Markets steady as traders eye Jackson Hole

It’s been a relatively flat start to trading on Tuesday as it seems the Jackson Hole waiting game is underway.

Source – Thomson Reuters Eikon

Once again we’re in a situation whereby the week hangs on what Jerome Powell says about interest rates and whether he can live up to the huge expectations set by the market. Given his reluctance in the past and the current positioning, I feel the market has set itself up for disappointment but I guess we’ll see.

What’s interesting is that this huge void between Fed signals and market positioning stems from the fact that markets have had no time for remarks that indicate a gradual easing at best. Their response has been to fully price in rate cuts and assume the Fed will do as its told, like a naughty school child.

This makes Friday’s speech from Powell all the more important. The same approach won’t work and at the moment, the Fed looks like it’s being bullied, albeit by the markets rather than Trump. Powell needs to either strongly signal that markets are wrong, which will cause a jolt and have repercussions, or lay the foundations clearly. I fear he’ll do neither.

Sign up for our next webinar on 20 August below

Gold prone for correction as momentum fades

Gold is back in the green today after spending a couple of days in unfamiliar negative territory. The yellow metal broke below $1,500 on Monday which could be viewed as weakness in the trend, and it may partially reflect that, but $1,480 is the more important level and we’re still comfortably above there.

That said, the trend has clearly weakened over the last couple of weeks as it’s losing momentum. That in itself doesn’t spell doom for the rally but it is a red flag in the near-term and may suggest it’s shaping up for a correction. If it breaks below $1,480, then $1,440-1,450 looks interesting, being the resistance barrier during the July consolidation.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

Oil steady but recession talk going nowhere

Oil prices are steady, mimicking the moves we’re seeing in equity markets as global growth fears ease a little and provide some relief for risk assets. Oil is particularly exposed to the threat of recession so it’s no surprise to see prices so sensitive to these moves.

I would stress that the US 10-year yield may be back above the 2-year but recession talk has not and will not go away that easily. Oil prices will likely remain very volatile then, particularly in response to trade war headlines which represent the greatest risk to the economic outlook.

Brent Daily Chart

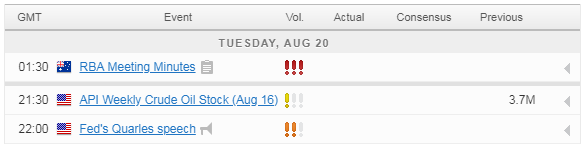

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.