- RBNZ hiked its official cash rate as expected by 25 bps to 5.50%

- It is the first time RB NZ’s monetary policy-setting committee went to a vote today.

- Split vote of 5 to 2 has indicated a high probability 5.50% is the terminal rate after today’s hike.

- USD bulls are playing catch-up against prior NZD’s outperformance.

The New Zealand dollar, NZD is the weakest currency against the US dollar in today’s Asian session as it tumbled by -1.10% at this time of the writing reinforced by post-RBNZ, the New Zealand central bank’s monetary policy decision to hike as expected by 25 basis points (bps) to bring the official cash rate to 5.50%, the highest level since December 2008.

Why did the NZD fall so much since the 25-bps hike by RBNZ is already priced in?

It’s all about positioning and forward guidance. Firstly, today’s monetary policy decision after the prior surprise hawkish vibe, a 50-bps hike in April 2023 has been accompanied by a split vote of 5 to 2 in RBNZ’s monetary policy committee; the first time the committee went to a vote over its decision which has signalled that official cash rate of 5.50% after today’s hike is likely the terminal rate for its current interest rate hiking cycle.

Also, the latest RBNZ’s forecasts show that the probable path of an interest rate cut cycle will only start at the beginning of Q3 2024 which indicates that monetary policy will remain restrictive for the rest of 2023 in New Zealand.

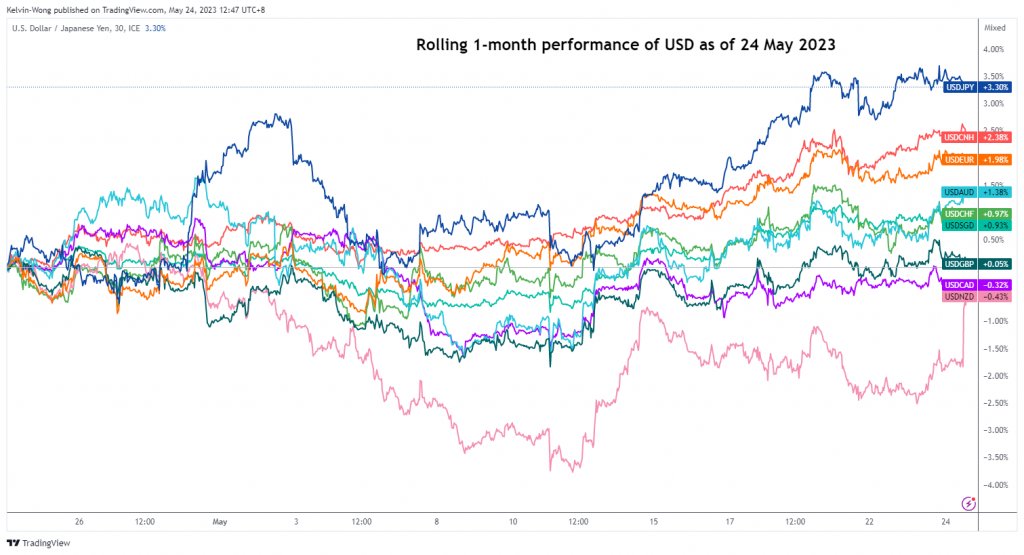

In the recent two weeks, the US dollar strength has started to creep back into the foreign exchange market where the US Dollar Index recorded its best weekly gain of +1.4% since 19 September 2022 for the week of 8 May 2023. However, the NZD was the strongest against the USD versus other major currencies in the past two weeks as seen in the rolling one-month performance chart below.

Thus, the sentiment that has driven the prior NZD’s outperformance has been altered easily after today RBNZ’s less hawkish surprise tilt on its forward guidance which led to a possible US dollar bullish momentum trend following systematic trading strategies to target the laggard NZD that explains its steep movement in today’s Asian session.

NZD is now playing catch-up to the recent US dollar strength renewal

Fig 1: US dollar rolling 1-month performance against other currencies as of 24 May 2023 (Source: TradingView, click to enlarge chart)

NZD/USD Technical Analysis – Risk of a bounce within minor downtrend phase

Fig 2: NZD/USD trend as of 24 May 2023 (Source: TradingView, click to enlarge chart)

The medium-term trend of the NZD/USD as highlighted on the daily chart is trapped within a complex range configuration since its 2 February 2023 high of 0.6538 after a failure to stage a breakout above a major descending trendline resistance from its 21 October 2021 swing high of 0.7218 on 11 May 2023. The medium-term range support and resistance are at 0.6095 and 0.6315 respectively.

In the shorter term as depicted on the hourly chart, its price actions have evolved into a minor downtrend (descending channel) from its 11 May 2023 minor swing high of 0.6385. Today’s Asian session’s steep decline post RBNZ’s monetary policy outcome has led the hourly RSI oscillator to hit an extremely oversold level at 15% which suggests an overextended slide where a minor bounce cannot be ruled out at this juncture.

The key short-term pivotal resistance to watch will be at 0.6235 to maintain the minor downtrend phase with the next intermediate support at 0.6115/6095. However, a clearance above 0.6235 negates the bearish tone to see the next resistance coming in at 0.6315.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.