Stocks were reeling early in NY after Chinese tech giant, Huawei’s CFO was arrested sparking concerns it could derail the trade progress that was made over the weekend. The Dow was down 780 points and turned negative for 2018 but managed to finish the day only lower by 79.4 points. The dollar also recovered some of its losses against the Japanese yen after falling to a fresh monthly low.

The rebound in risk appetite also benefited from the Wall Street Journal report that “Federal Reserve officials are considering whether to signal a new wait-and-see mentality after a likely interest-rate increase at their meeting in December, which could slow down the pace of rate increases next year.”

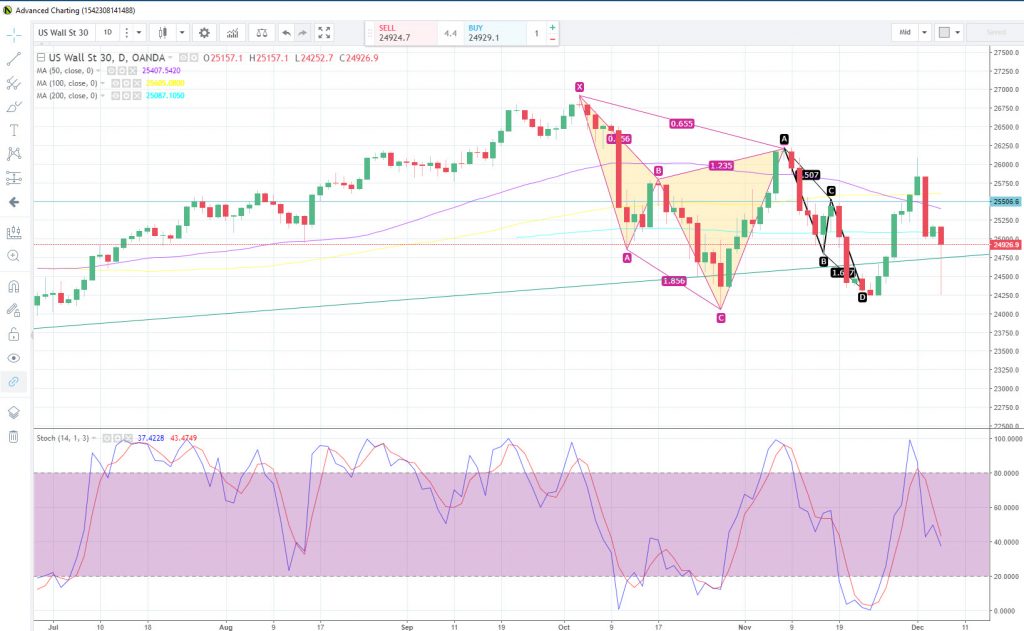

Price action saw the Dow form a triple bottom pattern at around the 24,250 level. Price is now facing key resistance from the 200-day SMA, which currently trades at the 25,113 level. If bearish momentum returns and the triple bottom pattern is invalidated, we could see a run towards the 23,500 region. To the upside, 26,300 remains major resistance.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.