Chinese manufacturing production increased slightly at the end of 2018, after stagnating in the prior two months. However, there were signs of softer demand conditions, as total new orders fell marginally, and companies reduced their output charges for the second month running. The latter was supported by the first drop in input costs for just over a year-and-ahalf.

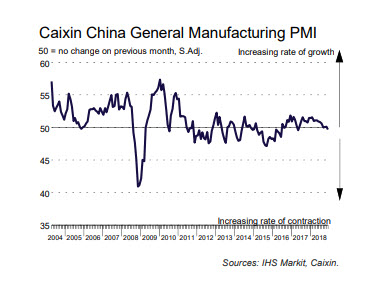

Looking ahead, business confidence was relatively subdued, and companies reduced their headcounts for the sixty-second month running. The headline seasonally adjusted Purchasing Managers’ Index™ (PMI™) – a composite indicator designed to provide a single-figure snapshot of operating conditions in the manufacturing economy – fell from 50.2 in November to 49.7 at the end of 2018, to signal a renewed deterioration in overall operating conditions. Though only slight, it was the first time that the health of the sector worsened since May 2017.

After stagnating in the prior two months, production rose slightly during December. Notably, the rate of expansion was much softer than those seen earlier in 2018. Concurrently, latest data signalled a renewed fall in total new work received by Chinese manufacturers during December. Although the pace of reduction was fractional, it was the first time that new orders had fallen since June 2016. A number of surveyed companies mentioned that relatively subdued market conditions had hampered sales. New export business meanwhile fell for the ninth month in a row, albeit at a softer pace than in November.

Efforts to reduce operating costs alongside decisions to not replace voluntary leavers meant that manufacturing employment in China continued to fall in December. The rate of job shedding was modest and similar to that seen in November. At the same time, unfinished workloads continued to increase, with some firms mentioning difficulties with production equipment.

Firms expanded their purchasing activity for the third month running, though the rate of growth remained marginal. Some firms indicated that buying activity rose due to forecasts of rising costs in 2019. Inventories of inputs were meanwhile little-changed from the previous month,

while stocks of finished goods rose slightly.

December data indicated that pressures on supply chains eased, as vendor performance stabilised following a 27-month period of deterioration. Average input costs fell for the first time in just over a year-and-a-half at the end of 2018. Though modest, the rate of reduction was the quickest since February 2016. At the same time, reports of a general drop in market prices led firms to discount their output charges for the second month in a row.

Confidence towards the 12-month outlook for production edged up to a three-month high, but remained subdued overall. Concerns largely stemmed from softer client demand and restrictive national policies around production.

Comments

Commenting on the China General Manufacturing PMI™ data, Dr. Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group said:

“The Caixin China General Manufacturing PMI dipped to 49.7 in December, the first time since May 2017 that the reading has been below 50, the mark that separates expansion from

contraction. “The subindex for new orders slid below the breakeven point of

50 for the first time since June 2016, reflecting decreasing demand in the manufacturing sector. Although the gauge for new export orders remained in contractionary territory, its reading rose marginally in December. That showed external demand remained subdued due to the trade frictions between China and the U.S., while domestic demand weakened more notably.

“The employment subindex edged up but remained in contractionary territory. The output subindex rose slightly to above 50, but was still near its lowest level in three years. The drag of weak demand on production may gradually become more evident. Stocks of finished goods increased at a slower pace while stocks of purchased items declined, pointing to companies’ growing intention to destock, which may in future disrupt the stability of the manufacturing sector’s output.

“The subindex for suppliers’ delivery times rose above 50 for the first time since August 2016, implying an improvement in manufacturers’ cash flow. That was probably due to recent

government policies to support the financing needs of small and midsize companies, and the State Council’s requirement that government agencies and major state-owned enterprises

pay the overdue debts they owed to private enterprises. “Output charges declined at a quicker rate, while input costs fell for the first time since May 2017 in line with the weakening

domestic commodities market and plummeting oil prices. The fall in year-on-year growth of the producer price index is likely to accelerate.

“In general, China’s manufacturing sector faced weakening domestic demand and subdued external demand in December. Companies had a stronger intention to destock and prices of

industrial products were declining, which could further drag on production. It is looking increasingly likely that the Chinese economy may come under greater downward pressure.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.