Delay, delay, delay!

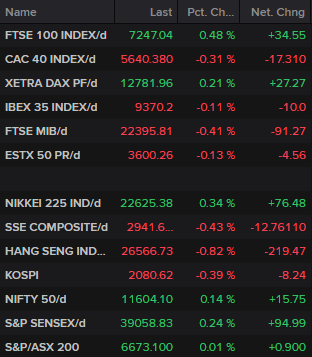

We’re seeing mixed markets on Wednesday, with attention in Europe still on Westminster as MPs further drag out the process of leaving the European Union.

Source – Thomson Reuters Eikon

The UK may be heading towards an orderly smooth Brexit – the BoE finally got something right – but it wouldn’t be Brexit if it was going to be straightforward. After months of deadlock we’re finally seeing progress. Unfortunately, when that comes in the form of two forward steps and one backward, it still feels like torture.

Yesterday Parliament both approved the second reading of the Brexit deal legislation and rejected the proposed timetable that would have enabled the country to leave in eight days time. That now leaves the government at the mercy of the European Union to grant the three month “flextension” at which point we’re probably headed for an election.

GBPUSD Daily Chart

OANDA fxTrade Advanced Charting Platform

Sterling fell on the latest developments but only slightly as the chances are it won’t change the outcome, not in a manner that leads to a harder Brexit anyway. Of course, if the EU surprised the world and rejected an extension, that would rapidly change. But that would be a huge surprise, not to mention a bizarre decision.

We’re now back in limbo but with Boris Johnson appearing at PMQs shortly and Parliament debating the Queen’s Speech after, we’re not going to be short of entertainment and who knows, perhaps we’ll have an idea by the end of the day what we’re heading towards. Of course, that hangs on what the EU offers.

Our next webinar will take place at 12.30 GMT on 29 October. Sign up below.

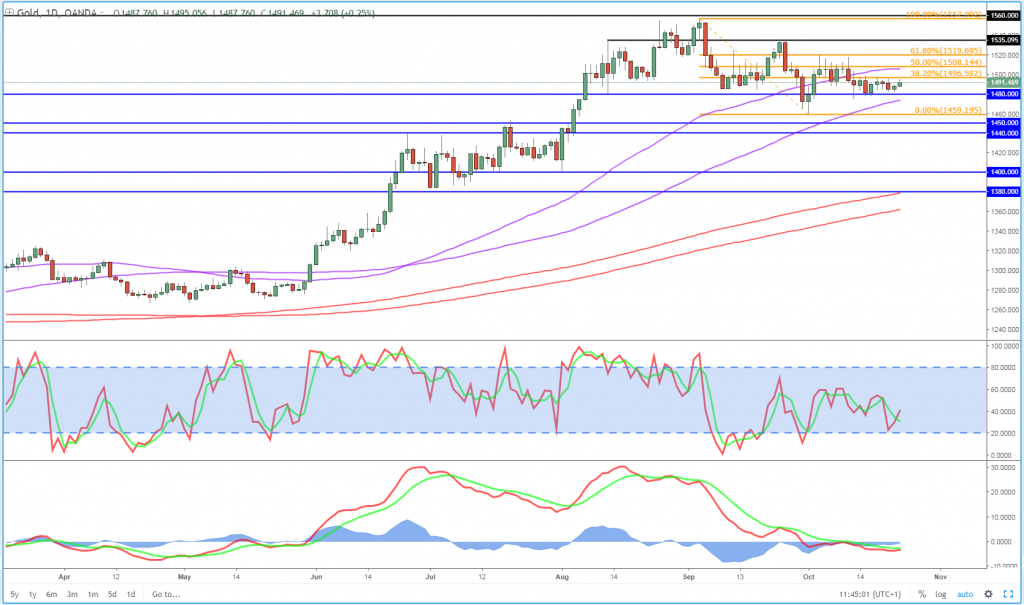

Gold edges higher but remains range-bound

Gold is edging higher on Wednesday, building on Tuesday’s small gains while at the same time not really threatening to break out of the recent tight range. One notable thing in the recent price action is that we are seeing a series of slightly higher lows which may suggest upward momentum is very gradually building.

When combined with the inability to hold onto a move below $1,480, this may suggest the tide is turning again but it’s still early days. The test above here is $1,500 and then $1,520. If these break then bulls may grow in confidence.

Gold Daily Chart

Oil quietly making gains

Oil prices remain in consolidation mode, quietly making small gains since the start of the month without attracting too much attention. This may become interesting if WTI breaks above $55, Brent $60.50, but until then it continues to look a little sluggish. The global growth story is a massive burden for oil prices, particularly in such an oversupplied market which is why they’re struggling to drag themselves off the lows. The narrative may need to change if we’re going to see any decent rallies.

Brent Daily Chart

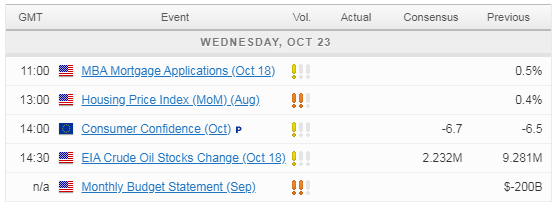

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.