Stocks Higher Ahead of US Jobs

We’re off to a decent start in Europe as traders await the ever-highly anticipated jobs report from the US.

Source – Thomson Reuters Eikon

This week has seen attention shift a little from a phase one trade deal between the US and China – although we are once again being assured things are progressing well – to the flurry of economic data and NATO summit in London.

Reporters will have had this week’s summit circled in their calendars for some time, given the proximity to the UK election and loose tongue of the US President. You can imagine their disappointment then when all they got was a Presidential backlash against Trudeau for appearing to mock him to fellow leaders at the Palace. Trump had clearly been heavily briefed by the White House and Number 10 and was on his very best behaviour.

It’s been a heavy data week but I’m not sure we’ve learned too much. Global manufacturing remains in the pits and the services sector is holding up but clearly affected by a slowdown in economic momentum. The only bright spot was oddly China, which saw its manufacturing PMI in growth territory again and the services survey outperform expectations. But will it last? Probably not.

The non-farm payrolls is next but I must admit, this once obsessively followed data release has somewhat lost its spark. Unemployment is as low as it’s feasibly going to be and job growth is consistently decent. There’s rarely anything interesting to take away from the report at this point. Famous last words, of course.

This time next week the votes will have been counted and we in the UK may finally have an idea on what’s going to happen with Brexit and who’s going to lead it. Too optimistic? The polls are all pointing to a Conservative majority and sterling has had a very good week in anticipation of it which can only mean one thing, hung parliament!

Gold may be preparing another run higher

It’s been an interesting week for gold, rallying in the early stages as stock markets tumbled before running into $1,480 like a brick wall and stumbling backwards, dazed and confused. The interesting thing with that is that rather than turn south, it’s consolidated which suggest bulls may be a little dizzy but they’re not deterred. That wall may have to sustain a couple more charges yet. If it comes tumbling down, $1,520 offers the next test.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

OPEC backing 500,000 barrel cut

Four years of production cuts and low prices and the emergence of the US as an oil behemoth and the conclusion of OPEC is that more of the same is needed. Members agreed on Thursday to cut production by another 500,000 barrels, with the Saudi’s likely shouldering much of the burden as they look to support the Saudi Aramco IPO with higher oil prices.

This time it’s different though, it seems, the logic being that the US will not be able to take advantage of higher prices to ramp up more shale production, as it has in the past. Good luck with that. Russia has been skeptical for some time, but appears to be on board. Of course, a signature doesn’t mean compliance but that’s a 2020 problem.

Brent Daily Chart

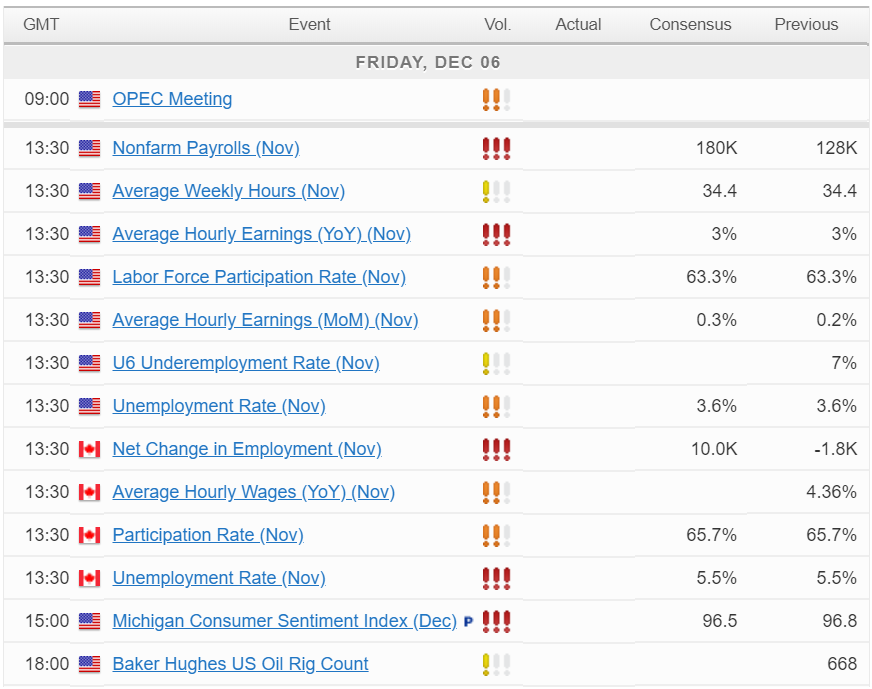

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.