The US dollar is taking a break from its recent strong rally and the near-term weakness is helping metals rebound from multi-month lows. The agricultural sector is mixed with sugar still struggling to catch a bid though projected smaller harvests are helping some crops. The energy commodities are reacting according to usual supply/demand mechanics.

Base metals

COPPER is extending its recovery from 1-1/2 year lows as the US and China once again prepare to sit at the negotiating table to discuss the trade tariff war. The negotiations come as the US starts public hearings on another $200 billion of proposed tariffs on Chinese imports.

Hopes of a breakthrough are lifting ideas that a global slowdown may be avoided and hence keep demand for the industrial metal buoyant. Adding to the bullish news, workers at Chile’s Escondida mine inked a new labor contract last week, thereby avoiding a potential strike. Copper is poised for its fourth straight daily gain and has rallied 4.65% from the low on August 15. It is still down 19.3% from the June peak.

Copper Daily Chart

Precious metals

GOLD is benefiting from a respite in the dollar’s advance as the greenback retreats on profit-taking and hopes for the trade talks. The precious metal is set to rise for a third straight day after hitting a 19-month low last week. It has rebounded 1.8% from the lows and positive momentum indicators suggests the rally may have more legs. The 55-day moving average is at 1,240.72 and has capped prices since April 25.

Latest CFTC data as at August 14, shows the net positions of speculative accounts turned short for the first time since August 2002, mostly as a result of added short positions. There were also signs of buying interest in gold from Chinese investors, with the Bosera Gold Fund ETF attracting the biggest daily inflow since May 23, mostly from China, according to a Bloomberg report. A slow local property market, falling stock markets and a weakening currency all helped spur interest in buying gold.

Speculative positioning in SILVER also turned net bearish in the week to August 14, the first switch since May 8. ETFs were also net buyers of 31,428 troy ounces of silver yesterday bringing total net purchases this year to more than four million troy ounces, according to data compiled by Bloomberg.

The gold/silver (Mint) ratio is in the upper half of this month’s range having peaked at 82.068 last week. It is currently trading at 80.702.

As the US dollar retreats, so PLATINUM has also rebounded from 10-year lows though the momentum for the move appears shaky. Platinum is still suffering from oversupply and the recent fall in the South African rand has reduced the necessity for miners in that country to cut production. The metal is currently trading at 797.376 with mild support at the August 16 low of 755.761 and the 55-day moving average at 842.542 acting as resistance.

PALLADIUM has had a stronger rebound than Platinum, rising 9.9% from the August 16 low. Speculative net long positions were reduced by 1,531 contracts to 2,011 as short positions were increased, latest CFTC data shows. Palladium is trading at 915.35 today having touched 924.85 yesterday, the highest since August 3.

Energy

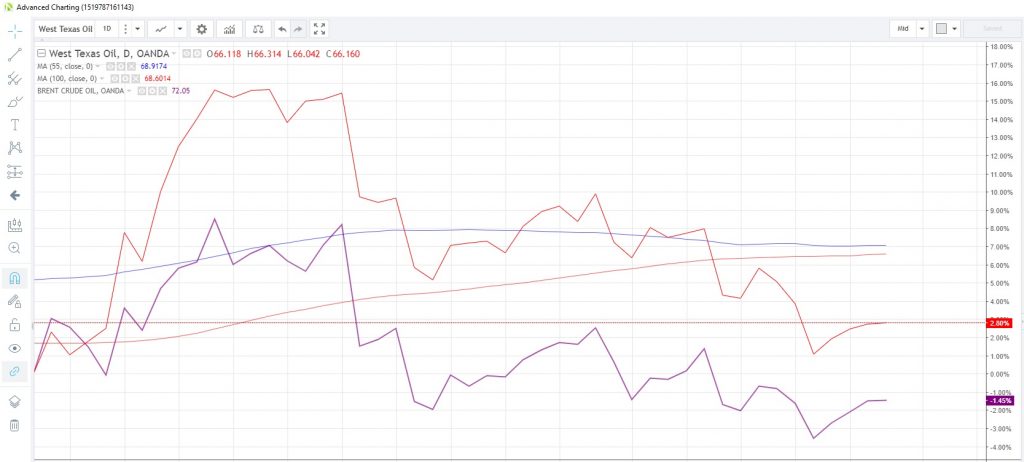

OIL prices are consolidating a three-day up-move today as markets consider the pending trade talks and the impact of Iran sanctions, which kick in completely in November. Iran has challenged other OPEC members, saying that none should be allowed to take over Iran’s share of oil exports as the OPEC Ministerial Conference had not issued any license for such actions. In an attempt to prevent prices from spiking because of this potential supply reduction, the US on Monday offered 11 million barrels of crude from its Strategic Petroleum Reserve (SPR) for delivery from October 1 to November 30, Reuters reports.

WTI is currently trading at $66.161, 2.4% higher than the two-month low struck on August 16. The WTI/Brent spread has widened to 5.9 points, up from last week’s reading just below 5.0. Tomorrow’s release of weekly EIA crude oil inventories is expected to show an increase of 2.7 million barrels, according to the latest survey, adding to the 6.8 million gain the previous week.

WTI/BRENT Spread Chart

NATURAL GAS has stalled in the past week, confined to a tight range and unable to push through the August 14 high of 2.981. Cooler weather across the US is reducing the demand for energy for cooling, though this could only be a temporary phenomenon. Natural Gas inventories rose by 33 billion cubic feet in the week to August 10, according to EIA data released August 16. The commodity is currently trading at 2.967 and is looking to test the 55-month moving average, which is currently at 3.0163.

Agriculturals

WHEAT is currently retracing Friday’s spike higher after rumors circulated that Russia was planning curbs on exports. The rumor was subsequently denied by Russia’s Agriculture Ministry and wheat is now lower, testing the opening levels from last Friday. There are expectations of smaller wheat crops across Europe, in France, Germany, UK and Poland, as drought conditions shrink crop sizes, Reuters reported Friday.

SUGAR is the exception to recent trends and continues its downward spiral amid no letup in supply and building of stockpiles. Sugar is now at 0.09998, breaching the 0.10 mark today for the first time since December 2008. This now could set up at test of the 2008 low of 0.09247.

The USDA’s latest Crop Progress Report released Monday indicated crop conditions remain favourable throughout most of the US farm country. The harvesting of the CORN crop is progressing well and the quality of most of the crop is rated good to excellent, the report states. Corn is now at $3.582 as it remains sandwiched between downside support at the 50% retracement level of the rally from July 12 to August 8 and resistance at the 100-day moving average.

Corn Daily Chart

SOYBEANS welcomed timely rains throughout much of US farm country last week which helped the crop maintain impeccable crop conditions ratings, the USDA said in its Monday report. According to the report, 65% of the crop is rated good to excellent. The commodity is currently attempting a breach of the 55-day moving average, which has capped the market on a closing basis since May 29.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.