Traders braced for major events to come

It’s shaping up to be a relatively flat start to the week in Europe, with futures hovering around Friday’s closing levels and the day offering little to grab our attention.

Source – Thomson Reuters Eikon

Don’t get me wrong, this week will be anything but boring but as is often the case, the opening day is unlikely to be the most memorable. It may instead be used to reflect on last week’s Fed comments – with the blackout period now underway – earnings season and the risk of conflict in the Strait of Hormuz.

Moreover, with almost a third of S&P 500 companies due to report this week, include some big hitters, a new UK Prime Minister being announced and a rate decision from the ECB, there’s plenty to prepare for.

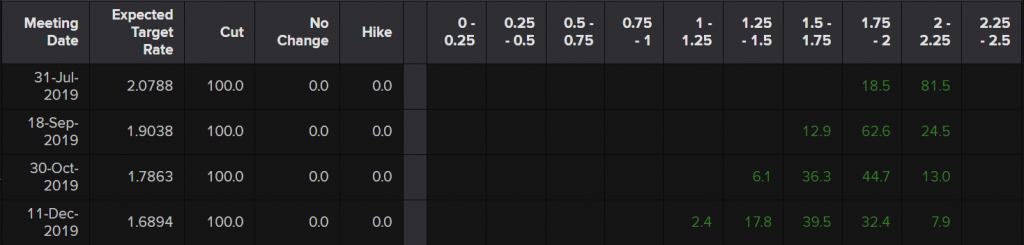

Bullard’s comments on Friday surely put an end to speculation of a 50 basis points cut at the Fed meeting next week although for some reason, markets continue to price it at just shy of 20%. Bullard is among the most dovish policy makers so when he says he’d like to see rates cut by only 25 basis points, with there being no need for anything larger, it really should end the discussion.

Fed Interest Rate Probability

Source – Thomson Reuters Eikon

Earnings season has been decent so far but there has been a mix of very good – Microsoft – very poor – Netflix – and somewhere in between. There’s still a long way to go but an earnings recession still looks very much on the cards, something investors may continue to be vulnerable to.

Johnson expected to succeed May on Tuesday

The UK will elect its new Prime Minister this week, with Boris Johnson widely expected to succeed Theresa May and succeed where she failed in negotiating a Brexit deal with the EU that gets through Parliament.

Being a Brexiteer that actively campaigned for it in 2016 immediately puts him at an advantage with getting a deal through Parliament but doesn’t necessarily make his visits to Brussels any easier, nor will it help him get the country out by the end of October as he’s repeatedly promised during the campaign.

GBPUSD Daily Chart

OANDA fxTrade Advanced Charting Platform

Traders haven’t particularly warmed to his no-deal talk, shockingly, but with the pound now languishing near more than two year lows, I wonder whether the worst may be priced in for now.

The currency may have earned some reprieve after slipping more than 6% since it became clear that May was not going to get her deal through Parliament. With traders minds once again focused on Brexit negotiations, it could be another volatile period for sterling.

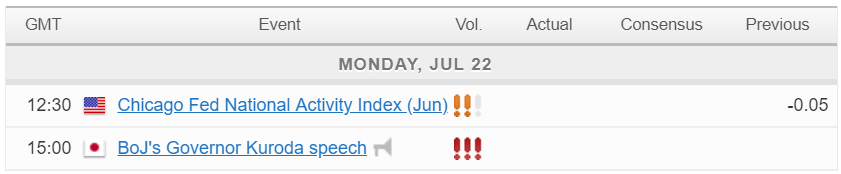

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.