Trump optimistic on deal with China

A subdued session in Asia and early on in Europe looks to be carrying over to the US on Friday, with futures mixed ahead of the open on Wall Street.

Trade talks between the US and China in Washington appear to have gone very well, with trade representative praising the “substantial progress” on various issues and Trump himself expressing optimism at the prospect of the “biggest deal ever made”. Both sides will be hoping that enough progress will have been made by later this month, when Trump and Xi are expected to meet to confirm a deal.

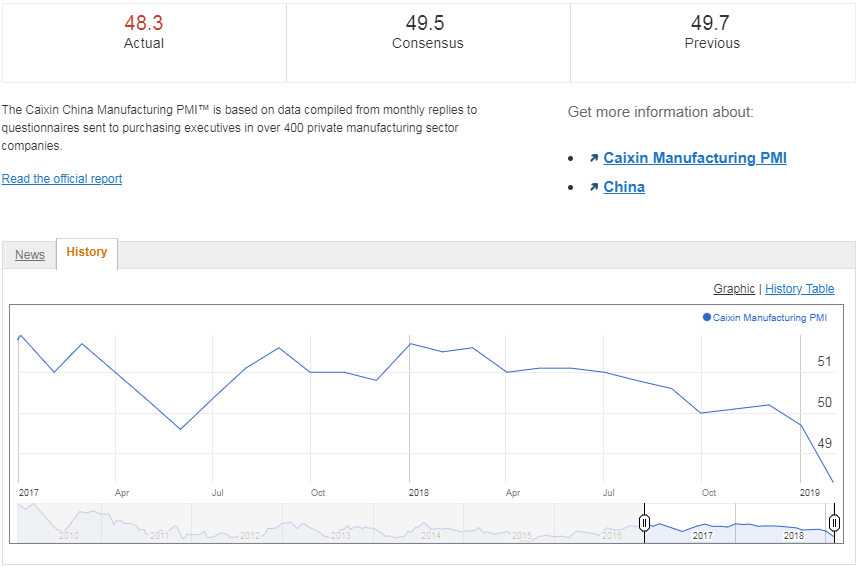

Both have good reason to find a compromise on the issue and avoid further tariffs, or even reverse those previously imposed. The Chinese economy is currently in the midst of an economic slowdown – as evidenced by the worrying manufacturing PMIs this week – and Trump will be hoping to secure re-election next year and is in need of a big win.

China Caixin Manufacturing PMI

Trump will be particularly keen to divert attention away from the government shutdown and onto a good news story, after he was forced to back down and reopen government without funding for the wall. Of course, the fight is not over for the wall but a deal with China will certainly take the pressure off.

OANDA Business Breakfast on Jazz FM

US jobs report expectations too low?

That brings us nicely to the US jobs report, which is scheduled to be released today, despite the delays to other data releases because of the shutdown. The shutdown itself is not expected to have a direct impact on the non-farm payrolls figure, but there may be less significant indirect impacts that weigh on the number. With that in mind, it would take quite a horrible number to grab people’s attention, with investors most likely shrugging off the data as an anomaly.

Aussie dips as Caixin PMI slips

Better NFP may offer USD some reprieve

With everything appearing to be a dollar-negative headline right now, I wonder whether the jobs report may offer the greenback some reprieve. If markets are already expecting a potential blip in the report then the room for upside surprise may be significant. Positive Sino-US trade talks and a more dovish Fed have dragged on the dollar over the last month or two so some bullish headlines may be welcomed.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

Gold has been the biggest beneficiary of the weaker dollar, climbing above $1,300 last Friday before running into resistance around $1,320 in the middle of the week. We continue to trade around these levels and a good report may put pressure back on $1,300 from above and test just how much conviction there is in the initial breakout. I remain bullish on gold, with numerous factors providing an ongoing bearish case for the greenback.

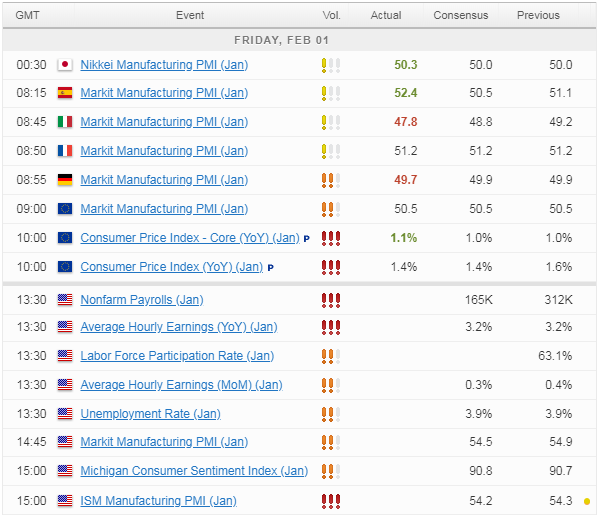

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.