Cautious optimism ahead of ECB

There’s caution optimism across European markets on Thursday as China and the US offer gestures of goodwill and investors get excited about a massive ECB stimulus package.

Source – Thomson Reuters Eikon

The trade war has seriously tested investors’ eternal optimism over the past year and while there has been scares and investors faith has at times wavered, we’re now back at near record highs again and all is hunky dory. I mean, we’re also apparently headed for recession so perhaps that’s not entirely true.

But we have apparently seen a thawing in relations between the US and China, following token gestures of goodwill between the two, so perhaps we’re at least on the right track. Unfortunately, I’m not really convinced and don’t think they represent a thawing of anything. We’re no closer to a deal despite the niceties and more tariffs are coming. Investors don’t really want to believe that though.

Sign up for our next webinar below

Draghi to go out with a bang or a whimper?

The big event today is undoubtedly the ECB and whether Draghi is going to go out with a bang or a whimper. Everyone is convinced Draghi means business today and is packing the bazooka for one last showdown. Investors have high expectations with a rate cut, QE and tiered deposit rates expected, combined with all the technical adjustments that makes it all possible.

I can’t help but fear that investors have got a little ahead of themselves here. There are hawks on the board that have repeatedly questioned the need for stimulus and I question whether Draghi’s penultimate meeting as President is appropriate for such a huge package. Draghi isn’t shy of bold policy decisions though, as we’ve seen over the last eight years so who knows.

Gold looking a little soft despite rebound

Gold is back above $1,500 in early trade and enjoying a second day in the green after having tumbled from its peak earlier in the month. It does feel like the mood has shifted towards gold in the near-term, following such a strong rally. The key level above remains around $1,530, while below a break of $1,480 would be very interesting.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

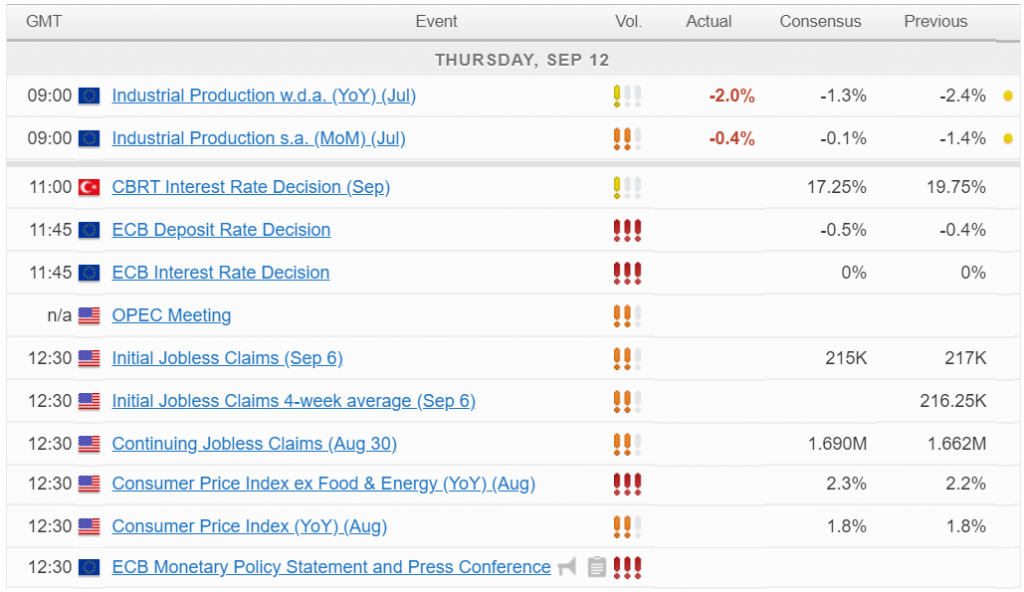

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.