Mixed start to the week ahead of Fed meeting

We’re seeing mixed trade at the start of the week and gains may continue to be limited by events over the coming days.

Source – Thomson Reuters Eikon

The most obvious of these is of course the Fed meeting on Wednesday. Expectations may still be low when it comes to a rate cut but that by no means is a given. The timing of the meeting, coming just before Trump and Xi’s meeting at the G20, is clearly a good reason to hold off with the outcome of that potentially strongly influencing the path to come.

That said, the central bank has favored these quarterly meetings in the past for monetary policy changes as they’re accompanied by new economic projections which can justify the moves. Either way, this weeks meeting will be interesting.

Even in the absence of a rate cut, the Fed will release new economic projections and the dot plot of interest rate expectations at a time of considerable uncertainty.

Fed Interest Rate Probabilities

Source – Thomson Reuters Eikon

If the markets are correct and they’re planning to cut in July – currently 82% priced in vs only 18% this week – we should expect a clear signal of such this week, one which policy makers may be forced to act on regardless of the outcome of next weeks talks at the G20 in Japan.

The outcome of the meeting this week though is far from certain, which may feed into the feeling of wariness at the start of the week.

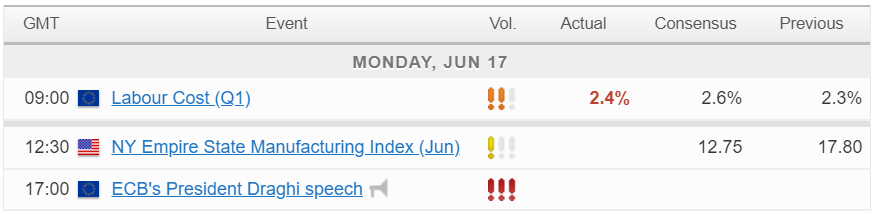

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.