Public borrowing could double next year if there is a no-deal Brexit, the country’s spending watchdog says.

The Office for Budget Responsibility (OBR) said borrowing would be almost £60bn if the UK leaves without a deal – up from £29.3bn if it does get a deal.

The watchdog said this scenario was based on assumptions that a no-deal Brexit would cause a UK recession.

The UK is set to leave the European Union on 31 October.

Chances of a no-deal outcome appear to have risen recently, after both Tory leadership contenders said they would be willing to leave the EU without a deal.

The OBR was created in 2010 to give independent analysis of the UK’s public finances.

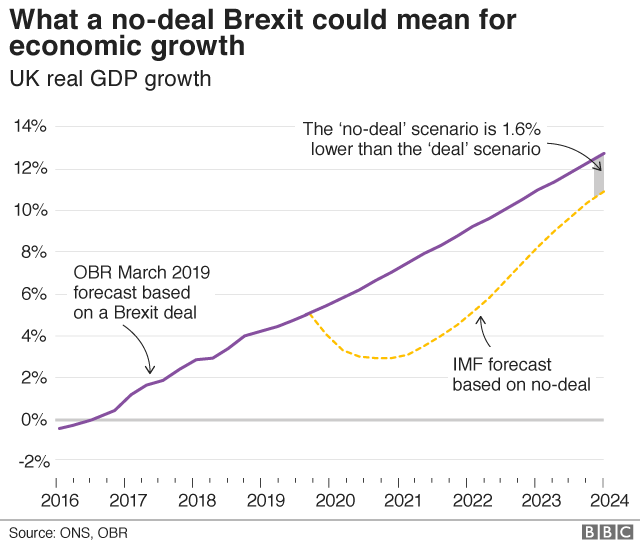

In its first assessment of the economic impact of a no-deal scenario, the OBR used IMF analysis that shows the UK economy would contract by 2% in 2020 before recovering in 2021.

This would come as tariffs of 4% were imposed on goods traded with the EU – up from zero currently – although the IMF does not expect there to be disruption at the border.

In this scenario, the OBR said that “heightened uncertainty and declining confidence” would deter investment, while higher trade barriers with the EU would “weigh on exports”.

“Together, these push the economy into recession, with asset prices and the pound falling sharply,” it said.

It said this could push up public sector borrowing, leaving debt 12% higher by 2024.

The OBR added this was “not necessarily the most likely outcome” but also “by no means the worst case scenario”.

It also warned that both Conservative leadership contenders had made “a series of uncosted proposals for tax cuts and spending increases that would be likely to increase government borrowing by tens of billions of pounds if implemented”.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.