The Australian dollar is higher for a second straight day. In the European session, AUD/USD is trading at 0.7746, up 0.16% on the day.

RBA maintains policy

There were no surprises from the RBA, which maintained its policy settings, including keeping interest rates at a record low 0.10%. There is some unfinished business on the plate of RBA policymakers, as the bank will decide in July whether to implement further QE. The RBA statement did not provide any clues as to what the RBA is planning to do come July. The statement noted that “despite the strong recovery in the economy and jobs, inflation and wage pressures are subdued” and added a typical message that the bank is “committed to maintaining highly supportive monetary conditions”.

Inflation remains below the RBA’s target of 2-3%, and RBA Governor Phillip Lowe has said that he expects that wage growth will have to rise a clip of more than 3% in order for inflation to reach the bank’s target.

The Australian economy continues to improve, but the recent Covid outbreak in Melbourne serves as a stark reminder that Covid has not disappeared. The RBA tends to move cautiously and would not be acting out of character if it remained dovish and decided to extend QE for another six months. At the same time, the RBA acknowledged the strong Australian recovery in its quarterly update earlier in May, and if the economic data continues to point upward, the bank may have to change its timeline for a rate change. Meanwhile, the bank’s commitment to maintain a dovish policy has kept a lid on any significant appreciation recently.

.

AUD/USD Technical

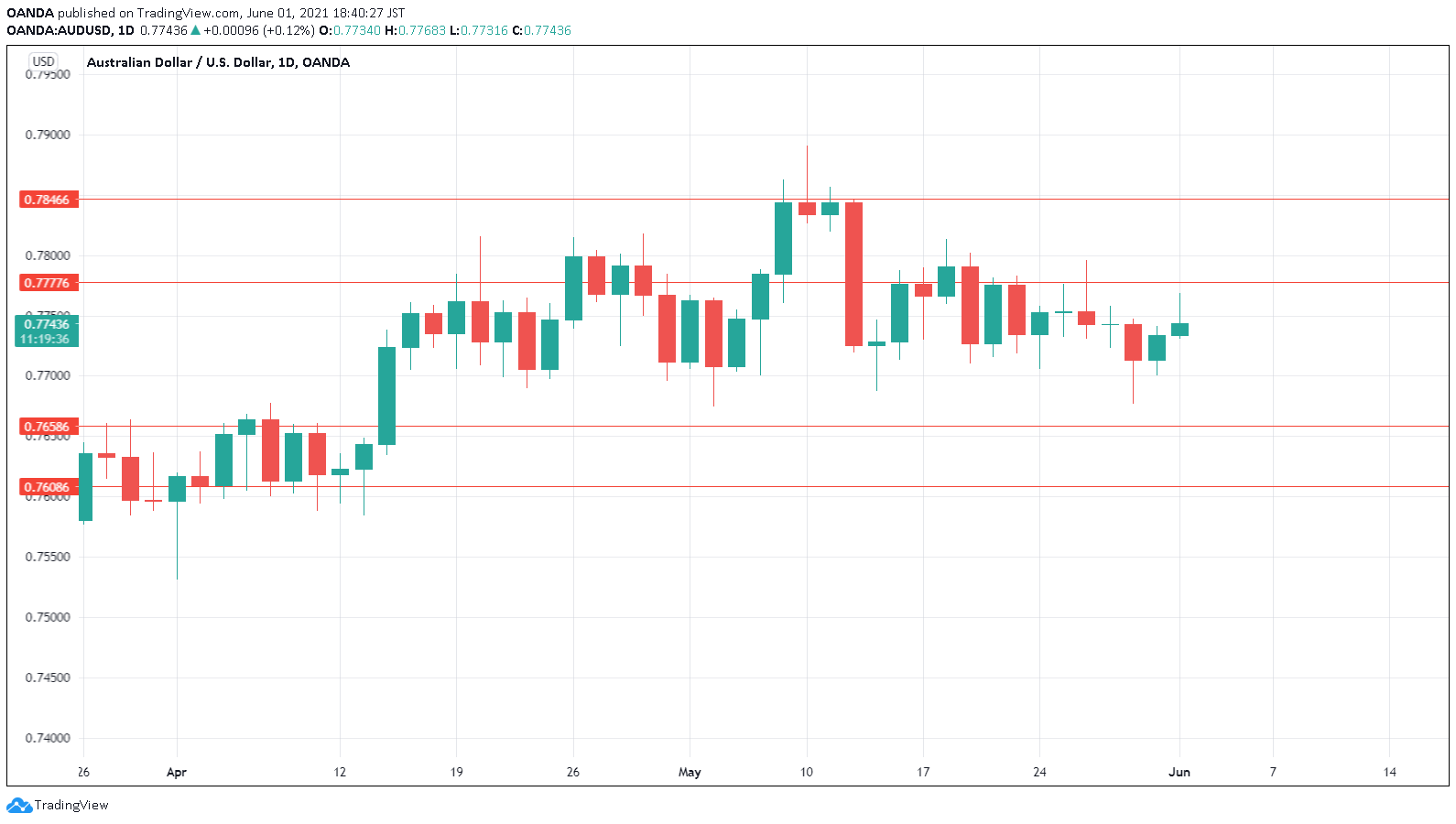

- AUD/USD is testing resistance at 0.7777. Above, there is resistance at 0.7846

- On the downside, there are support levels at 0.7658 and 0.7608

For a look at all of today’s economic events, check out our economic calendar. www.marketpulse.com/economic-event

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.