Europe Higher, For Now

Stocks markets have opened a little higher on Wednesday as Europe plays catch-up from the US surge late Tuesday, after investors became excited by the prospect of stimulus from Washington.

It was reported that Trump had pitched lowering the payroll tax to 0% for the rest of the year as part of a package of measures aimed at countering the affects of the coronavirus. I’d be lying if I said the timing wasn’t curious given how closely we know the administration watches the markets but as it turns out, the effects have only been temporary.

It’s just another reminder of how volatile and sensitive these markets are. Investors are desperate for a reason to jump back in but these are highly uncertain times so this kind of whipsawing is likely to continue. Perhaps once the measures are confirmed, investors will have something to celebrate but the concern now is that anything will take time.

BoE adds some power to Treasuries punch

The UK won’t have to wait quite as long, with the new Chancellor, Rishi Sunak delivering the budget this morning. “Historic” levels of investment are being promised as the new Conservative government looks to finally draw a line under the decade of austerity and fight the coronavirus at the same time.

As had been speculated, the Bank of England added a bit more power to the Treasuries punch hours before the budget, cutting interest rates and announcing a new Term Funding Scheme to support small businesses.

This coordinated action, two weeks before the BoE’s next regular meeting, caught traders a little off-guard but at the same time confirmed what they had already been expected at some point this month which is why the pound now finds itself back where it was just before. This is the problem with central banks all being near their lower bound, the potential for shock and awe just doesn’t really exist.

Gold finding its feet for now

Gold is starting to find its feet again after another roller-coaster start to the week. Once again we saw on Monday that gold isn’t a particularly useful safe haven during times of extreme market stress, with Tuesday then piling further misery on the yellow metal as risk appetite improved at the prospect of US stimulus, which in turn lifted the dollar.

Now that the dust has settled, some order is resuming, with the gold seeing some gains but bulls may be a little more wary than they would otherwise have been. I don’t think anyone is confident that there aren’t more Monday’s to come and the White House is going to continue to try and bring order, even if that only comes via regular market-boosting hints from the President.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

Brent bounce short-lived

A lot is being made of oil’s recovery on Tuesday but all you have to do it plot the price on a chart to see that, in the context of the last week, it’s not actually that impressive. Of course, producers will be a little relieved to see Brent closer to $40 than $30 but I’m not sure they’ll be particularly convinced it will stay there.

Already today’s rally has exhausted itself and crude finds itself back in the red, having peaked just shy of $40. Given just how much both Saudi Arabia and Russia are planning to boost production by, it’s tough to not be bearish even at these levels, which could push Brent back below $35 before too long and those early 2016 levels suddenly don’t look too far away.

Brent Daily Chart

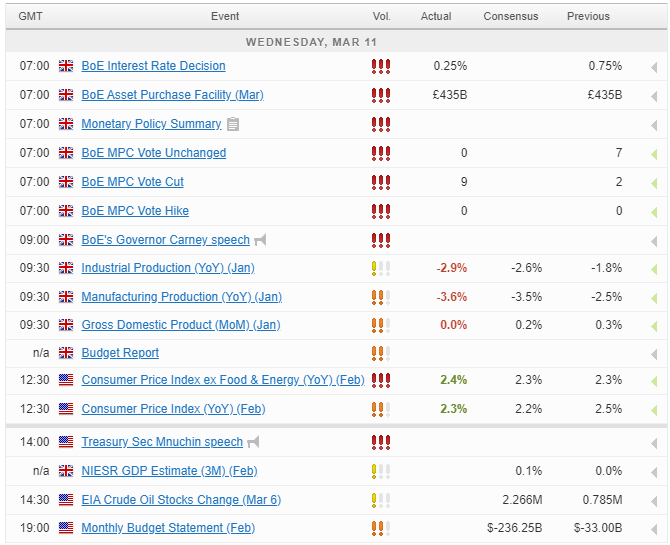

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.