Oil back in the groove?

Oil prices appear to have found a little bullish momentum again in the last few days, with the rallies we’ve seen in equity markets clearly a major factor. Another reported inventory build from API on Tuesday may have taken some of the gloss off the rally, which should make today’s EIA number all the more interesting, but momentum still looks very much with the bulls.

It now faces a big test around notable resistance though, just as momentum is building. Perhaps this is a bullish signal but so far, we’re yet to see a breakout. If price can break above $70 in Brent crude , then $71.50 would be the next notable resistance.

Brent Daily Chart

OANDA fxTrade Advanced Charting Platform

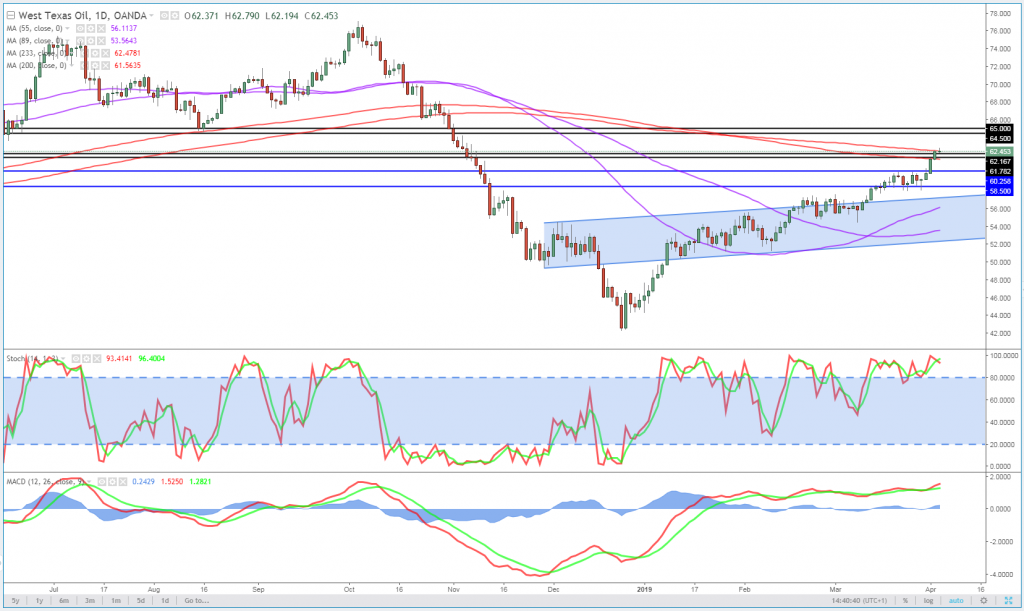

In WTI, the notable levels are $63 in terms of resistance, with further resistance above potentially coming around $64.50-65.

WTI Daily Chart

We’ve very much seen oil prices benefit from stronger risk appetite this year and that again appears to be what we’re seeing this week. It also comes at a time when US output is stabilizing, oil rigs are on the decline and OPEC+ remains committed to output cuts. It’s been something of a reluctant rally over the last month or so but it appears to have gathered some momentum this week.

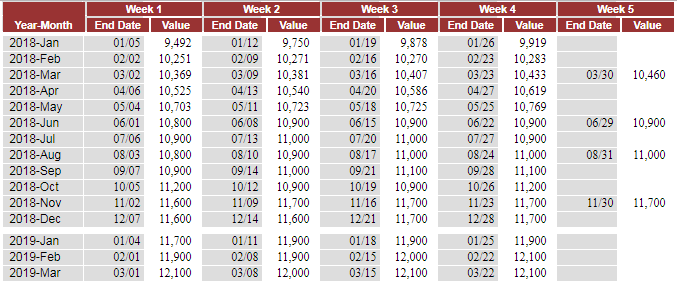

US Oil Production

Source – EIA

US Oil Rig Count

Source – Thomson Reuters Eikon

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.