Rally has momentum

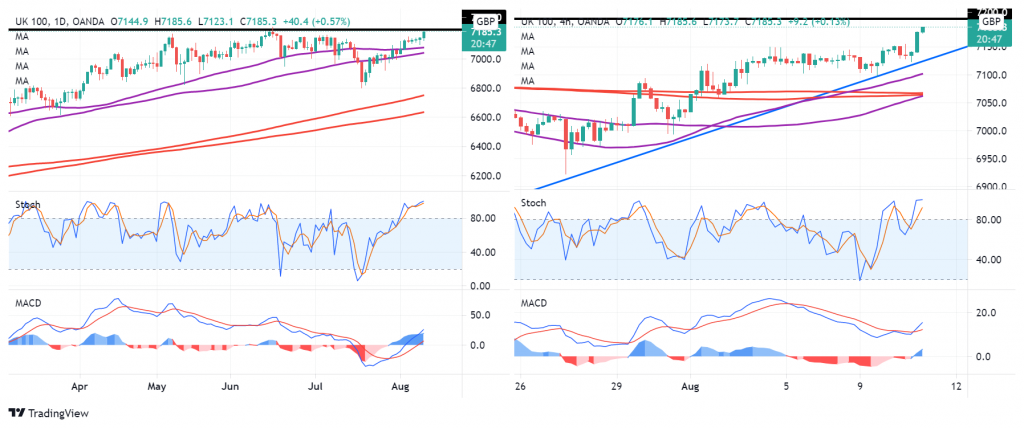

The UK100 is closing in on 7,200 and approaching levels not seen since the start of the pandemic.

This isn’t the first time the index has eyed up this level in recent months but in the past it has failed to break through in any significant way – it briefly touched 7,217 a couple of months ago before reversing course – and each time a corrective move has followed.

This has left the FTSE trading between 6,800 and 7,200 since April but that could all be about to change.

While we may see some profit taking on approach, the MACD and stochastic suggest there’s plenty of momentum still in the rally that could carry it to levels not seen in 18 months.

If we do see some profit taking, the rising trend line below could be interesting support if the rally is going to continue. A move below this would suggest a larger correction may be on the cards.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.