- Bank of Japan maintained its ultra-loose monetary policy but issued a lukewarm hawkish statement to introduce a “flexible” Yield Curve Control programme on the 10-year JGB yield.

- JPY strengthen but did not lead to a sell-off in other Asian benchmark stock indices.

- Nikkei 225 has managed to trim its intraday loss of -2.60% and ended with a smaller magnitude of -0.4%.

- Japanese banks outperformed; the TOPIX-17 Banks ETF rallied by +4.70%.

- The new YCC with “greater flexibility” may reduce speculative activities in the JGB futures market.

Bank of Japan (BoJ) has once again maintained its ultra-loose monetary policy outright in today’s conclusion of its July MPM; kept the short-term interest rate target unchanged at -0.1% and maintained the 10-year Japanese Bond Government Bond yield at around 0% with upper and lower limits cap at 0.5% on each side.

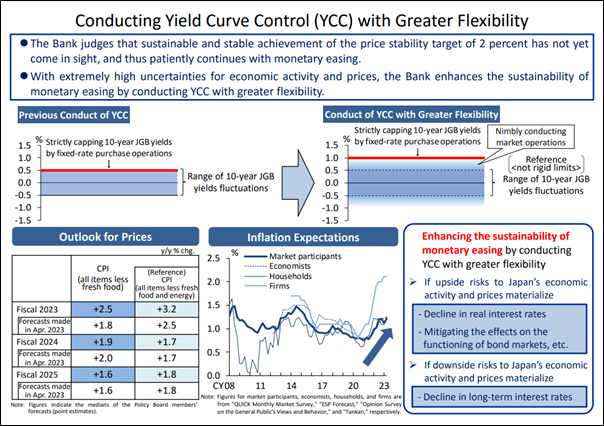

Also, BoJ has upgraded its median consumer inflation (CPI) forecast for FY 2023 on its latest quarterly outlook report; core CPI is expected to increase to 2.5% year-on-year (y/y) from the prior forecast of 1.8% y/y, and core-core CPI (excluding fresh food & energy) has also been raised to 3.2% y/y from prior forecast of 2.5% y/y.

No change in the median CPI forecasts for FY 2024 and FY 2025. For FY2024, forecasted core CPI (1.9% y/y), and core-core CPI (1.7% y/y), as for FY 2025, forecasted core CPI (1.6% y/y), and core-core CPI (1.8% y/y).

Meanwhile, the median forecast for FY 2023 real GDP is being downgraded slightly to 1.3% y/y from the previous forecast of 1.4% y/y. BoJ has maintained its real GDP median forecast for FY 2024 and FY 2025 at 1.2% y/y and 1% y/y respectively.

Based on its latest inflation and growth forecasts, BoJ seems to have a view that inflation growth is likely to slow down after FY 2023 in conjunction with a mild reduction in economic growth which suggests the 2% inflation target in terms of sustainability has not been obtained, and such forecasts support BoJ’s current modus operandi of maintain its ultra-easy monetary policy, in contrast with the rest of other developed nations.

Interestingly, BoJ is well-known for being a forerunner in enacting “creative monetary policies”, and issued a rather lukewarm hawkish monetary policy statement that starkly stated two key points.

Firstly, it will operate the Yield Curve Control (YCC) programme of the 10-year JGB yield with more flexibility to respond nimbly to upside and downside risks which implies that it is pointing to a potential abolishment of the current fixed upper and lower limits of 0.5% on either side (see chart below for more details on the new flexible YCC).

Fig 1: Bank of Japan’s new YCC with greater flexibility framework (Source: BoJ website, click to enlarge chart)

Secondly, BoJ will offer to purchase 10-year JGBs at 1% yield every business day through fixed-rate purchase operations which suggests subtly that the “new invisible” limit is now set at 1% on the YCC programme.

Overall, it seems that the new YCC with “greater flexibility” by not committing to any hard upper and lower limits is to reduce undesirable speculative activities in the financial markets, especially the JGB futures that are likely to trigger adverse reflexive loops into other asset classes and the real economy.

No major risk-off in the Asian session despite the continuation of JPY strength

Fig 2: USD/JPY minor short-term trend as of 28 Jul 2023 (Source: TradingView, click to enlarge chart)

Even though the USD/JPY has continued to weaken (JPY strengthening) ex-post BoJ meeting where it slipped below yesterday, 27 July US session low of 138.76 to print an intraday lower low of 138.06 after a retest of the 20-day moving average that is acting a key short-term resistance at around 141.30 during today, 28 July Asian session at this time of the writing.

In the past, a significant further JPY strengthening due to a slight hint of hawkish monetary policy from the BoJ tends to trigger a risk-off behaviour where Asian stock indices sold off. In today’s “subtle tweak” to the YCC, the worst performer in the Asian region today is the Nikkei 225 which ended with a daily loss of -0.40% (trimmed away a much larger intraday magnitude of -2.60%) while other Asian benchmark stock indices have traded mostly with gains throughout today’s session; Hang Seng Index (+1.45%), Hang Seng TECH Index (+3.00), China’s CSI 300 (+2.3%), and Singapore’s Straits Times Index, (+1%) at this time of the writing.

Japanese banks outperformed

Also, within the Nikkei 225, the share prices of Japanese banks stood out significantly today where the TOPIX-17 Banks exchange-traded fund was the top performer among the 17 TOPIX sectors with a daily gain of +4.70% which suggests that market participants are anticipating an improvement of net interest margins for Japanese banks in a new “flexible” YCC environment.

Fig 3: TOPIX-17 Banks ETF major term trend as of 28 Jul 2023 (Source: TradingView, click to enlarge chart)

From a technical analysis standpoint, the TOPIX-17 Banks’ ETF has traced a major bottoming formation in place since September 2011 which suggests that perhaps taking baby steps in normalization of Japan’s ultra-loose monetary policy may not lead to an adverse risk-off effect in the Japanese stock market and even globally by considering the current price actions movement seen in the major cross asset classes.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.