Trump comments unpopular but markets steady

It’s been an interesting start to trading on Tuesday, although markets are so far relatively unmoved with European indices mixed and US futures relatively flat ahead of the open.

While US President Donald Trump has come under intense criticism for his comments after his meeting with Vladimir Putin, in which he appeared to side with the Russian President on claims of interfering in the 2016 election that he won over the country’s own intelligence services, it hasn’t been a big market story. Investors have instead remained focused on the possibility of a trade war and the upcoming earnings season, with 10 S&P 500 companies reporting today including Goldman Sachs.

Powell appearance may be less informative than past testimonies

Another event of interest today will be Federal Reserve Chair Jerome Powell’s appearance in front of the Senate Banking Committee. The testimony on the semi-annual monetary policy report is the first of two appearances in Washington, with the House Financial Services Committee having the chance to grill him tomorrow.

Whether we learn as much from the events as we have in the past is debatable as the Fed appears to be on quite a clear and steady course of tightening and so I’m not sure what we could learn that we don’t already know.

Currencies, Stocks and Bonds await Fed Powell’s Testimony

GBP rises after encouraging employment data as rate hike expectations rise

This week we’ll get a raft of data from the UK which may prove pivotal in determining whether the Bank of England will raise interest rates at its next meeting in two weeks and this morning’s labour market figures got things off to a positive start. While many of the numbers were in line with expectations – unemployment remaining at 4.2% and average earnings growth of 2.5% – some of the finer details will be very encouraging for the central bank.

UK Job Vacancies

ONS UK Labour Market Report – July 2018

Job vacancies hitting the highest since records began – 824,000 – inactivity being the lowest since records began – 21% – and the employment rate being the highest since records began – 75.7% – are just a few examples that will convince policy makers that the economy remains on a steady path and slack has diminished. While economic uncertainty linked to Brexit still very much exists, the BoE will be encouraged by today’s data and see it as being consistent with a rate hike.

DAX subdued on lack of fundamentals

Of course, the timing of the rate is what investors are interested in and should the inflation and retail sales numbers over the next couple of days be as good as we’re expecting, I think there’s a very good chance that the Monetary Policy Committee raises rates next month. It was clearly intending to in May, prior to the first quarter slowdown, and the latest figures should be enough to convince them that this was nothing more than a blip.

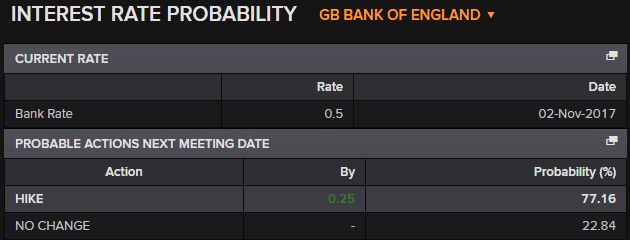

UK Interest Rate Probability

Source – Thomson Reuters Eikon

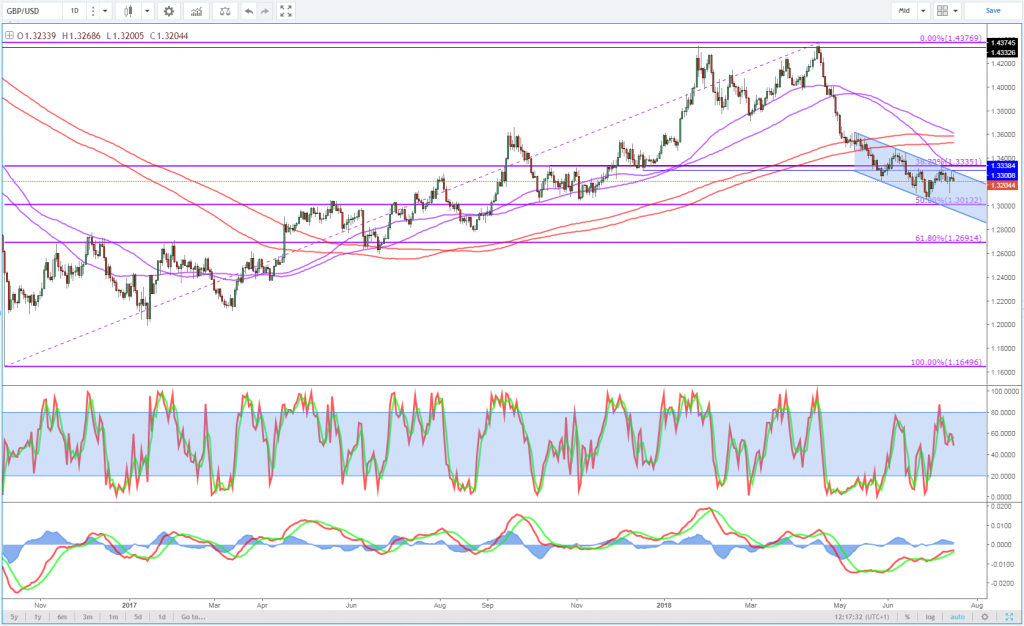

The pound has seen some support from the jobs report, with traders seeing it as one hurdle passed towards a rate hike. An August interest rate hike is currently 77% priced in and should the data over the coming days fall in line with expectations, or beat them, this could increase which may lift sterling further. The pound is currently finding resistance around 1.33 against the dollar but some positive releases over the next couple of days could push it through, which would be quite a bullish signal.

GBPUSD Daily Chart

OANDA fxTrade Advanced Charting Platform

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.