Oil surges ahead of OPEC and IEA reports

Oil is pushing higher again this week, with the rally in the last couple of sessions taking us through technical resistance and providing a further catalyst for gains.

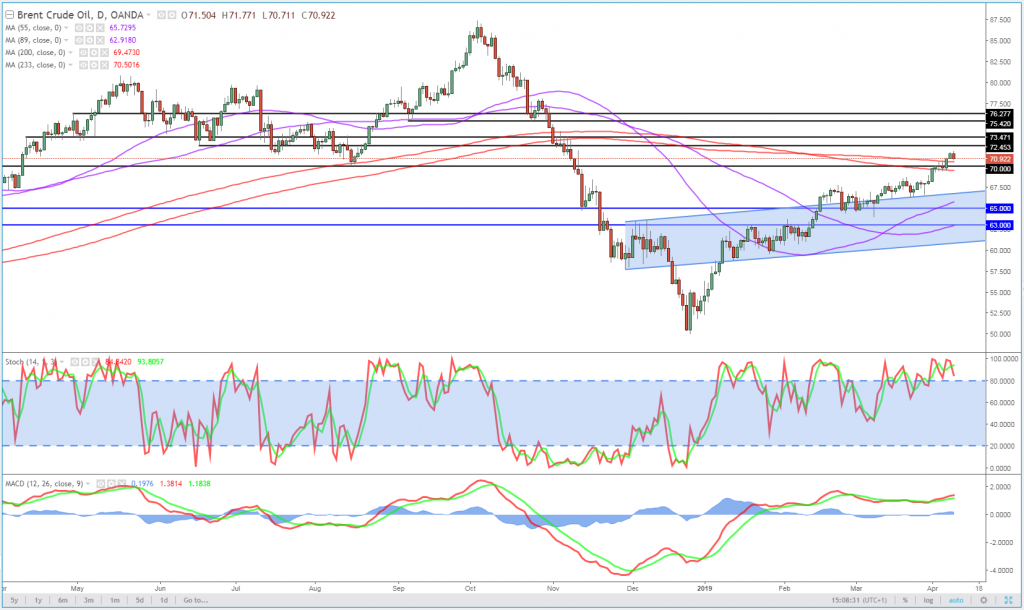

Brent stumbled at $70, but not for long, while WTI is now running into resistance around $65. Dollar weakness may be contributing to the surge, while the potential for supply disruptions in Libya may also add to the bullish case.

Brent Daily Chart

OANDA fxTrade Advanced Charting Platform

With prior resistance and the 200/233 simple moving average combination now overcome, further resistance ahead could lie around $72.50-73.50, with $75.50-76.25 being notable above here. A keen eye will remain on momentum indicators for any indication that it’s slipping as we scale new highs.

It promises to be an interesting week for oil though, with the usual inventory data being accompanied by reports from OPEC and IEA which should provide additional insight on the latest production numbers and expectations for demand.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.