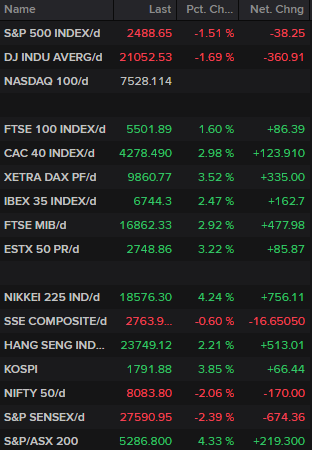

Investors Premature Again?

There’s no shortage of volatility at the start of the week, or over-confidence for that matter, as stock markets jump on some apparently promising numbers in recent days.

Source – Thomson Reuters Eikon

Europe appears to have turned a corner, with Italy and Spain – the worst hit in the region – seeing a sustained period of declining new cases and deaths. Other countries are starting to see similar results as well which is certainly cause for optimism after a quite horrific month. The quarantine measures are clearly having the desired effect, let’s just hope people continue to respect them or we could be back to square one.

Optimism is misplaced as far as the UK and US is concerned though. The next week or two is going to be grim and one day of better data from the US doesn’t change that. Investors are keen for the market to have bottomed but I’m not sure they’ll easily whether the storm to come and their nerves will likely be heavily tested.

The pound came under a little pressure this morning after UK Prime Minister, Boris Johnson, was admitted to hospital for further tests almost two weeks after testing positive for the virus. The currency bounced back fairly quickly though to trade flat on the day. it may face a tough week though if the coming week or two is as bad as many fear.

Too much optimism in oil markets

The optimism is spreading to oil markets, where traders are shrugging off the Russia/Saudi spat over the weekend, turning a blind-eye to the apparent reluctance of the US to be part of any deal. and completely ignoring the fact that today’s emergency virtual meeting has been pushed back until at least Thursday.

I know crude is trading a little lower this morning but Brent is still more than 35% off its lows and WTI 45%. Maybe I’m the one getting carried away but the weekend’s action strikes me as a major setback. It may be being helped by the overall lift markets are seeing as a result of the declining fatalies across Europe but that’s extremely premature for me. Oil is now loooking very shaky below.

WTI Daily Chart

OANDA fxTrade Advanced Charting Platform

Gold bounces back quickly

Gold gapped lower overnight but took no time to fill the void and is now marching on higher again. The temporary break in its relationship with risk and the dollar makes it as difficult as ever to anticipate the moves in the gold market but there may be a little catchup being played after the yellow metal was just another victim in the stock market rout.

We’ve since seen unprecedented amounts of stimulus injected into the financial system recently and there’s probably more to come. There may be a lagging effect because of the market turbulence but I can’t see gold ignoring that forever. It’s got its eye on $1,640 now, after which $1,700 could again be on the cards.

Gold Daily Chart

Bitcoin bulls piling on the pressure

Undeterred by the late March pullback, bitcoin is continuing to push on higher and fancies another stab at the $6,500-7,500 region that has so far got the better of it. It’s struggling to gather the momentum required to break the barrier down but as we know with bitcoin, that can change dramatically in a heartbeat. If it breaks through those levels then we could be looking at a healthy surge and another run towards $10,000.

Bitcoin Daily Chart

Source – Thomson Reuters Eikon

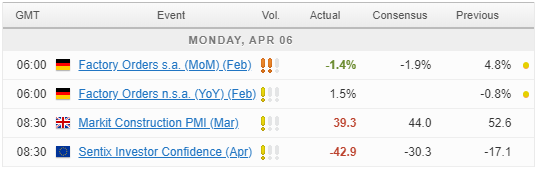

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.