Rocky week in store for UK as Brexit deal goes to parliament

Another very interesting week awaits investors, particularly those in the UK, where parliamentarians will finally get their chance – fingers crossed – on Theresa May’s unpopular Brexit deal.

It could be a very volatile week for UK instruments, particularly the pound, with the vote in parliament unlikely to pass, assuming it even goes ahead. It was very late in the day in December when May pulled the vote, facing certain humiliation, so I don’t think anyone would be too surprised to see similar tactics deployed this time around.

Assuming it does go ahead then defeat looks almost guaranteed – despite her last minute efforts to pressure MPs, warning against a catastrophic and unforgivable breach of trust in democracy – with only the scale unclear.

The days that follow – of which May has only three to come up with a plan B after defeat last week – will then become very interesting with everything from no confidence vote in government to May’s resignation being on the table. Needless to say, the pound is looking very vulnerable, the only upside coming from MPs efforts to block no deal which protects it against the very worst of outcomes.

Aussie retreats as China import growth stops

China trade data to frustrate Trump as longest ever shutdown drags on

As the US enters into its longest ever partial government shutdown – and with the two sides looking no closer to a deal – news over night that it registered is largest trade deficit in a decade with China won’t be the news Trump and his administration will have been hoping for.

China’s surplus with the US rose 17% from a year ago as the two countries continue negotiations in the hope of avoiding further tariffs. While both countries are expected to suffer as a result of the tariffs, China appears to have come off the early exchanges worse off – despite the trade data – with the country reported to be forecasting growth of 6-6.5% this year, down from around 6.5% in 2018.

OANDA Trading: China trade data tanking investor sentiment

Gold taking another run at $1,300

Gold is having another run at $1,300 this morning, with the weaker US dollar providing the catalyst for such a move. The greenback continues to look soft despite a pull-back late last week, with a more dovish – or “patient” – Fed and positive trade talks between the US and China – both bearish factors for the currency.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

What’s interesting with gold is that each corrective move off $1,300 over the last 10 days has been bought at a higher level that the previous. This is a typically a bullish signal and reflects a market where the buyers are in control. Obviously there’s never a guarantee with these things but it certainly looks as though a break higher could be on the cards in the not too distant future.

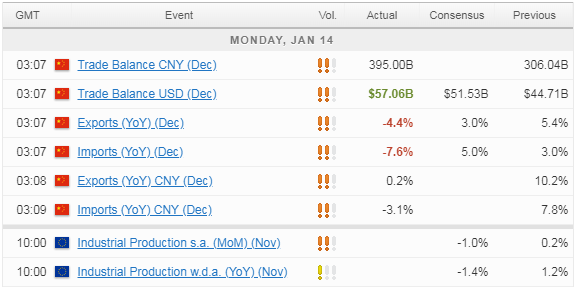

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.