Sino-US talks feeding investor optimism

All eyes on the US on Friday as Trump meets with Chinese Vice Premier Liu He following another week of talks between the world’s largest economies.

It would appear that there’s been some real progress made in the talks, at least enough to extend the truce and avoid further tariff hikes. This is a major risk for markets and is helping to feed into the improved risk appetite we’ve seen this year. If Trump’s team can get this over the line before next week’s deadline, it could provide a major boost although European investors may get a little anxious at the prospect of the US President then turning his attention that way.

U.S dollar stronger by default, but for how long?

Gold pares gains but remains bullish

Gold has come under pressure in recent days but this looks nothing more than a little profit taking on a stronger dollar at this stage. The yellow metal has looked bullish for some time and the break above $1,300 just confirmed that. Since then, it’s gone from strength the strength and I see no reason to believe that’s over.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

The environment right now may not be perfect for gold – the resurgent dollar is clearly a drag – but it is bullish. Central Banks around the world are gradually coming to terms with the fact that the global economy is slowing and is in need of a little support. The decision to put tightening on hold and maybe even loosen a little is both appropriate and supportive for gold prices for now.

EUR/USD – Euro shrugs off soft German numbers

Oil stalls after breakout

This fact may not be quite so bullish for oil. Slower global growth, a resurgent dollar and record US production are all weighing on prices and causing any rallies to stall relatively quickly. It has recovered from its sell-off late last year but not as much as you may have expected and there does seem to be a reluctance to hop on board.

Oil (WTI and Brent) Daily Chart

WTI broke through a strong resistance zone this week and rather than being the catalyst for another tear higher, it’s just stalled again. That doesn’t fill me with confidence near-term. That may change in the coming weeks but we’ll need to see evidence that OPEC still has the sway it once did. It’s safe to say, Saudi Arabia has gone well above and beyond and the market shrugged. If US output starts to fall in line with oil rigs then that may change but for now, it’s only going higher, 12 million and counting.

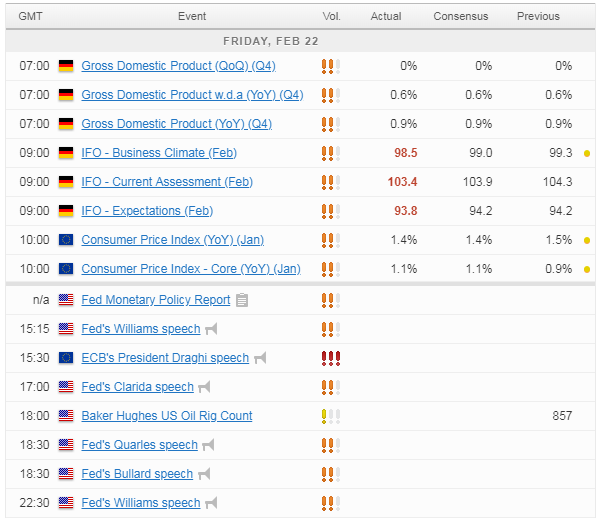

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.