More Stimulus, Please

A strong performance on Monday is not being replicated in early trade so far today, with European stocks struggling to capitalize on those encouraging PMI reports.

It’s not been a great couple of weeks for European markets and the acceleration late last week may have shaken investors confidence. Of course, we in Europe don’t have the might of the US tech stocks on our side, which is why we continue to see distortions between indices on both sides of the pond.

Still, we are see stocks drag themselves off their lows at the start of this week, with yesterday’s PMI readings aiding the move. In much the same way that investors seemed all-too-willing to give a free pass to the horrific data, I do take these numbers with a pinch of salt until we see how containment efforts during localized spikes are dealt with. That’s not to say they’re not encouraging but as we’re seeing in the US, the situation can get out of hand quickly again which will take its toll.

This comes as lawmakers on Capitol Hill struggle to come to an agreement on another pandemic support package, with the Republicans and Democrats still seemingly far apart on a potential deal. On a more promising note, daily new cases have dropped below 50,000 for a second day which may suggest the recent trend is levelling off.

Oil taking it easy over the summer

Oil prices rebounded nicely at the start of the week but have quickly given up those gains, with WTI sitting around the $40 mark. This is pretty much in the middle of the range it’s sat in for more than a month and it’s showing little sign of breaking out in either direction. The risk of second waves will continue to hang over crude prices but oil traders may be encouraged by how well its stabilized and held on to second quarter gains.

USD on the ropes, gold bulls getting excited

The dollar’s rebound has taken some of the shine off the yellow metal over the last few sessions, with gold losing momentum just as it closes in on the psychologically significant $2,000 level. Gold has already achieved a new high in the recent rally, which is arguably far more significant, but you can never underestimate the value of big levels in the markets and $2,000 is no different in this case. Whether that can be overcome quickly or will take a little time will ultimately depend on whether the greenback can steady itself after a bruising few weeks. It’s on the ropes, which may have gold bulls excited.

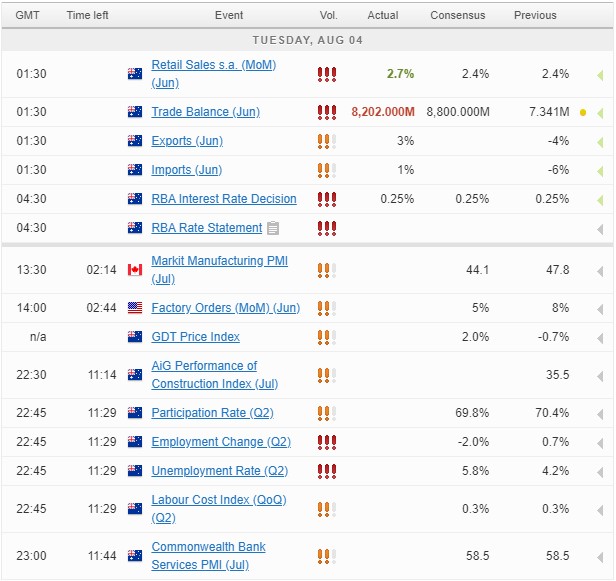

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.