Sterling slips on Brexit delay

European markets are a mixed bag at the start of trade on Monday as the Brexit saga drags on, weighing a little on the currency.

Source – Thomson Reuters Eikon

We saw strong gains in the pound last week in anticipation of a Brexit deal but it was always likely to face challenges once it got to Parliament. Events on Saturday gave us another insight into just how little trust there is in Westminster and how MPs are not going to make Johnson’s life any easier just because he’s got a deal.

The pressure is unlikely to ease up on MPs though just because the extension request was sent to Brussels. Until they confirm that it’s been accepted, there is still a risk of no deal Brexit in 10 days time. The EU could wait until late in the day before accepting an extension in an attempt to pressure MPs to back Johnson’s deal.

This week is therefore likely to be another chaotic one in Westminster, as Boris tries to get Parliament to back his deal and MPs try to change it and attach conditions, like a second referendum. That will make for another volatile week for the currency as the drama unfolds and we learn whether we’re actually leaving this time or not.

Our next webinar will take place at 12.30 BST on 22 October. Sign up below.

Gold consolidates but remains vulnerable

Gold prices are stable on Monday, trading within the same ranges that it did throughout the last week. While the yellow metal continues to look a little bearish in the near-term, it is dragging its feet which may be giving bulls some hope. The lack of clarity around the phase one trade agreement probably isn’t helping matters while ongoing Brexit uncertainty just adds to this. The key levels remain unchanged with $1,480 and $1,460 below still looking vulnerable.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

Oil prices linger around their lows

Oil prices have also been consolidating around their lows this month, unable to break below long-term support but lacking the catalyst for a corrective move higher. The $55-57 area is still key for Brent crude, with a break through here possibly providing the momentum for another hefty move to the downside.

Brent Daily Chart

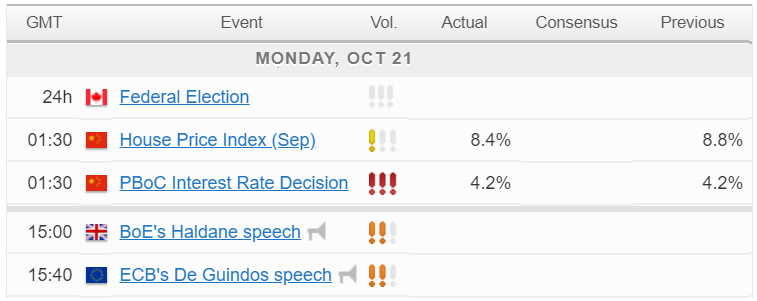

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.