Sterling tumbles despite strong wage growth

Sterling has taken a tumble this morning to hit fresh two year lows. The declines started early in European trade and have continued throughout the morning.

The decline accelerated when the pound broke below 1.25 against the dollar and is now pushing 1.2450. A selection of Brexit reports may have contributed to the decline, but its interesting that the UK jobs report failed to slow the decline.

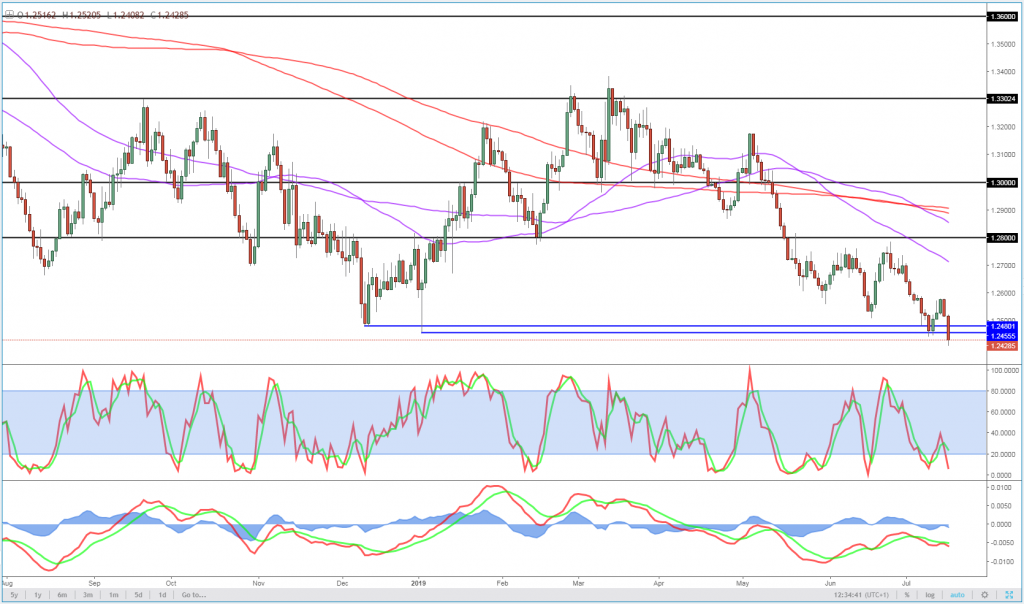

GBPUSD Daily Chart

OANDA fxTrade Advanced Charting Platform

While unemployment was unchanged and the claimant count rose, wages were strong which if sustained and no deal can be avoided would surely strengthen the case for no rate cuts and maybe even rate hikes. Unfortunately, traders are finding it hard to look past no-deal risks or at the very least a delay and hard Brexit, which continues to weigh on the currency.

There have been various Brexit headlines that have been attributed to the decline including both Boris Johnson and Jeremy Hunt last night claiming they have no interest in a time limited backstop, which has been read as further evidence that no-deal Brexit is more likely. While I’m not convinced that is necessarily the case, particularly in the case of Hunt, that’s not particularly important.

The question now is whether the break will act as a catalyst for further declines or quickly reverse and prove to be a false breakout. So far it’s looking good and has moved back towards 1.24 – down 0.8% on the day – but the momentum indicators are yet to truly support it.

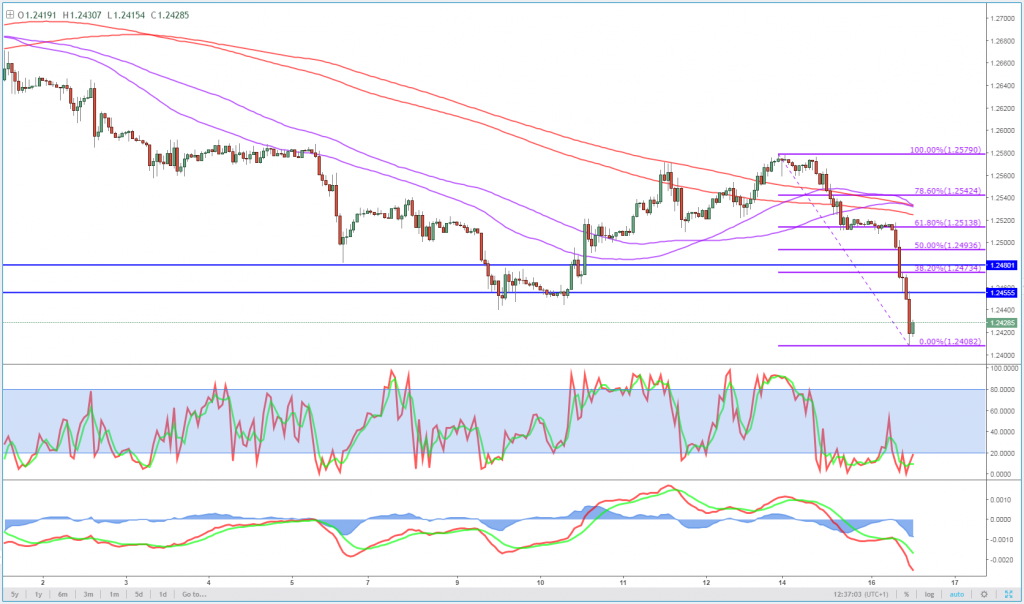

Both the stochastic and MACD moving averages are failing to make new lows. This may just be a matter of time but if the move reverses before they do, it would not be an encouraging sign. At that point, its response around 1.2450 and 1.25 would be interesting, being the most recent areas of support. The latter also falls between the 50 and 61.8 fib, from last week’s highs to today’s lows (assuming we don’t push below again).

GBPUSD 1-Hour Chart

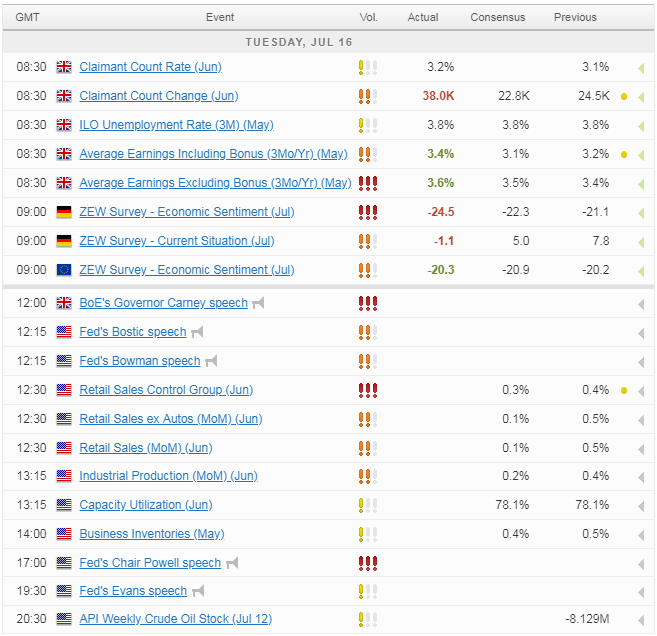

Of course we can’t forget the role that the dollar may play in the pair going forward and with US companies reporting earnings this morning and retail sales data being released, this could increasingly be a driver for the pair as the day progresses.

Our next FX Webinar takes place on 16 July at 12.30 EST

How are the rest of the markets trading?

Markets are trading very flat on Tuesday, a theme we may become accustomed to this week as we head into what could be a very interesting summer.

With central banks turning far more dovish in a bid to support the economy and equity markets, attention is shifting to companies who will report second quarter earnings over the coming weeks. This week the focus will primarily be on the banks and in particular, Goldman Sachs and JP Morgan on Tuesday.

The US is widely expected to have entered into an earnings recession in the second quarter which makes the outlooks for these firms all the more important. Citigroup got us off to an okay start but highlighted a few challenges that will likely be repeated by its peers over the coming days, most notably related to trading revenues and lower interest rates.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.