Stocks bounce off key technical levels

US futures are lower ahead of the start of the week on Wall Street, with stocks further paring last week’s gains following the post-Christmas bounce.

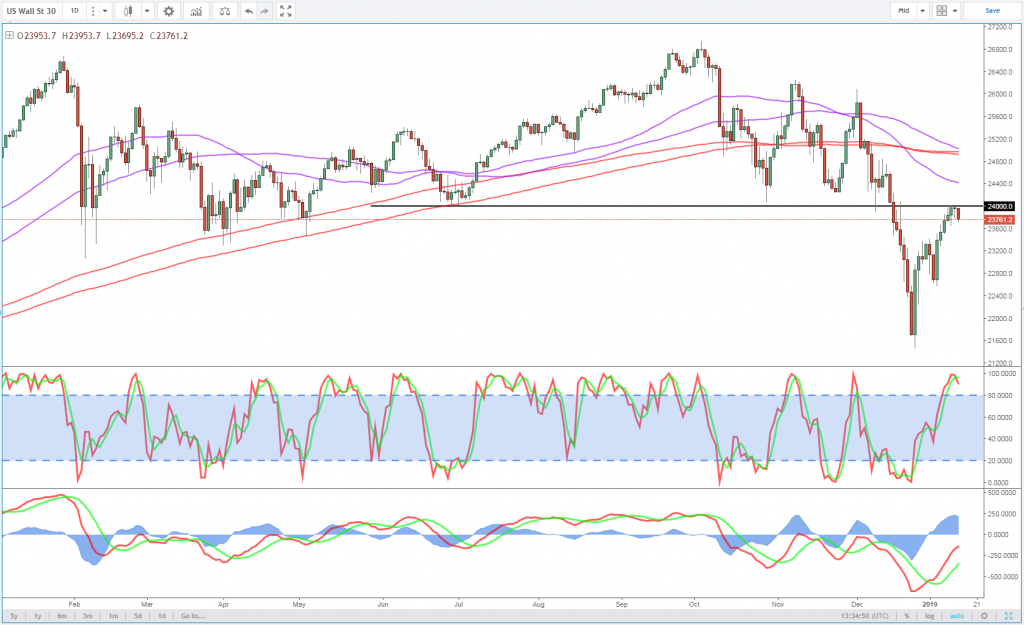

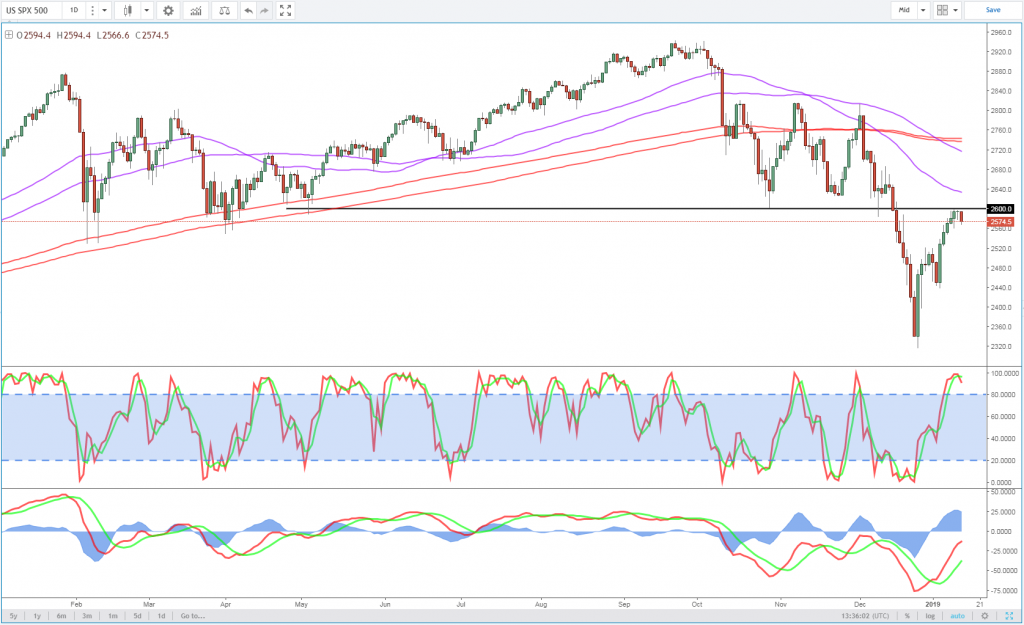

We’re now seeing a real test of this improved risk appetite, which has been evident over the last few weeks. US stock markets have rebounded back towards levels that were very well supported during the second half of 2018. A break of these levels in mid-December saw the sell-off pick up significant momentum, so it’s natural that we’re seeing some profit taking when approaching them again from below.

If we can break back above these levels – ≈2,600 in the S&P and 24,000 in the Dow – then it would suggest sentiment has indeed improved and this is more than just a brief correction in a broader downturn. The fundamentals certainly look better which could support it – a more “patient” Fed, positive trade talks between the US and China – but this may be too little too late.

Dow 30 Daily Chart

S&P 500 Daily Chart

OANDA fxTrade Advanced Charting Platform

Citigroup kicks off earning season with a whimper

Gold remains well supported by weaker USD

These two factors that have contributed to the improvement in sentiment across the markets are also responsible for the slide in the US dollar. The greenback was very well supported throughout the escalation of the trade war and imposition of tariffs as others, most notably China, were seen as standing to lose more economically as a result. With relations improving, the reverse is now true. Add to this a more dovish central bank, which means fewer likely rate hikes, and the dollar is looking vulnerable.

Gold vs US Dollar Index

Source – Thomson Reuters Eikon

This is good news for gold bulls, with a weaker greenback helping to support prices. The improved risk environment may slow the rise but it still continues to look bullish regardless. A break above $1,300 is still a struggle but with pressure mounting once again, it looks more of a case of when rather than if at this stage.

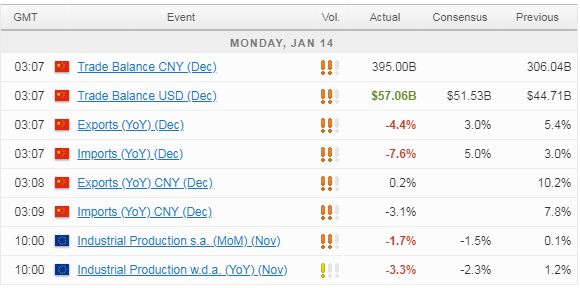

DAX starts off 2019 in style, but will China spoil the party?

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.