Oil prices are having a great start to the year and are poised to have the best weekly advance since June. West Texas Intermediate crude was higher on the optimism that hit Wall Street following the robust NFP report and dovish tone from Fed Chair Powell. Powell noted that Fed policy is flexible and officials are “listening carefully” to the financial markets. Oil came off the intra-day highs after the Energy Information Administration weekly report showed oil inventories rose 7,000 barrels last week. Expectations were for a draw-down of 2.2 million barrels. Expectations were high for inventories to come down and we could see the $50 level prove to be key resistance in the short-term.

The Canadian dollar is poised to have the best weekly gain since March, benefiting from the strong rebound that oil has had since Christmas Eve.

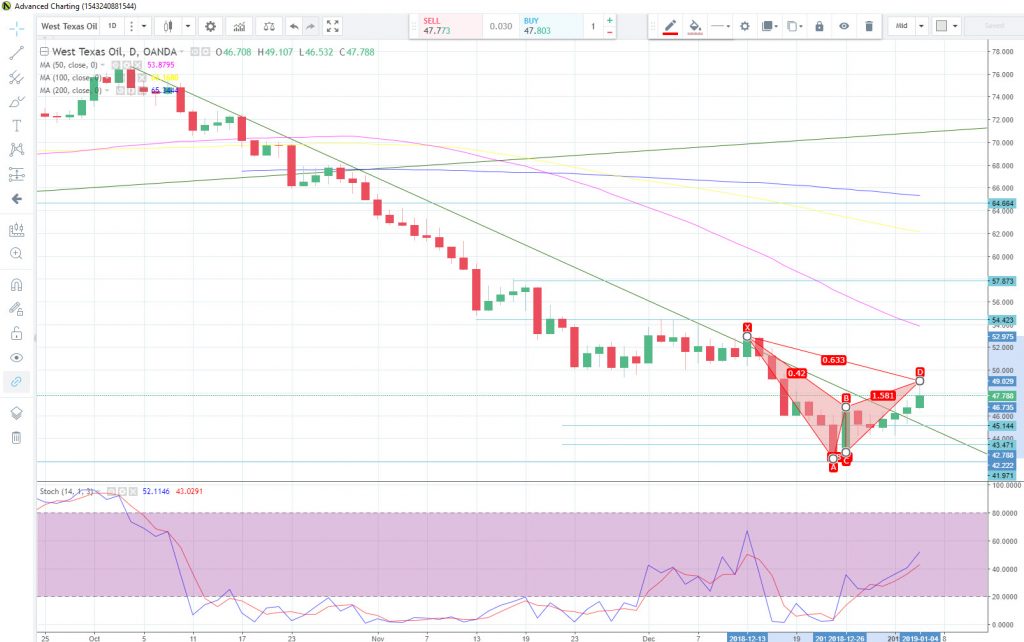

Price action on the West Texas Intermediate (WTI) crude daily chart shows key low of $42.36 held and the bullish rebound is tentatively respecting the psychological $50 handle. Today’s rally tentatively formed a bearish Gartley pattern. Point D was targeted with the 61.8% Fibonacci level of the X to A leg and the 161.8% Fibonacci expansion level of the B to C move. If the pattern is valid, we could see price retest the $46 region. If the pattern is invalidated and price surges above the $50 level, $53.50 will be major resistance. To the downside, the $40 level remains critical support.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.