Markets in Full Holiday Mode

It’s shaping up to be another relatively flat session, with investors already in full holiday mode ahead of the festive break.

Source – Thomson Reuters Eikon

The Trump impeachment saga may write some great headlines and put the President in an unenviable group of three that have gone through a similar process but as far as markets are concerned, it’s nothing more than a sideshow.

It’s all well and good being impeached in the Democrat controlled House where only a simple majority is required, it a whole other thing asking the Republican controlled Senate to impeach their own President with a two thirds majority.

BoE and Queens speech to look forward to in the UK

MPs in the UK are not quite in holiday mode just yet. Today they’ll gather for the Queen’s speech before voting on the EU Withdrawal bill on Friday, which will apparently contain an amendment ruling out an extension to the transitional period. Traders haven’t been particularly impressed with this news but with an 80 MP majority, it’s unlikely Boris won’t have his way.

The BoE interest rate decision today will be another non-event today, with markets pricing in a near-zero percent change of a rate cut. Those odds do increase throughout the course of the next year, although a lot can change in that time. I feel the BoE, like many others, may be rather hands off in 2020.

Gold drags sideways in light festive trade

Gold is flat again in early trade but continues to hold around the upper end of its recent range. It’s still struggling to break and hold above $1,480, despite breaching the level on a couple of occasions. When markets are as quiet as they are though, it’s difficult to read too much into these moves as there isn’t anything of real substance driving them. If a trade deal and an impeachment can’t spur the yellow metal to life, what will?

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

Oil extends run to five sessions

Oil has clearly missed the holiday mode memo, rising for each of the last five sessions to a three month high. There’s no lack of momentum in the move and while we may be seeing marginal losses today, there may still be room for the rally to run. Brent could have its eyes on $70 again which it hasn’t hit since April, while WTI may be eyeing a move back into mid-60’s territory. The news has certainly been positive for oil prices recently.

Brent Daily Chart

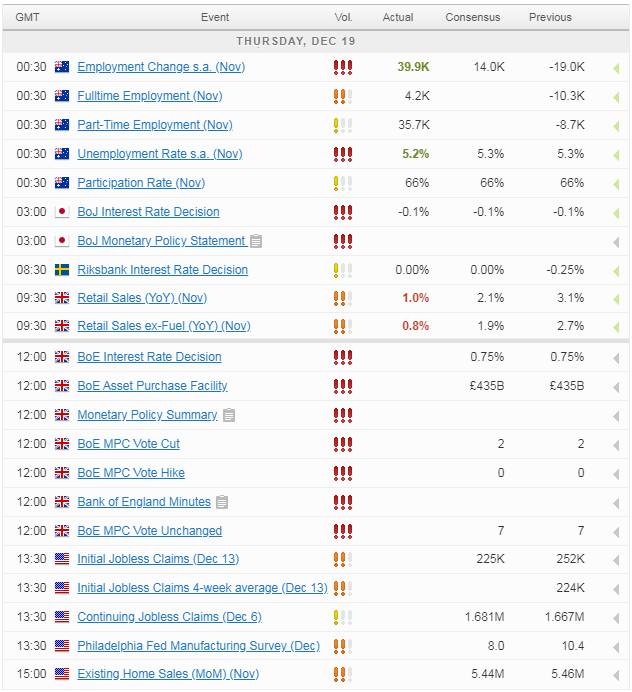

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.