet Day

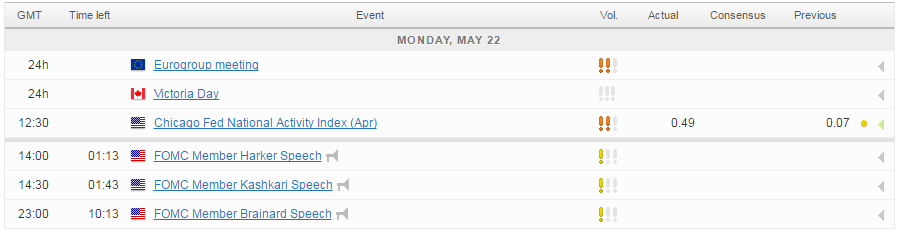

The first trading day of the week is looking a little quiet in terms of economic data or events. US President Donald Trump’s global tour will be of interest to traders although we do appear to be seeing a more reserved version of himself so far, which will come as a relief to many. The political storm at home is unlikely to go away but it may take a bit more of a backseat this week. We will hear from three voting members of the FOMC today, with Neel Kashkari, Lael Brainard and Patrick Harker scheduled to make appearances.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.